Author, Mike Smith

Author, Mike Smith

Last Updated on August 5th, 2024

In this article, I will explain what a foreign exchange transfer is, how they work, and most importantly, how you can make them as cheap and easy as possible.

What is a foreign exchange transfer?

A foreign exchange transfer is when a person or business sends money to a bank account in another country.

Foreign exchange transfers involve converting money from one currency to another.

When sending a large amount of money to another country, you need to pay close attention to the exchange rate.

The exchange rate makes a big difference to the final amount received.

For example, a Pound to Euro rate of 1.18 is better than 1.17. This is because you’re getting 1.18 Euros for every Pound.

The difference on a £100,000 transfer means an extra €1,000.

You can see even the smallest differences matter.

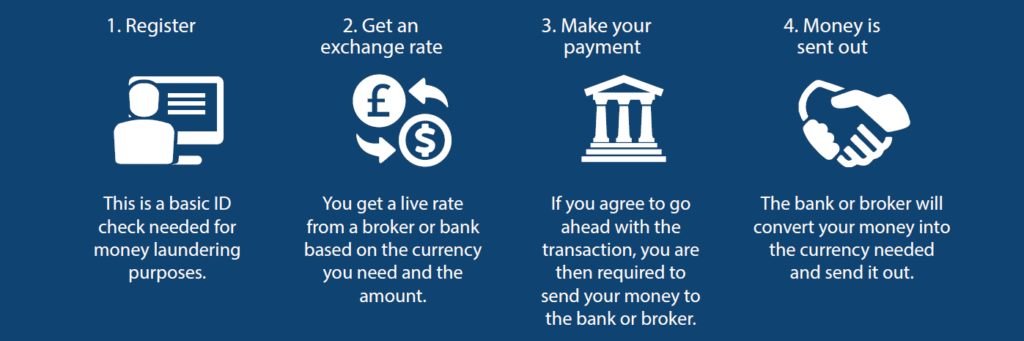

How to make a foreign exchange transfer (in 4 simple steps)

Step 1 – ID Check

To set up an account for foreign exchange transfers, you must do an ID check.

This is to comply with anti-money laundering regulations.

It’s often a straightforward check but may require a copy of your ID and proof of address.

An ID check is required at all banks and money transfer companies.

Step 2 – Secure an exchange rate

The largest cost of your foreign exchange transfer is the exchange rate.

Once you’ve found a good exchange rate that you’re happy with, lock it in with your provider.

This guarantees you’ll get the quoted exchange rate, regardless of any future movement in the market.

If you use a bank, they generally require the funds in your account before they will lock in an exchange rate.

By using a money transfer specialist, on the other hand, it’s sometimes possible to secure an exchange rate with just a small deposit.

Step 3 – Send the funds

Your money transfer specialist or bank will provide you with instructions on where to send the funds to the appropriate account.

Once you send the funds in, your provider should give you confirmation that they’ve been received.

After this, your part is done. You can relax and wait for the currency to be exchanged and land in the recipient’s account.

Nice and simple!

Step 4 – Receive the converted funds

Once your funds have been received, the currency exchange happens.

It’s a quick process, but there’s likely to be a short wait for the funds to clear through the banking system.

It shouldn’t be long though, before the funds land in the recipient’s account in your chosen currency.

How do exchange rates work?

All banks and money transfer companies charge a margin in their exchange rates.

The exchange rate margin is the difference between the interbank exchange rate and the exchange rate you’re quoted for the transfer.

The interbank exchange rate is what the banks use to trade between themselves.

Quoted exchange rates for a foreign exchange transfer will always be higher than that.

This is how banks and money transfer companies make their money.

If you’re not familiar with margins, it can be unclear exactly how much you’re charged because it’s part of the exchange rate.

However, you may not need to calculate the exact margin down to the last penny.

It is often enough to understand how exchange rate charges margins work so that you’re informed when getting exchange rate quotes.

What is the cheapest way to make a foreign exchange transfer?

While people are familiar with their bank, they’re usually not the cheapest option for foreign exchange transfers.

Banks typically charge an exchange rate margin of around 3%-4% of your transfer amount.

If you were transferring £100,000 for example, the banks are taking £3,000-£4,000 in their exchange rate costs.

That is massive!

Costs like this aren’t unique to one bank either.

Most high street banks charge large exchange rate margins.

And on top of this, some banks have the cheek to charge additional transfer fees every single time you wish to do a transfer.

You’re likely to get a much better exchange rate using a money transfer specialist and can also avoid any nasty fees.

You could potentially save thousands on sending money overseas.

Making foreign exchange transfers easy

If you’ve ever tried using a bank for large foreign exchange before, you may have had a frustrating experience.

It’s a problem I hear all the time.

With banks, you often get staff who aren’t particularly knowledgeable on the details of foreign exchange, or you find annoying red tape slows things down.

The truth is banks are more focused on loans and mortgages.

But if you move a large amount of money abroad, you need it to be done right.

To put it bluntly, there can’t be any slip-ups.

When you use a money transfer specialist, you typically get a more efficient and helpful experience when making a foreign exchange transfer.

This is because international money transfers are the only thing they do!

They know where the potential snags may occur and make sure they don’t become a problem.

A money transfer specialist makes the entire process much easier for you.

How long does a foreign exchange transfer take?

Most foreign exchange transfers are completed within a few days, but it depends on the currency you’re transferring to and from.

Foreign exchange transfers within Europe usually take one or two days. Outside of Europe, they normally take between three to five days.

Most of the time taken for transfers to be completed comes from the clearing time through the international banking system.

International transfers either use the SWIFT or SEPA payment networks.

SEPA is just for payments within Europe and can operate slightly quicker than payments across the rest of the world.

Ask your money transfer provider if you have any questions about how long your specific transfer will take.

Making your foreign exchange transfer at the right time

The currency market moves every few seconds and can affect the exchange rate you’ll receive.

On large transfers, even the smallest of changes can have a big impact on the final amount.

If you need to change £100,000 for example, every 1% change in the exchange rate makes a £1,000 difference to the final amount.

Bear in mind, changes of 1% happen regularly. Often multiple times over a week.

Movements as big as 5% can happen over several weeks.

It’s why it’s important to find the best time to make your foreign exchange transfer.

But how are you meant to know when the best time is?!

We’ve all got busy lives, and continuously tracking and predicting the currency markets in detail isn’t realistic.

It pays to have someone you can turn to who can keep you informed on market movements and discuss the transfer.

At Key Currency, we monitor the currency markets for you and give you a call when the exchange rate reaches a favourable point.

How safe are money transfer specialists?

If you haven’t used a money transfer specialist before, you’ll want to know if they are safe.

The key to safety is down to regulation by the Financial Conduct Authority (FCA).

You should check that your money transfer specialist is FCA regulated.

All FCA Authorised companies must transfer all client money through separate safeguarded bank accounts.

Be aware though, that not all money transfer specialists are Authorised by the FCA.

To check if a company is FCA Authorised, search for them on the Financial Services Register.

If they’re not on the register, they’re not Authorised and don’t operate under the same strict safety regulations.

Using an FCA Authorised company is by far your best and safest option.

Why risk making a large money transfer with a company that isn’t regulated?

About Key Currency

We aim to make foreign exchange transfers as easy as possible.

We’re an alternative to big high-street banks and impersonal, faceless apps.

You get your account manager who will look after your transfer from start to finish.

You can speak to them at any time over the phone to discuss any queries you may have about exchange rates or how the transfer works.

This makes your transfer as easy as possible.

Having someone to talk you through the transfer takes the stress out of the process and makes it easier for you to get a better exchange rate.

We are an Authorised Payment Institution (Financial Services Register No. 753989), so all transfers are conducted through safeguarded client accounts for your security and protection.

We are committed to providing our customers with value for money and outstanding service.

Our company has attained a 5-star customer rating on Trustpilot, based on over 2,500 reviews.

To compare our rates to your bank or another provider, you can get a free quote below.