Author, Mike Smith

Author, Mike Smith

Last Updated on August 10th, 2024

Making international money transfers is becoming a more common occurrence for both individuals and business owners.

In this article, we will give you the essential information you will need, explain the simple process, and identify what factors will affect transfers across different international borders and possible fees.

What Information is Needed for an International Bank Transfer?

To send money internationally, you need three vital pieces of information.

These are:

- the recipient’s account number or IBAN

- the receiving bank’s BIC/SWIFT code

- the bank’s address

Be sure to confirm the details thoroughly as accuracy is essential to make an international money transfer.

- The account number or IBAN (international bank account number) of your intended recipient. The IBAN in particular is essential as its unique digits will ensure that your funds are sent directly to the correct account of your recipient. You can confirm your, or your recipient’s IBAN with our checking tool before sending it to a provider.

- BIC/SWIFT Code: The Bank Identifier Code or SWIFT Code is the specific code which assures that your international transfer arrives at the designated receiving bank.

- The office address of the branch of the bank where the recipient’s account is held. Including the full address of the bank is essential, because it verifies the bank’s identity when sending international money transfers.

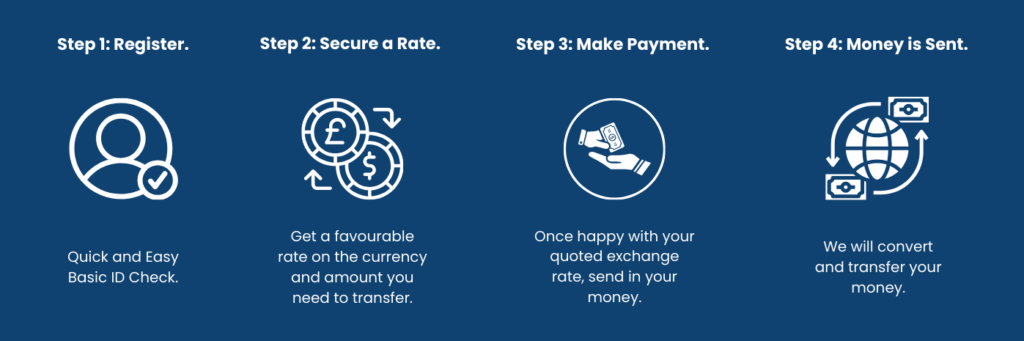

The Process of an International Bank Transfer

Sending your international bank transfer can be smoothly handled by our team of experts at Key Currency and the steps are simple:

Register your account

You can register online or over the phone. It’s quick, easy and there’s no obligation to trade.

Discuss exchange rates

All you need to do is tell us what currency you need and the amount. We’ll then quote you a rate, completely free.

Make your payment

On instruction, we will send your money to a segregated client account by bank transfer.

Sending your money

Your funds are converted and transferred to the account you requested as soon as your payment is received.

Details for Different Parts of the World

The general process of international money transfers is consistent, however, certain differences will vary depending on where you to send money internationally depending on the part of the world you are transferring to.

Here we will use Europe and the USA as examples.

Details to send money to Europe

When sending money between European countries, you need the international bank account number and BIC/SWIFT code of your recipient’s bank. European transfers can use what is known as Single Euro Payments Area or SEPA system.

This simply offers faster processing and lower fees within the European Union.

Details to send money to the USA

When sending an international transfer to the United States you will need to provide the recipient’s account number, routing number and the BIC/SWIFT code of the specified bank account you are transferring funds to.

A useful tip is to also determine the office address of the bank to minimise the chance of internal errors.

Do I need to Provide Details for Receiving Money?

You are not required to provide any additional details other than your account information.

We advise to always keep in mind that the receiving banks may well charge fees for processing incoming transfers, these fees will vary depending on the policy of the individual bank.

Always ensure that you provide the accurate account number or IBAN number to the sender. Some countries or financial institutions may have specific requirements or regulations depending on the amount you are set to receive.

What are the Fees Involved with Sending an International Bank Transfer?

Sending an international bank transfer will incur various fees. These fees on average are between £20-£40, but will differ according to the policy of the recipient’s bank and the details of the transfer, for example, the destination country and the amount which is being sent.

We always recommend checking with your bank to ascertain the exact fees associated with international transfers.

If you’re looking to send large, regular, currency transfers abroad, or even one-off transfers then currency brokers might be one of the best options available for you.

Often much cheaper than banks, currency brokers charge customers much less in transfer fees, and, in some case won’t charge a transfer fee at all, like us at Key Currency.

Another game changer is that brokers have far lower overheads enabling them to undercut the banks on fees and charges.

Exchange rate charges with currency brokers are lower, at times this is between 60% to 70% cheaper than using a bank for sending money abroad.

Get a free quote today and find out how you can save money on your international money transfer with Key Currency.

You May Also Like Reading…

Author,

Author,