Author, Mike Smith

Author, Mike Smith

Last Updated on August 19th, 2024

Transferring money from New Zealand to the UK can seem complicated. Here I will explain how the process works and how long you can expect it to take. I’ll also cover how you can do it cheaply and efficiently.

If you’re looking to transfer money to New Zealand from the UK, then click through for our guide on that transfer!

How to transfer money from New Zealand to the UK

You have two main options for transferring money from New Zealand to the UK:

- Use a bank

- Use a currency broker

Both these options are essentially international bank transfers.

But the two types of providers differ greatly in the way they operate.

Which, most importantly, affects the service and the final amount of money you receive.

Currency brokers can usually offer better exchange rates.

They’re also specialists that often provide a more bespoke, fast, and friendly service for large currency transfers.

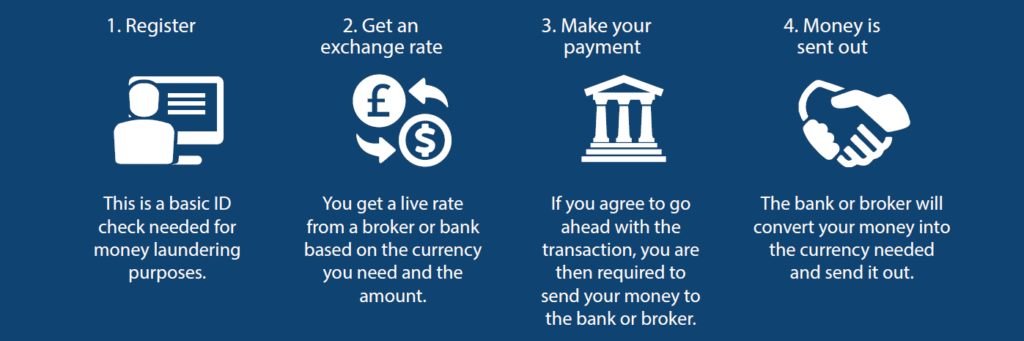

4 simple steps to transfer money from New Zealand to the UK

-

Register your account

The first step to transferring your money from New Zealand to the UK is to register an account with your chosen currency exchange provider.

This is typically a simple ID check to comply with anti-money laundering regulations.

You’ll only have to do this the first time you use a currency exchange provider.

-

Secure an NZD to GBP exchange rate

After registering, you’ll be able to enter the live market to secure an exchange rate.

Or if you’re using a quality currency broker, your account representative will do this on your behalf.

This is where you’ll need to navigate the market and know when it’s a good time to make the transfer.

Comparing the New Zealand Dollar to Pound Sterling rate against previous rate averages is a good way to gauge where the market is currently.

Our live NZD to GBP converter will give you the latest mid-market rate.

Additionally, having an account representative could be a huge advantage in helping to achieve the best rate possible.

Tackling the market yourself could increase the risk of you making the transfer at an unfavorable time, which could be a costly mistake.

Once you’ve agreed on an exchange rate, your broker or bank will be able to lock it in for you.

-

Send in your New Zealand Dollars

Banks require you to send your funds before locking in a rate.

Currency brokers can secure a rate before sending in your funds.

Sending your New Zealand Dollars to your currency broker allows them to conduct the transfer as soon as you give the go-ahead.

Once the money reaches their bank account, they will make the currency exchange from New Zealand Dollars to Pounds Sterling.

-

Receive the Pounds, Sterling

When the currency exchange has taken place, the Pound Sterling will be sent to the recipient’s account in the UK.

After you’ve transferred the money to your broker, the transfer shouldn’t take longer than a few working days.

How much does it cost to send money from New Zealand to the UK?

The main cost of transferring money from New Zealand to the UK comes from the exchange rate.

Some people think that the main costs of an international money transfer are transfer fees.

However, it’s mostly just inefficient banks that add unnecessary transfer fees.

You should avoid these wherever possible.

However, you need to pay the closest attention to exchange rates.

Exchange rate margins account for the biggest costs of every international money transfer.

Banks tend to have margins of around 3%-4%.

These are huge.

If you were transferring $100,000 through the banks on a margin of 4%, it would cost you $4,000.

Currency brokers are typically able to provide much more competitive exchange rates.

How long does it take to transfer money from New Zealand to the UK?

It takes between 2-4 working days to transfer money from New Zealand to the UK.

This is due to the time it takes for the funds to clear when they reach the UK bank.

The time difference is an added complication that can make things slower than your regular bank transfer.

Be aware of the time involved in a transfer from New Zealand to the UK and factor it into your plans.

Your broker should be able to answer any specific questions you have about the time it takes to transfer money from New Zealand to the UK.

What information will I need to transfer money from New Zealand to the UK?

To transfer money from New Zealand to the UK you will need:

- Proof of ID (for your account setup)

- The name and information of the recipient (whether a person or business)

- IBAN of the recipient’s account

- SWIFT code (also known as bank identifier code)

Proof of ID is only needed for the first transfer.

If you’re making a regular payment to the same person or business, naturally the recipient details will remain the same.

For different recipients, you’ll need to make sure you get the details correct each time.

You can sometimes find the long IBAN number, which can vary in length, at the top right of bank statements.

SWIFT numbers are unique to each bank and can also sometimes be found on bank statements.

If you can’t find them on your statement, it’s best to get them from your bank’s website.

What’s the best way to send money from New Zealand to the UK?

Currency brokers are generally a more efficient and cheaper option for currency transfers than big banks.

They are specialists in large international money transfers.

Because banks offer so many financial services, currency exchange is not their highest priority.

If you’ve not used a currency broker before, they’re able to get much closer to the interbank rate by buying currency in bulk.

Most don’t have any annoying transfer fees that banks tend to unnecessarily add.

Their quality of service is often much more tailored and personal than you get from a bank.

You are made the highest priority.

You don’t want to be made to feel like an afterthought when handling large amounts of money.

Currency brokers often have bespoke service features that banks are unable to offer.

For example, some currency brokers can monitor exchange rates so you don’t have to.

Account representatives at Key Currency can give you currency alerts when the NZD to GBP rate moves favourably.

This saves you from worrying about watching market movements constantly.

Currency brokers, like Key Currency, listen to what matters to you – the purpose, timeframe, and size of your transfer, or whether you need to achieve a specific exchange rate.

Quick Summary

- To transfer money from New Zealand to the UK you can use either your bank or a currency broker.

- Currency Brokers are often the cheaper and more efficient option.

- It will take between 2 to 4 working days for your money to arrive in the UK from NZ.

- The main cost of the transfer will be the exchange rate charges.

- You will need to know the IBAN of the recipient’s bank account to complete the transfer.

At Key Currency, we are a UK-based currency broker that’s helped thousands of people with their international money transfers – including from New Zealand to the UK. Our currency exchange account representatives deliver bespoke and personal, one-to-one service. You’ll get guidance from start to finish on your currency transfer, specific to your circumstances. Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and all transfers are conducted through safeguarded client accounts. We also have over 2,000 reviews on Trustpilot – with a 5-star rating. Click below to get a quote for a New Zealand Dollar to British Pounds exchange rate.About Key Currency