Author, Mike Smith

Author, Mike Smith

Last Updated on July 24th, 2024

In this article, I’ll explain the process of how to exchange Dollars to Pounds, the options you have, the costs to look out for, and the best ways to save money.

Where can I exchange Dollars to Pounds?

You can exchange/convert Dollars to Pounds using a bank or a money transfer specialist. While both are viable options, a money transfer specialist is likely to be your cheapest option both in terms of exchange rates and the fees you pay.

Generally speaking, the most important part of exchanging Dollars to Pounds is securing a good exchange rate.

And the simple fact is you’re likely to get a better rate from a money transfer specialist.

Dollars to Pounds exchange rates can differ by as much as 3-4% depending on whether you use a bank or a currency broker.

As well as getting a good exchange rate, currency brokers also provide a better service than a bank.

Any service would be a start!

A money transfer specialist (currency broker) can give you helpful exchange rate guidance and support you through the entire process.

Is it a good time to exchange Dollars to Pounds?

The US Dollar gained a lot of value against the Pound in recent years.

As the US Dollar is in a strong position compared to the Pound, it can be considered a good time to exchange Dollars to Pounds.

When exchanging Dollars to Pounds, you’ll want to make the transfer when the US Dollar is strong.

A good way to check if it is a good time to convert USD for GBP is to compare the exchange rate against historical averages.

Over the past 5 years, the average US Dollar to British Pound rate has been $1 buys £0.77.

In simple terms, if the current exchange rate is higher than the 5-year average, it’s generally a good time to exchange Dollars to Pounds.

At the moment the US Dollar to Pound is well above the 5-year average.

Want more detailed analysis and insights?

You can read about our forecast for the GBP to USD exchange rate here.

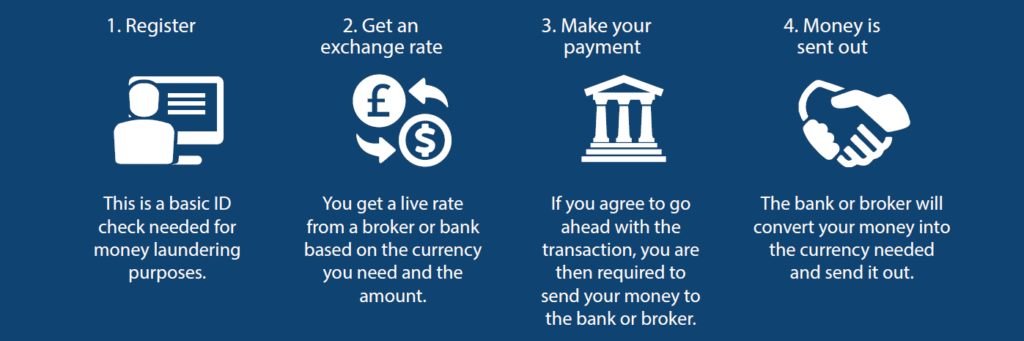

Exchange Dollars to Pounds (in 4 simple steps!)

Exchanging Dollars for Pounds follows a simple process once you know what to expect.

These four simple steps explain how you exchange Dollars to Pounds.

Step 1 – ID Check

The first step is to create an account with your money transfer provider.

You’ll only have to do this the first time you make an international money transfer with your provider.

As part of this, you’ll need to do an ID Check.

Don’t panic though.

It’s often a straightforward process and a passport, and a bank statement can be enough to pass the checks.

It’s purely to comply with anti-money laundering regulations.

Step 2 – Secure an exchange rate

Getting a good USD to GBP exchange rate is the most important part of exchanging Dollars to Pounds.

This is where most of the costs come from.

It can sometimes be a common misconception that there is an ‘official exchange rate’ that’s offered across the board.

That’s not the case.

Each currency broker offers its exchange rate.

So, once you’ve found a Dollar to Pound rate that you’re happy with, lock it in.

As a tip, many banks and money transfer specialists require a certain amount of funds on account before you can get an exchange rate secured.

Step 3 – Send in the Dollars

With the USD to GBP exchange rate sorted, that’s the hardest part done and out of the way.

The next step is to send in your Dollars to your provider.

Your provider will provide the bank details of where you need to send the Dollars.

If you have any questions about this, or just want to be extra careful, contact your bank or money transfer specialist.

That’s the final step you have to worry about.

After that, you can relax, your part is done.

Step 4 – Receive the converted Pounds

Once your US Dollars are received, your provider can make the currency exchange for you.

Your provider will convert your Dollars into Pounds at the exchange rate agreed.

It’s then a case of waiting for the Pounds to arrive in the recipient’s account.

Then it’s all done!

The true costs of exchanging Dollars to Pounds

There are two types of costs to be aware of when you exchange Dollars to Pounds.

- Exchange Rates

- Transfer Fees

As a general rule, transfer fees have a greater impact on smaller money transfers.

For larger money transfers, the exchange rate is the most important factor.

Exchange Rates

Whoever you use, there will be a profit margin built into the exchange rate.

But, some providers will charge much more than others.

Banks are notorious for having some of the worst exchange rates available.

Based on our research, the exchange rate margin from a US bank is usually 3% to 4%.

For a transfer of $100,000 to Pounds, a 4% margin means the transfer would cost you $4,000 in exchange rate costs.

This is huge, whichever way you try and spin it.

Money transfer specialists are likely to get you a much better exchange rate. It will often be dependent on the amount of money you send.

Transfer Fees

It is normal practice for banks often add transfer fees to the cost of an international money transfer (or ‘wire transfer’).

This is on top of the exchange rate costs.

Transfer fees tend to be fixed costs that apply every time you want to make an international transfer.

Here’s a breakdown of the additional transfer fees from some of the USA’s biggest Banks.

| Bank | Transfer Fee |

| Chase | $50 |

| Bank of America | $45 |

| Wells Fargo | $30 |

| Citibank | $35 |

| US Bank | $50 |

It’s a bit of a kick in the teeth, given their exchange rates tend to be uncompetitive.

And some banks have a knack for adding on other fees too.

Examples include intermediary fees, tracking fees, and payment priority fees.

They’re essentially charging you over and over for the same transfer!

The only real way to avoid the fees is to avoid the banks.

Some currency brokers out there will never charge you fees, like Key Currency.

The way to exchange Dollars to Pounds cheaply is to find a company with a good USD to GBP exchange rate that doesn’t then add on extra fees.

How long does it take to change Dollars to Pounds?

It typically takes 2-4 working days to exchange Dollars to Pounds and receive the money in the destination bank account in the UK.

Turning the Dollars into Pounds doesn’t take very long at all. That’s the quick part.

It’s the clearing time between banks based in different countries that takes time.

Transferring between the US and the UK is done through a SWIFT transfer.

Some banks are quicker than others at this!

Plus, things like cut-off times, weekends, public holidays, and the time difference can also drag out the process.

If you have a deadline or you’re on a tight schedule, make sure to factor in the processing time.

You could also send in the full amount to your provider before making the currency exchange, and this will get some of the waiting time out of the way.

The information you’ll need exchanging Dollars to Pounds

Of course, you’ll want to be as prepared as possible ahead of your transfer.

When you exchange Dollars to Pounds, the really important information relates to the recipient’s bank details.

This information must be correct.

Here’s the information you’ll need:

- Proof of ID (to set up your account)

- Name and address of the recipient

- Recipients IBAN

- Recipient’s SWIFT code

The recipient IBAN is the most important piece of information as this is what’s used to identify bank accounts around the world.

It can usually be found on a bank statement.

SWIFT codes are a unique identifier for each bank.

If this isn’t on your bank statement, it’s usually on the bank’s website.

If you have trouble finding any of the details, you can always contact your money transfer specialist.

At Key Currency, you’ll get your Account Manager who can talk you through finding the payment details and every other step along the way.

How to get the best exchange rate for exchanging Dollars to Pounds

Getting a favourable rate can save you a lot of money when changing Dollars to Pounds.

We’ve covered the importance of avoiding providers that charge huge exchange rate margins, like many of the big banks.

But there’s another significant factor that affects exchange rates.

The timing.

If you exchange Dollars to Pounds at a time when the exchange rate has moved against you, you could lose thousands.

Even small differences in the exchange rate can have a significant financial impact.

The bottom line is timing matters.

I’d be very surprised if you got even a hint of guidance about the best time to make your Dollars to Pounds transfer from a bank.

Yet another reason to avoid using a bank.

The online apps and some money transfer specialists are also not very helpful.

Online-based apps may look good on the face of things, but when it comes down to it, there are a lot of things that seem to go wrong behind the scenes.

I just see too many bad reviews from people using the apps.

If I were transferring a lot of money, that wouldn’t fill me with confidence.

I’d want to be able to speak to a real person who could help give me practical and valuable support.

That’s basically what we do at Key Currency.

With us, you get your Account Manager who can guide you through the transfer from start to finish. And what’s more, our rates are highly competitive and we charge no fees.

Quick Summary

- Your cheapest option for exchanging Dollars for Pounds is likely to be through a money transfer specialist.

- It takes between 2-4 working days for a Dollars to Pounds transfer to be completed.

- You’re likely to receive better service using a money transfer specialist rather than a bank.

- You can save money by exchanging your money when the USD to GBP is favourable.

Key Currency: About Us

Key Currency is a leading money transfer specialist.

We aim to make international money transfers as cheap and easy as possible.

Once you’re registered, you’ll deal with the same Account Manager all the way through.

No need to explain yourself over and over as you’re passed around a call centre or even worse, chat to a robot.

We’re about helping our customers.

You’ll also be able to get guidance from us on the latest exchange rates.

Our currency experts watch the market all day long, spot the trends and help give you the best guidance possible.

If you want to see who we are, you can have a look at all of us on our About Us page.

We’ve also got a 5-star customer rating on Trustpilot with over 2,500 reviews.

In terms of regulation, we are an Authorised Payment Institution (Financial Services Register No. 753989).

All money transfers are conducted through fully safeguarded client accounts.

If you’d like a free no-obligation quote for exchanging Dollars for Pounds, click below and one of our team will be in touch.