Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 3rd, 2024

Below you will find out the highs, lows & averages of GBP to AUD, its full history, and how you can achieve a better GBP to AUD exchange rate.

Highest GBP to AUD rate ever

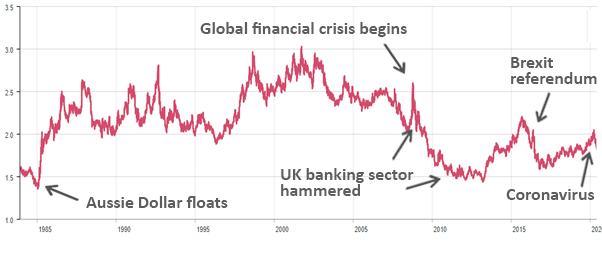

The Pound hit an all-time high of $3.028 against the Australian Dollar on 27th September 2001.

In 2001, the UK had a booming financial sector and a stable political and economic environment. These factors lifted the Pound.

Lowest GBP to AUD rate ever

The Pound fell to an all-time low of $1.3606 against the Australian Dollar on 14th January 1985.

In 1985, it was more a case of Dollar strength than Pound weakness.

Average GBP to AUD rate

The GBP to AUD rate has averaged $2.1345 since the Australian Dollar floated in 1983.

The Aussie Dollar was introduced in 1966, but its value was fixed against other currencies until 1983. From 1983 onward, it has been freely floating, reflecting the underlying supply and demand.

Why most GBP to AUD exchange rates are ‘fake’

Most people get exchange rates off the internet these days.

There are dozens of websites that provide live exchange GBP to AUD rates.

XE, Oanda, and Yahoo for example.

But here’s the thing many people don’t know…

The exchange rates you see online are not customers’ rates.

What you are seeing are “interbank rates”.

As the name suggests, an interbank rate is used by banks to trade with other banks.

Even large corporations or currency brokers don’t buy or sell at interbank rates.

You will find a disclaimer on most websites (in small print of course!) explaining that the rates shown are for “informational purposes” or “cannot be accessed”.

If you want to budget more effectively, I would suggest getting a genuine GBP to AUD exchange rate.

GBP to AUD chart – ups and downs explained

You can see the GBP/AUD rate has had some big moves over the years.

Even on a smaller scale, over days and weeks, there are frequent peaks and troughs.

These present risks and opportunities…depending on which side of the fence you sit.

It’s always worth trying to get the best Aussie Dollar rate possible.

More money in your pocket!

Can you trust GBP to AUD forecasts?

I don’t generally trust exact exchange rate forecasts.

Most are just extrapolations of recent history dressed up with technical jargon.

The truth is no one has a crystal ball.

But I appreciate people want to know whether it’s or good or bad time to exchange your money.

Forecasting is more a case of probability than precision.

My simple advice is to use historical data as your guide.

Exchange rates have a natural ebb and flow. It’s about trying to take advantage of favourable moves.

You can get some perspective on the GBP to AUD rate by looking at the current trend and observing recent highs and lows.

Alternatively, speak to a currency broker who can help guide you and discuss realistic levels to aim for.

What moves the GBP to the AUD rate?

There’s a whole lot of economic data that impacts the GBP/AUD rate.

It’s a long and exhaustive list including inflation, interest rates, economic growth, unemployment, international trade, and business investment – to name just a few.

It comes down to which economy -the UK or Australia – is performing better.

Outside the daily news, you also have the occasional big event, such as Covid, Brexit, and the Global Financial Crisis.

These big events can trigger major moves in a matter of months (5%-15%).

The main lesson from history is that big global events tend to cause a sudden sell-off in the Australian Dollar relative to the Pound, given its sensitivity to economically-sensitive commodity prices.

No matter what your timeframe, there will always be opportunities and risks to consider.

A currency broker can monitor GBP to AUD rate fluctuations and work with you to achieve a better rate.

Getting the best GBP to AUD rate

I would never suggest accepting whatever GBP to AUD rate you come across.

Even small improvements in exchange rates can make a big financial difference to you.

As currency specialists, we want to help our clients get the best rates possible.

It’s a key part of what we do.

In currency markets, trends, and trading ranges are frequently observable events, particularly if you are watching the screens all day.

These price patterns can be turned to your advantage.

As an example, say you were looking to send £75,000 to Australia.

Even achieving a 1.5% improvement in the GBP to AUD rate, would mean gaining an extra £1,125.

Likewise, bad timing could cost you thousands more.

I appreciate that most people have neither the time nor the inclination to watch the GBP to AUD rate all day.

It’s why you might find it useful to use a currency broker.

A currency broker can alert you if the GBP to AUD rate hits a certain level or just let you know if there’s been a favourable move.

If you want further information about exchange rates, we’ve written all about the ins and outs on how to get the best exchange rate, for travel or money transfer, so click through for more!

Who are we?

Key Currency is an independent currency broker.

Unlike banks and online apps, we provide you with a personal service.

Most places these days make you do everything yourself online.

But I’ve found most people aren’t comfortable sending large amounts of money via an online system or app.

We’re happy to guide you through the whole process, including discussing current rates and the timing of your transfer.

Because we have far lower overheads than the big banks, we can pass on the savings by providing highly competitive exchange rates and charging no fees.

As a company, we are open and transparent – the names and faces of all our people on our website.

We have attained a 5-Star “excellent” rating on the customer review website Trustpilot, the highest rating available.

In terms of regulation, Key Currency is an FCA Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

You can click below to get our latest GBP/AUD rates.