Author, Mike Smith

Author, Mike Smith

Last Updated on August 2nd, 2024

Sending money from Greece to the UK is a frequent requirement, particularly for the vibrant British expat community enjoying Greece’s sunny climate.

Since 2019, around 17,000 British citizens have made Greece their home, and of course, many people need to make transfers back to the UK for various reasons.

In this guide, we will explore the available money transfer options and most importantly, how you can do this most cost-effectively!

The Best 3 Ways to Send Money from Greece

When looking to transfer money from Greece to the UK, you generally have three main options: banks, currency brokers, or transfer apps. Each has its pros and cons, influenced by factors such as cost, speed, and convenience.

Let’s take a look at these in more detail…

Banks

Greece has a robust banking sector, people there have been banking since the 4th century BC, after all!

Greece has a combination of domestic, regional, and large international banks such as HSBC, and online banks including N26.

However, when choosing to make an international money transfer from Greece to the UK – your bank may not be the best option for several reasons.

Whilst writing this article, I discovered that Greek banks charge substantial transfer fees and apply an exchange rate margin of around 3.5%-5%.

These figures are based on a quote I received from the National Bank of Greece.

These high charges can significantly reduce the amount of money received by your recipient in the UK.

For example – if you were to send €100,000 with an exchange rate margin of 5% – that would give the bank €5,000 of your hard-earned money, not an insubstantial amount!

The Top 5 Popular Banks in Greece

Money Transfer Apps

Transfer apps offer a modern, app-based approach, boasting user-friendly interfaces and quick transfers.

Some popular companies are Wise, Revolut, and Remitly.

Whilst they’re convenient for smaller amounts, they can be less transparent about exchange rates and fees for larger transactions.

It’s possible to send money to the UK with PayPal, one of the largest transfer app providers, but it is expensive.

The average cost of transfers from Greece to the UK with PayPal is around 5.5% – to use an example here:

If you needed to send €300,000 to the UK using PayPal – their overall fee, factoring in transfer fees and exchange rate margin would be €16,500. Daylight robbery in our opinion!

Transfer apps will also offer different ways to pay for international money transfers, these include:

Credit Card Payments

This method of payment is quick and convenient but comes with several drawbacks when compared to using a professional currency broker.

Credit card payments are often classified as cash advances, which bring additional charges, on top of the currency conversion and usage fees.

Forgetting to pay your balance can also result in high-interest charges and damage your credit score.

Debit Card Payments

Another convenient and quick option, much like a credit card payment, fees are less using a debit card for payment but you will still have additional ones added to use this method.

Both are more expensive than using an international bank transfer, which is usually the cheapest method you can use.

Currency Brokers

Currency brokers like Key Currency provide a middle ground, offering competitive exchange rates and lower fees than traditional banks.

Some brokers don’t add on any transfer fees.

They specialise in larger transactions, such as property sales, making them ideal for transferring significant sums of money from Greece to the UK.

Compare Our Great Euro to Pound Rates

How much will transferring money from Greece to the UK cost?

Understanding the costs involved in transferring money internationally is vital.

Greek banks, for instance, may charge hefty fees and less favourable exchange rates.

Money transfer apps will offer much lower fixed fees and better exchange rates but this will increase the larger the amount transferred.

On the other hand, currency brokers operate with much lower overheads than traditional banks, which allows them to offer competitive exchange rates and at times no transfer fees. Using a currency broker can help people save a lot of money on large transfers from Greece.

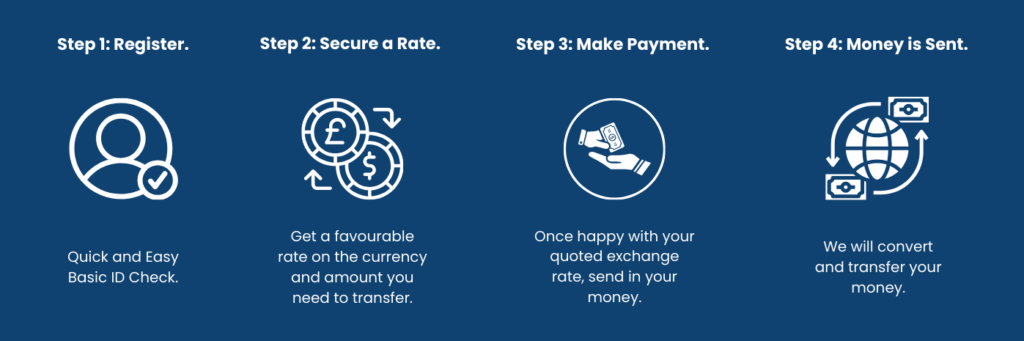

Transfer money from Greece to the UK with Key Currency today – it’s simple!How to Transfer Money from Greece to the UK

Top Tip: Make sure you get the best exchange rate

When sending money from Greece to the UK, securing the best exchange rate can significantly impact the amount received on the other end.

Understanding the difference between mid-market and customer exchange rates is crucial in this process.

In simple terms, the mid-market rate, often referred to as the interbank rate, is the real exchange between currencies without any added margins or fees.

However, banks and online app services frequently offer customer rates that include these extra charges, resulting in a less favourable exchange rate for the sender.

To ensure you’re getting the best deal, it’s advisable to compare customer quotes from various transfer services, including banks, with currency brokers.

Currency brokers often provide more competitive rates than traditional banks, passing savings back to customers.

How long will the transfer from Greece to the UK take?

Transfer times from Greek banks to UK banks are between 3 to 5 days.

In circumstances where speed is essential, for smaller amounts, a transfer app may be the better option.

However, for quick, large money transfers, a currency broker can complete transfers much faster than a bank.

For example, if you were to use Key Currency to make your transfer, it would take 1 to 2 working days. A considerable difference!

At Key Currency, we prioritise not only speed but also security. As an FCA-regulated Authorised Payment Institution, we ensure your funds are handled securely and efficiently. Using an FCA (Financial Conduct Authority) regulated company for international money transfers is crucial. The FCA regulation makes sure that the company will adhere to strict financial standards and conduct its business in a fair, transparent, and ethical manner. This provides security and trust, as the company is subject to regular oversight and must meet rigorous compliance requirements. How to make sure your money is secure

What details will you need to send money from Greece to the UK?

To complete a money transfer from Greece to the UK, you’ll need the recipient’s bank details, including account number, sort code, and any necessary international codes e.g., IBAN and BIC/SWIFT for UK transfers.

Note: it’s vital to double or triple-check these details! Getting just one digit wrong can make reversing the transfer very complicated!

You can even use our IBAN checker tool to confirm you’ve put in the right details!

Are there daily limits when transferring funds from Greece?

There are no legal limits on the amount of money you can send to the United Kingdom. The UK only restricts the amount of cash you can physically bring into the UK. You have to declare cash of £10,000 or more. But there are no limits on money transfers sent through the banking system.

It’s worth mentioning though that banks and some transfer apps will apply their daily limits for international money transfers.

Alpha Bank, in Greece, has a transfer limit of €15,000. This applies per transaction per day.

Online apps may also have differing limits depending on the account you hold with them.

Using a currency broker, like Key Currency, allows you to transfer all of your money in one fell swoop. No added-on costs or limits.

Great for large money transfers from Greece.

Are you transferring funds from property sales in Greece?

Kieran Wiles, one of our traders tells me his experiences when handling money transfers from Greece to the UK:

“When receiving funds from Greece, or handling an international currency transfer the most likely/common transfer we will assist with is a property purchase or sale, in my experience.

When selling a property in Greece, the best option for clients who are exchanging the proceeds ready for an international transfer is to have their lawyer/notary send the funds directly into the client’s account at Key Currency.

This typically has to be set up with the lawyer/notary beforehand to ensure a smooth and straightforward transfer of funds.

If this does not happen, funds can be issued in Greece as a banker’s cheque which can be a nightmare to clear, and then getting the funds out of a Greek bank is extremely difficult in some cases!”

Useful insight indeed!

A friend of mine had a similar experience when selling her holiday home in Mykonos.

After finalising the sale, she needed to transfer €200,000 back to her UK bank account.

Aware of the high fees with Greek banks, she used Key Currency.

Key Currency helped her take advantage of an exchange rate closer to a mid-market rate, saving around 3-5% compared to using her Greek bank.

This saved around €6,000-€10,000 which is not small change!

For British expats in Greece or individuals involved in significant financial transactions between Greece and the UK, Key Currency offers a compelling service. Our expertise in currency exchange rates from Greece to the UK, combined with our commitment to security and customer service, makes us the best option for your international money transfer needs. In a world where money is needed to move as freely as people do, choosing the right partner for your international transfers is more important than ever. Key Currency stands out for its commitment to transparency, competitive rates, and personalised service, ensuring that transferring money from Greece to the UK is a seamless, secure, and cost-effective process. Our experts in foreign currency exchange are only a phone call away at all times. They can support you with anything regarding international money transfers. With a 4.9/5 TrustPilot rating, we’re a currency broker trusted by thousands of happy customers. Contact us today for a free, no-obligation quote!Why choose Key Currency for your Money Transfer from Greece?

Want to Read More?