Last Updated on May 16th, 2024

Use our IBAN checker and validation tool below for a simple and quick way to confirm your IBAN or one that you have received for an international money transfer.

Enter in the IBAN below, click check, and we’ll do the rest!

How are IBANs Created?

International Bank Account Numbers, or IBANs, are created using your domestic banking information such as your sort code and account number (if you’re in the UK) other information included in the IBAN is about your specific bank and the country you reside such as:

- Bank Identifier Code

- Country Code

- Check Number

The check number within an IBAN, which is the 3rd and 4th digits, helps each IBAN to pass integrity checks and authorisation.

For those outside of the UK, IBANs can be of different lentghs.

In Spain for example, their IBAN also includes a ‘National Code’ which is another form of authorisation to make sure the International Bank Account Number is valid.

This is why Spanish IBANs are 24 characters long as opposed to the UK where it’s 22 characters.

When are IBANs Needed?

International Bank Account Numbers are needed for sending or receiving money internationally.

The purpose of IBANs and the IBAN system is to make money transfers overseas much quicker and as secure as possible.

If you’re looking to transfer money to a destination/bank account in Europe, then IBAN information will be requested by your transfer service or bank, so they know where to send the money.

A lot of other countries around the world, in the Middle East and Africa are now adopting the IBAN system.

It is becoming much more commonly recognised as the go-to method for international payments.

Avoiding Mistakes with IBANs

IBANs allow money transfer services to send money internationally to the right account.

It’s key that you’re providing the right one, this will make sure your money arrives at the right recipient, and not someone else!

But, everyone is human, and typos can happen!

To avoid any incorrect IBAN mishaps, we recommend:

- Always stick to the digital format, this means, don’t add spaces in between the different aspects of the IBAN code. Banks may reject the IBAN you provide if it isn’t one string of characters.

- Don’t keep typing! IBANs are long and errors can happen when typing them out. Always continue to double-check, and use our tool for validation. Once you know the IBAN is correct, it is best to save it in your notes and continue to copy and paste it for future transfers!

- Communicate with your transfer service or bank. When you have provided the IBAN, it is worth checking and making sure it is connected to the right bank and account attached to your recipient. The company helping you with the transfer should be able to confirm these details.

If you are having trouble finding your IBAN, you can usually login into your online banking and find it in account details.

What Happens if I Provide the Wrong IBAN?

If you provide the wrong IBAN but it is still a valid one (someone else’s) this could potentially lead to the money being transferred to the wrong recipient.

If the IBAN provided isn’t valid, more than likely, an independent money transfer service like ourselves will let you know, but, your bank may still go through the transfer process and charge you, with no money being sent!

Of course, with any international money transfer, you want it to be smooth and as efficient as possible.

Providing the wrong IBAN can lead to the issues above which will then cause delays to the money being transferred.

Always double-check.

Our IBAN confirmation tool above uses all of the same checks that are made by banks for IBAN validation.

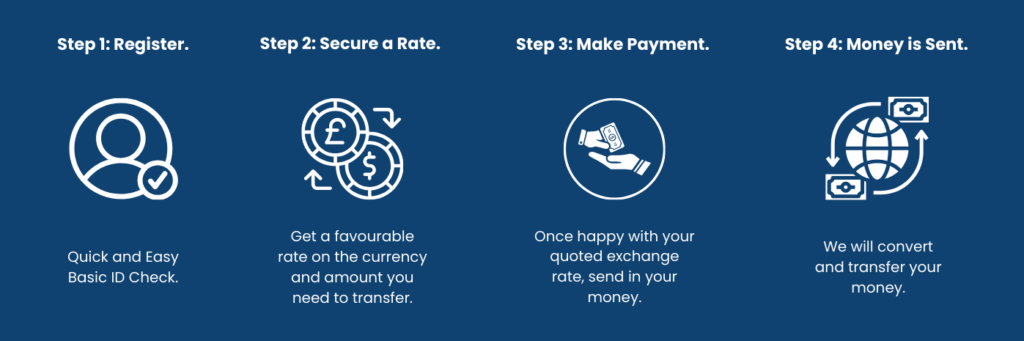

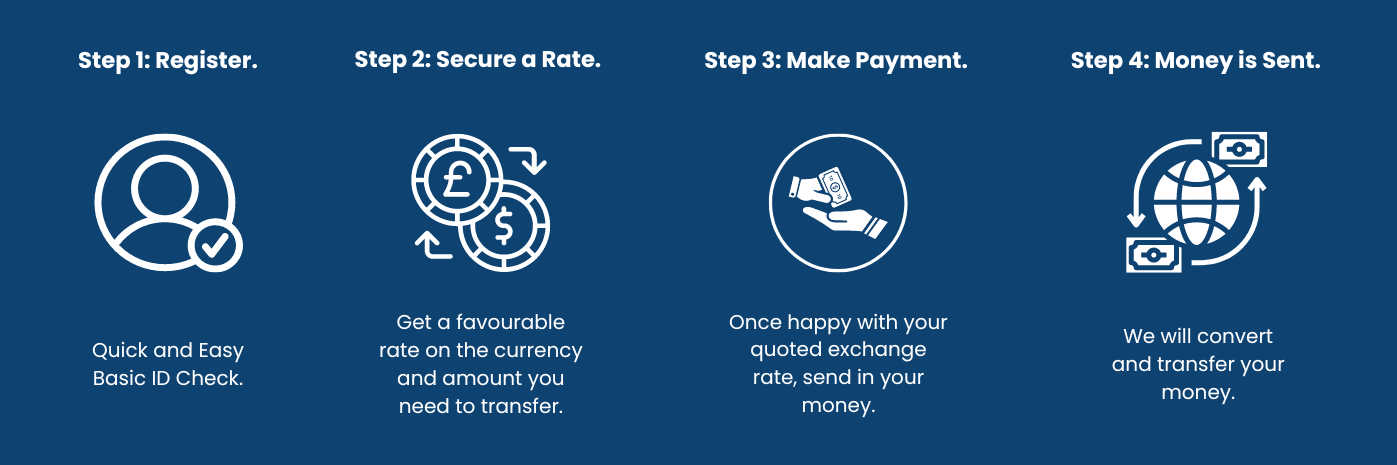

Key Currency: Specialists in International Money Transfers

At Key Currency, we support thousands of people with their money transfers abroad.

We are FCA-regulated and authorised, which means your money is secure and safe at all times throughout the transfer process in a safeguarded account.

We have over 2,000+ reviews on Trustpilot with an excellent rating, our goal is to support and help people with international transfers, where other services don’t.

This is why our expert traders are shown on our website and are just a call way, at all times.

They can answer any questions you may have and monitor exchange rates for you.

Why? So we can provide you with the most value possible for your money when transferring it overseas.

If you want to get the latest rates, please request a quote with us today!

Start Saving on Your International Transfers

Author,

Author,