Överför pengar från Spanien till Sverige (Tydliga och hjälpsamma råd)

Last Updated on April 16th, 2025

Oavsett om du säljer en fastighet, flyttar hem eller gör en betalning – här får du veta de bästa sätten att överföra pengar från Spanien till Sverige.

När du ska överföra pengar från Spanien till Sverige har du i princip tre alternativ:

- Använda en bank

- Använda en valutamäklare

- Använda en pengaöverföringsapp

Använda en bank

Att använda en bank för att skicka pengar utomlands är kanske det mest självklara, men det har också flera nackdelar.

För det första kan det bli mycket dyrare, och för det andra erbjuder bankerna sällan någon egentlig service längre.

Det är en av anledningarna till att bankerna fått så mycket konkurrens – de gör helt enkelt inte ett särskilt bra jobb!

Generellt sett kan du räkna med att betala 3–4 % mer med en bank jämfört med en valutamäklare eller pengaöverföringsapp.

Vid större transaktioner kan detta bli väldigt kostsamt.

Om du till exempel säljer en fastighet i Spanien för 120 000 €, och vill växla till svenska kronor, kan banken ta upp till 4 800 € i avgifter.

Poängen är – innan du använder en bank, jämför och ta in offert från annat håll.

Använda en valutamäklare

En valutamäklare är specialiserad på att skicka pengar utomlands för kunder.

Precis som en bank använder de det säkra SWIFT-systemet för internationella överföringar, men till en mycket lägre kostnad.

Du får bättre växelkurser och lägre avgifter, vilket gör att du får mer pengar i slutänden.

En annan fördel är att du får personlig service.

Som du säkert märkt är det svårt att få riktig service idag – stora företag vill att du gör allt själv och tar ändå lika mycket betalt.

Med en valutamäklare får du hjälp genom hela processen – från början till slut – vilket ger trygghet.

Liten rekommendation: Key Currency är en ledande valutamäklare som hjälper dig att skicka pengar från Spanien till Sverige på ett snabbt, enkelt och kostnadseffektivt sätt.

Vi är en av de få valutamäklare som inte tar ut några avgifter för att skicka pengar från Spanien till Sverige. Och till skillnad från banker och appar, erbjuder vi dessutom service på svenska!

Använda en pengaöverföringsapp

Pengaöverföringsappar har dykt upp överallt de senaste åren.

De är oftast populära för mindre betalningar.

Några välkända appar i den här kategorin är Wise, Revolut, Remitly och XE.

Tänk på dessa som ”gör-det-själv”-lösningar.

De passar bra för teknikvana personer, men för större belopp kan det kännas osäkert – gör du ett misstag finns det ingen att ringa.

All kommunikation sker via mejl eller chatt.

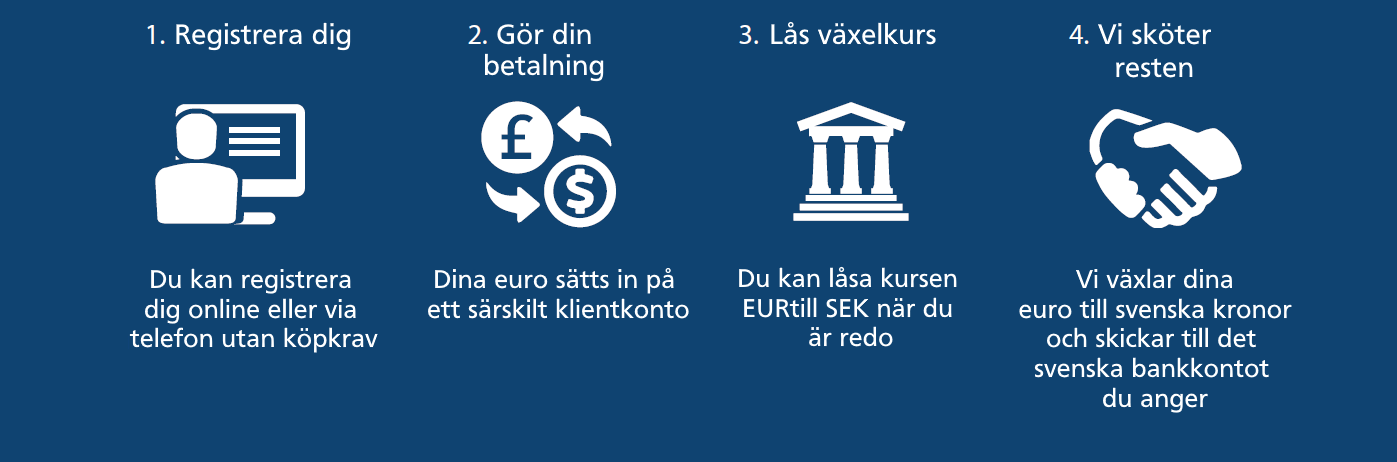

Så här överför du pengar från Spanien till Sverige (i 4 enkla steg)

Processen är ganska enkel och består av fyra steg:

Hur lång tid tar en överföring från Spanien till Sverige?

Generellt tar det 2–3 arbetsdagar att överföra pengar från Spanien till Sverige.

Själva växlingen från euro till kronor går snabbt – det kan ske på några minuter.

Den största delen av tiden går åt till att vänta på att pengarna registreras på det svenska bankkontot.

Detta kan variera beroende på hur snabbt mottagarbanken behandlar internationella betalningar.

Om överföringen sker över en helg kan det ta lite längre tid eftersom banker är stängda då.

Vad kostar det att överföra pengar från Spanien till Sverige?

När du jämför kostnader ska du tänka på två saker: avgifter och växelkurs.

Avgifterna kan vara svåra att förstå, särskilt hos banker – de tar ofta ut flera olika typer av avgifter som du inte ser förrän i slutet av processen (med flit).

Hos Key Currency tar vi inga avgifter när du skickar pengar från Spanien till Sverige.

Vi erbjuder konkurrenskraftiga EUR–SEK växelkurser och berättar exakt hur mycket du får när överföringen är klar.

Varning för avgifter vid bankcheck om du säljer en fastighet!

Om du säljer en fastighet i Spanien bör du vara medveten om extra kostnader.

Efter försäljningen får du oftast en bankcheck från notarien – det är fortfarande det vanligaste sättet att få betalt i Spanien.

Men när du försöker sätta in den på ditt spanska bankkonto, tar banken en avgift.

Stora spanska banker som Santander, Caixa, Bilbao och Sabadell tar ofta upp till 1,5 % av beloppet bara för att sätta in bankchecken!

Vid en fastighetsförsäljning kan detta bli en enorm kostnad.

Vi har en lösning.

Vi är en av de få valutamäklare som har verksamhet i Spanien och kan därför hjälpa våra kunder att sätta in sina bankcheckar utan avgift.

Detta är inget andra mäklare erbjuder, eftersom de ofta inte har någon fysisk närvaro i Spanien.

Vilken information behöver jag för att skicka pengar från Spanien till Sverige?

För att skicka pengar till ett svenskt bankkonto behöver du följande information om mottagaren:

- Fullständigt namn och adress

- IBAN

- BIC/SWIFT-kod

Alla svenska bankkonton har ett IBAN med 24 tecken.

Exempel på ett svenskt IBAN:

SE45 8000 3427 7654 4222 7891

Behöver du hjälp med detta, finns vi här.

Du kan skicka pengar till en rad svenska banker, som:

SEB, Nordea, Handelsbanken, Swedbank med flera.

Sammanfattning

- Du kan använda bank, valutamäklare eller app för att skicka pengar från Spanien till Sverige.

- Jämför kostnader – bankerna kan göra dig 3–4 % fattigare.

- Överföringen tar vanligtvis 2–3 arbetsdagar.

- Säljer du en fastighet? Se upp för avgifter på bankchecken– de kan bli höga!

Vem är vi?

Key Currency är en oberoende valutamäklare.

Vi erbjuder mycket konkurrenskraftiga växelkurser och tar inga avgifter.

Vi är specialiserade på stora transaktioner – särskilt fastighetsaffärer där kostnad och timing kan ha stor ekonomisk påverkan.

Eftersom vi hanterar andras pengar vet vi hur viktigt det är med förtroende, säkerhet och transparens.

Vi har 5-stjärnigt betyg på Trustpilot baserat på över 2 600 verifierade recensioner.

Tror du att vår tjänst kan vara till nytta för dig? Begär en kostnadsfri offert!

https://www.keycurrency.co.uk/overfor-pengar-fran-spanien-till-sverige/

Zelle does not support international transfers, so it cannot be used to

Zelle does not support international transfers, so it cannot be used to  Venmo does not work in the UK, as it’s only available to users with a US bank account and a US-based mobile number.

Venmo does not work in the UK, as it’s only available to users with a US bank account and a US-based mobile number.