Last Updated on August 11th, 2024

Switzerland, known for its picturesque landscapes and robust real estate market, also boasts a complex tax system, especially for non-residents.

When selling a property in Switzerland, several costs are involved, each one having an impact on your final proceeds.

In this article, we will take a closer look at the costs involved, including fees and taxes, and the best way to transfer your funds back to the UK.

What are the costs involved when selling a property in Switzerland?

Let’s first address the thing everyone loves to hate – taxes!

Like it or not they are part and parcel of your property sale – so, we have done the investigations for you, so that you know exactly what to expect.

Capital Gains Tax (CGT) on Swiss property

CGT in Switzerland is a chameleon, changing based on a multitude of factors, including your residency status and the property’s location.

Non-residents should pay special attention as CGT can significantly dent profits.

Capital Gains Tax in Switzerland can mix things up, especially if you’re not living there.

Switzerland is divided into ‘cantons’ (the Swiss phrase for regions), each with its own set of rules, how much CGT you end up paying can swing wildly depending on where your property is.

For example, selling a place in Valais might hit your wallet differently in terms of CGT compared to a sale in Zurich.

It’s all about where you are on the map.

The table below clearly outlines the differences between each canton.

| Canton | Purchase Price | Sale Price | Estate Agent Comission (2.5% of the sale price) | Capital Gains Tax on Property |

| Aargau | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 15,000 |

| Bern (city) | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 15,136 |

| Lucerne | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 12,159 |

| Solothurn (city) | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 10,508 |

| St. Gallen | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 16,817 |

| Thurgau | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 24,000 |

| Zurich | CHF 900,000 | CHF 1,000,000 | CHF 25,000 | CHF 16,520 |

This just goes to show why doing your homework on local tax rules in Switzerland is vital!

Other Swiss property sale taxes to be aware of

It’s not over yet!

When you’re looking to sell property in Switzerland, beware as there is more to think about than just Capital Gains Tax.

Real Estate Gains Tax

This one’s all about where your property is.

It hits the profit you make from selling, and how much you pay depends on how long you’ve owned it and if you’ve renovated your property to increase its value.

Each canton has its rate once again, so it’s something of a postcode lottery.

| Real Estate Gains Tax per Canton | After 5 Years | After 20 Years |

| Aargau | CHF 75,000 | CHF 25,000 |

| Bern | CHF 72,630 | CHF 45,685 |

| Geneva | CHF 75,000 | 25,000 |

| Lausanne | CHF 45,000 | CHF 22,500 |

| Lugano | CHF 65,000 | CHF 12,500 |

| Lucerne | CHF 52,565 | CHF 46,257 |

| St. Gallen | CHF 75,476 | CHF 60,815 |

| Zurich | CHF 84,930 | CHF 44,700 |

VAT on new builds or big renovations

Looking to sell a brand-new place or one you’ve majorly renovated? You might need to cough up some funds aside for VAT.

This is more common if you’re in the business of buying properties for the sole purpose of renovating and reselling.

Tax implications for Non-residents

Withholding Tax

If you’re not living in Switzerland, the government might hold back some tax on your sales profit upfront.

This is their way of making sure they get their share, depending on where you’re from and the agreements Switzerland has with your country.

Land Registry Tax

Some Swiss cantons charge a fee to register the new owner in the land registry. Usually, it’s the buyer’s worry, but it’s something to keep in mind during negotiations.

Municipal Taxes

Depending on your property’s location, there could be some local taxes to deal with. These vary a lot, even within the same canton, and can be easy to miss when you’re figuring out your expenses.

Navigating the Swiss tax landscape can be tricky, especially with all of those cantonal differences thrown into the mix!

If you’re thinking of selling, talking with a tax expert who knows the ins and outs of Swiss property taxes can save you a lot of guesswork and ensure you don’t miss anything important.

How much can I expect to pay when selling a property in Switzerland?

According to the Global Property Guide, the seller pays between 3.23% and 5.38% of the property sale price in fees.

It’s vital to remember that the buyers in Switzerland are responsible for the Notary and legal fees, property transfer tax and mortgage/financing costs!

In addition to the sale price, the estate agent commission also depends on the type of property, its location and the package of services provided by the property specialist.

- Estate agent fees for single-family houses and apartment buildings: 2% to 3%.

- Estate agent fees for plots of land: approx 5%.

- Estate agent fees for special properties: individually agreed rates.

However, this can vary depending on circumstance.

For instance, selling a luxury property in Geneva might attract lower percentage fees due to the high sale price.

However, selling a quaint chalet in Grindelwald to use an example, a less sought-after area, might fall on the higher end of the scale when it comes to fees.

Notary and Legal Fees

In Switzerland, notary fees for selling property are part of the process and can vary significantly depending on the canton in which the property is located.

Generally, these fees are calculated as a percentage of the property’s sale price, often ranging from 0.1% to 1%.

The role of a notary in Switzerland is crucial for the following reasons:

Notaries ensure that the sale agreement is legally valid, properly executed, and binding. They verify identities of the parties involved and ensure that all legal requirement are met.

They are responsible for the official transfer of property, including the registration of the new owner in the Land Registry. This step is vital for the legal recognition of the sale and transfer of ownership.

Notaries also provide impartial advice to both buyers and sellers, explaining the implications of the contract and ensuring that both parties understand their rights and obligations.

In many cases, notaries manage the financial transactions involved in the property sale, holding funds in escrow until all conditions are met for the transfer to proceed. Given their integral role in ensuring the legality and smoothness of the property transaction, notaries are an indispensable part of selling property in Switzerland.

Choosing a reputable legal representative can streamline the sale process, potentially saving you money in long-term corrections and legal adjustments. Swiss property law is complex, making legal representation important. Legal fees, around 1% of the sale price, ensure your transaction adheres to Swiss regulations, providing peace of mind throughout the sale process. While these fees add to your expense, they are an investment in the smooth execution of your property sale.

Transferring your proceeds – Understand your options

After the sale, the focus shifts to transferring your money from Switzerland.

Choosing the right option will considerably affect the end amount that lands in your bank account, so make sure to choose wisely!

Transferring your proceeds with Banks

While Swiss banks are synonymous with security, they might not be the best option for international transfers due to their fees and exchange rates.

Swiss banks like Credit Suisse, EFG, UBS, and Julius Baer are famous for keeping your money safe and private, which is great for UK expats looking for a secure place to bank.

But if you’re looking to send money abroad, they are, in most cases unable to offer favourable exchange rates and can charge high fees.

We can’t put too find a point on it here as each bank offers different rates and fees to their customers depending on their account’s status.

It’s also important to remember that what your Swiss bank may advertise on its website may not be the rate you get on the day.

It’s best to check in person with your branch to get exact rates.

I spoke to Harry Dyer and he gave me an example of how he recently assisted clients who had sold their Swiss property and needed to transfer their funds back to the UK.

“Transfer apps didn’t offer the security and personal service they sought. Key Currency, recommended by a friend, proved to be a favourable option with our competitive CHF to GBP rates and transparent no fee structure.

Initially tempted to use their Swiss bank, Credit Suisse – they found that their exchange rates and fees were less favourable.

Credit Suisse quoted 4% commission on the exchange rate. This meant that sending their 280,000 CHF would have landed them with a charge of 11,200 CHF, equating to a whopping £9,866 out of their well-earned property sale proceeds.”

Key Currency not only provided them with a better exchange rate but also personalised service through their dedicated account manager.

This approach allowed them to transfer their funds at an optimal time, maximising their returns.

The savings and confidence they gained from using Key Currency helped them significantly, enabling them to allocate extra funds towards renovating their new home in the UK.

Transferring your proceeds with a Currency Broker

Specialised foreign exchange services like Key Currency shine here, offering tailored advice, competitive rates and a seamless transfer process, especially for large amounts resulting from international property sales.

Kieran Wiles, one of our expert traders, gave me some valuable insight here as to how your international money transfer with Key Currency can help beat what Swiss banks offer:

Exchange Rates

UBS the largest bank in Switzerland are roughly 2% away from the market, whereas we work on the live currency markets, and can provide updates and insights as to what may potentially strengthen/weaken the CHF (Swiss Franc).

Therefore, when prospective clients are exchanging their funds/proceeds they can achieve far better using Key Currency.

Service

Funds can be transferred directly from the Notary into the client’s Key Currency CHF account, this avoids the funds going through the banks, and avoids delays etc providing a far more efficient service.

We also work on a one-on-one basis with our clients, so they will have personal contact to ensure the smoothest process when going through the stressful/busy process of selling international property.

Current Trends

The CHF (Swiss Franc) has been negatively affected by the recent SNB’s interest rate decision, so prospective clients selling a property in Switzerland or with CHF to move should get in contact now to find out more about how we can help.

Transfer Times

Transferring money from Switzerland to the UK can take between 3-5 working days using a Swiss bank.

If you are in a hurry to release your funds, again – heading to a professional currency broker will allow you to do this in 1 to 2 business days.

For a transfer by any means, you will need to provide beneficiary details, including account number and sort code.

One wrong digit here can delay or cause the transfer to be returned so be sure to triple-check those numbers for a smooth transfer.

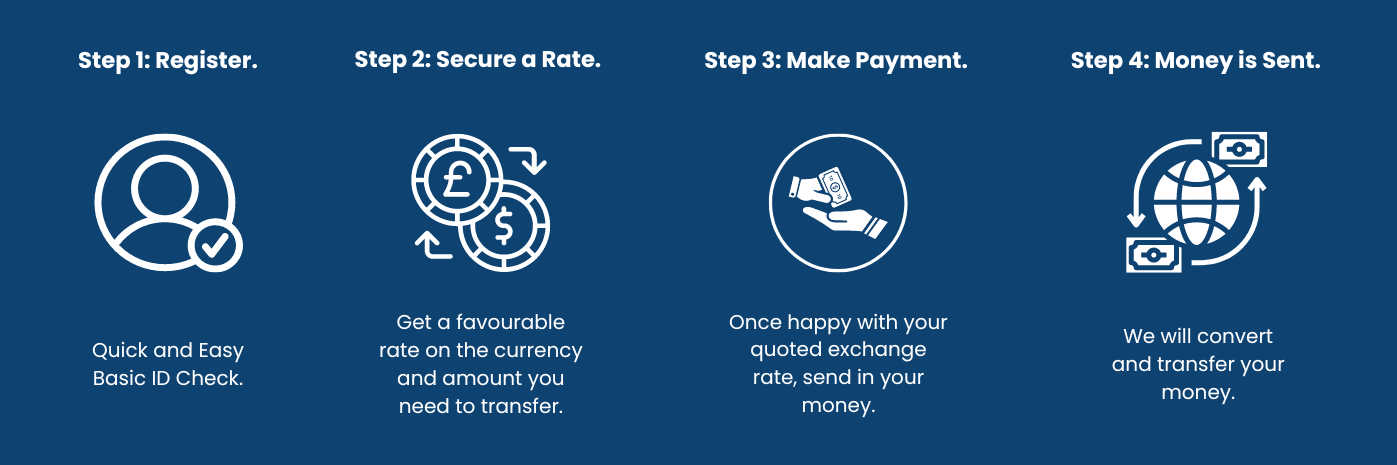

Transferring your property sale proceeds in 4 steps

Choosing Key Currency isn’t just about transferring money; it’s about maximising your Swiss property sale proceeds.

Our four-step process ensures you’re guided through every stage with expert advice and support:

- Consultation – We start by understanding your needs and timing, considering market fluctuations to lock in the best rates.

- Rate Lock – Securing a favourable exchange rate at the right time can significantly increase the amount you receive.

- Transfer Funds – You transfer the sale proceeds to us; we handle the rest, ensuring a smooth and secure conversion.

- Completion – Your funds are swiftly send to your specified account in the UK, ready for your next adventure or investment.

In financial transactions, trust is paramount. Key Currency is regulated by the Financial Conduct Authority (FCA), ensuring your funds are handled with the highest security standards. This regulation offers peace of mind, knowing your money is safe and your interests are protected. Selling property in Switzerland involves a nuanced understanding of costs, taxes and the importance of choosing the right partner for your international money transfer. By opting for a specialised currency broker like Key Currency, you’re not just choosing a transfer service; you’re choosing a partner dedicated to maximising your proceeds and ensuring a seamless, secure transfer. At Key Currency, we exist to simplify the complex world of international money transfers. We pride ourselves on personalised service, competitive rates, and our commitment to security, which has helped us achieve an excellent rating on Trustpilot from thousands of customer reviews. Trust us to be your ally in navigating the financial aspects of selling property in Switzerland and beyond. Get a quote today from one of our expert traders! Security, Trust and Peace of Mind with Key Currency

Want to Read More?

- How to Transfer Money to Switzerland

- See the Today’s Current CHF to GBP Exchange Rate

- What is an International Bank Transfer?

Sources Used in this Article:

- https://www.globalpropertyguide.com/europe/switzerland/buying-guide

- https://www.credit-suisse.com/ch/en/corporate-clients/entrepreneurs/products/payments/sepa.html

- https://www.efginternational.com/uk/private-banking/ebanking/efg-access.html

- https://www.ubs.com/ch/en/corporates/international/payments.html

- https://www.juliusbaer.com/uk/en/