Last Updated on August 7th, 2024

Selling property in Cyprus?

In this article, we will explore all of the costs you are likely to encounter along the way.

We’re talking taxes, estate agent fees and lawyer fees, money transfer options and more.

We will also offer guidance to help you navigate your sale smoothly and keep your finances in check.

Understanding the costs

Let’s take a look at the 3 main costs you’ll come across when selling a property in Cyprus.

Estate Agent Fees

In the Cyprus property market, estate agent fees aren’t a one-size-fits-all.

In hotspots like Paphos or Limassol, where the action never stops, fees might push the upper limits due to soaring demand.

Yet, in the serene settings of the Troodos mountains, you’re likely to be able to negotiate a lower fee from local agents.

Averaging out at 3-5% of your property’s selling price, these fees are a crucial point of discussion.

It’s all about the art of negotiation here, arming yourself with market knowledge could lead you to negotiate fees that leave more in your pocket, reflecting the true value of your property.

Lawyer Fees

When selling your place in Cyprus, having a lawyer isn’t just good sense – it’s practically a must.

In the maze of legal jargon, especially in a foreign language, a good lawyer is worth the investment.

They know the ins and outs of property laws, which can be complex, ensuring you don’t miss any critical steps or paperwork.

Plus, they’re your go-to for negotiating contracts, making sure everything is fair and square.

In short, a lawyer makes the whole selling process smoother and keeps you from stepping into any legal potholes along the way.

Most legal fees when dealing with property sales in Cyprus are around 1% of the sale value as well as disbursements (e.g. for the certification of documents).

Tax on Property Sales in Cyprus

Let’s face it – no one wants to talk about taxes, but being well informed can help to ensure you only pay exactly what you need to and not a penny more!

Capital Gains Tax

In Cyprus, you pay a 20% tax on the profit when you sell property.

But there is a nice perk: the first €17,086 of your profit doesn’t get taxed at all, and this exemption is a once-in-a-lifetime deal for each seller.

To figure out what profit is taxable, you can subtract certain costs from your sale price.

These include what you originally paid for the property, any transfer fees, and money spent on upgrades like renovations or adding central heating.

If you use a registered real estate agent in Cyprus, their fees can also be deducted.

How to report the sale

If you are a UK-domiciled and resident individual, you’re obligated to declare your Cypriot property sale as part of your Worldwide Capital Gains.

Unlike properties situated in the UK, a Cypriot property sale does not necessitate a 60-day disclosure to the HMRC.

Instead, the sale is to be documented in your annual self-assessment tax return.

Navigating the somewhat complicated tax implications of selling a property abroad can be challenging.

It’s best to always consult with a tax professional to ensure compliance and to take advantage of possible tax efficiencies.

Expenses for providing necessary documents to the buyer

Typically, a seller of property in Cyprus will need to provide the buyer with the following:

- Land Registry Search (for mortgages or other charges): This will range from €10 to €50.

- Copies of Architectural & Site Plans and previous contracts obtainable from Land Registry: €5 to €40

- Appointing general power of attorney: €50

- The energy certificate referred to above.

Northern Cyprus presents a unique landscape within the broader Cypriot property market. Governed by different regulations and market dynamics, the costs and processes involved in selling property here can diverge from those in the Republic of Cyprus. For example – the Capital Gains Tax is slightly different in Northern Cyprus: Understanding these regional differences is essential for sellers navigating the Northern Cypriot market, highlighting the importance of localised insights and expertise. Engaging the services of a well-experienced real estate agent is, in my opinion, absolutely vital here. Remember, every real estate agent will want your business and so they are invaluable for offering insights into a realistic sale price. They can also help with translating important facts, breaking the language barrier that many of our clients have issues with at times.Regional Tax Cost Variations: A closer look at Northern Cyprus

Vendor’s Position

Transfer Fee

Capital Gains Tax

Private Individual

6%

0% on the first sale 3.5% for the 2nd and so on.

Professional

6%

6.25%

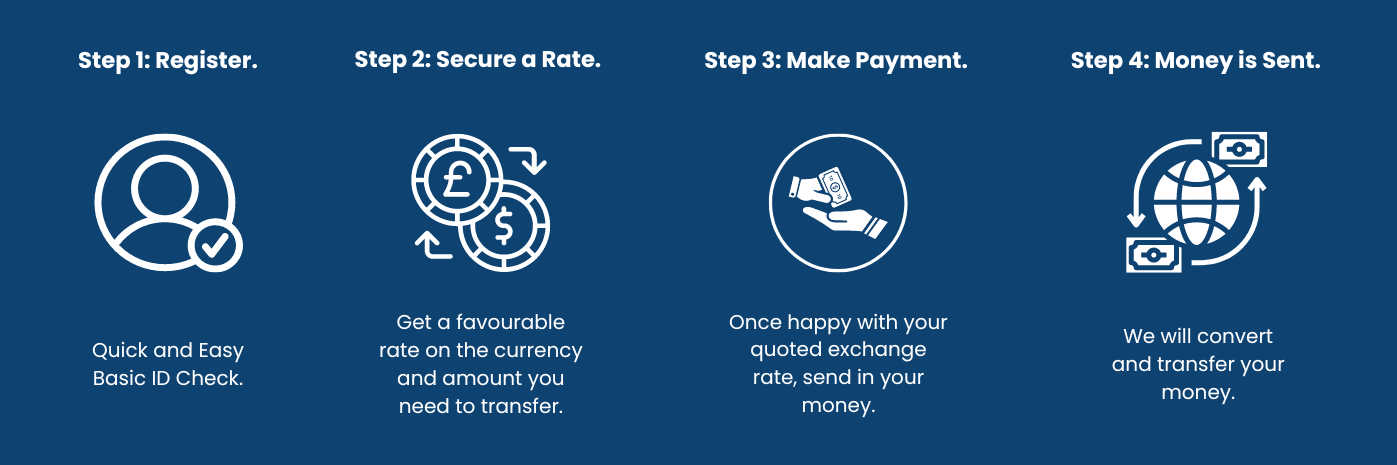

Send Money to the UK (No Fees)

Sending your Sale Proceeds back to the UK

When you’re selling a property in Cyprus and need to send money back to the UK, exploring your options can help you save a lot of money on exchange rates and transfer fees, a cost that many forget about!

Currency Brokers: Your Most Cost-Effective Option

Using a currency broker when selling property in Cyprus can significantly boost the value you get from your sale, thanks to better exchange rates compared to other ways to transfer money internationally, such as a bank or transfer app.

Currency brokers specialise in navigating the volatile forex market, ensuring you time your transfer when rates are in your favour.

They provide a tailored service, understand your specific needs and offer strategies to maximise your returns.

Plus, with dedicated brokers, you benefit from personal guidance through every step of the transfer process, making it smooth and stress-free.

As Wayne Sampson – one of our expert traders at Key Currency advised:

“Cyprus is considered a high-risk destination for receiving and dispatching funds to and from, a fact that many property sellers do not realise at the time of the sale.

Therefore, enlisting the services of a professional currency broker not only gives you as a client complete peace of mind, it means that your funds can be quickly transferred to your designated account in the UK.

For this reason, it’s best for a broker, like ourselves at Key Currency to receive the money directly from the seller’s solicitor, either as a banker’s draft or a transfer.

We have Greek translators to assist with any translation of documents required.”

Banks

Traditional banks, like the Bank of Cyprus and Hellenic Bank, are often the first port of call.

They’re reliable and established but may offer less competitive exchange rates and higher fees for international transfers.

This can significantly impact the amount you receive on the other end, especially for large sums when dealing with property sale processes.

For example – Hellenic Bank quoted a 4% currency commission fee when I asked for a quote to send £250,000 to a UK account.

That’s £10,000 in their pocket, not yours, which we consider to be pretty steep!

The Bank of Cyprus advised me that their commissions vary depending on what type of account the client holds, but would be between 3-5% – not a small change in anyone’s opinion!

Owen Wiles, a Senior Trader at Key Currency comments on this further:

“Ensure funds are paid from the sale straight to the broker, as banks in Cyprus can be expensive to transfer internationally with.

By paying the funds straight to a currency broker like Key Currency, we can act quickly should the markets be favourable.

On average, it typically takes around 3 to 6 months to sell a house in Cyprus so most people are keen to get the money back as soon as they can.

Consider interest rates when deciding on waiting on a better exchange rate, whilst interest rates are good, you may lose more interest than you’ll gain on the exchange.”

Online Transfer Apps

For a more modern twist, apps like Revolut have changed the banking world, offering fast, user-friendly, strictly online platforms to move money domestically and internationally.

Online apps though, are especially appealing for smaller money transfers, providing flexibility and lowering costs compared to high-street ‘traditional’ banks.

However, these fintech apps do lack a personal touch and bespoke advice that is paramount when dealing with larger international transactions.

Again, their fees can be higher the more you look to transfer with up to 4% of the transferred amount with Wise and 3.5% with Revolut, as examples.

Property sales internationally are where our expert team at Key Currency shines. We specialise in larger transactions, offering far more favourable exchange rates than banks and personalised services that apps can’t match. With an expert understanding of the market, our expert traders at Key Currency will guide you through the transfer process, help you time your exchange to get the best rates and provide a tailored service that looks at your individual needs. This approach can lead to substantial savings and a smoother property sale experience, making us an excellent choice for maximising the returns from your property sale in Cyprus. Choosing Key Currency for your international transfer needs after selling a property in Cyprus can offer peace of mind and financial benefits. As an FCA-regulated entity, we adhere to the high standards of security and trustworthiness, ensuring your money is handled safely. Our excellent rating on Trustpilot reflects a strong customer satisfaction record, highlighting our commitment to providing valuable, personalised service. This combination of regulatory oversight and positive customer feedback underscores why we are a standout choice for managing your funds efficiently and securely. Please contact us today for a no-obligation quote!How Key Currency can help you transfer your sale proceeds

Want to Read More?

- Costs of Selling a Property in Spain

- Best Ways to Transfer Money to Cyprus

- What is an International Bank Transfer?

Sources Used in this Article:

Author,

Author,