Author, Mike Smith

Author, Mike Smith

Last Updated on August 6th, 2024

In this article, I’ll explain how to transfer money from the UK to the UAE. I’ll make it as clear and easy as possible, removing the usual complicated financial jargon. What’s more, I’ll explain how to avoid expensive costs and fees.

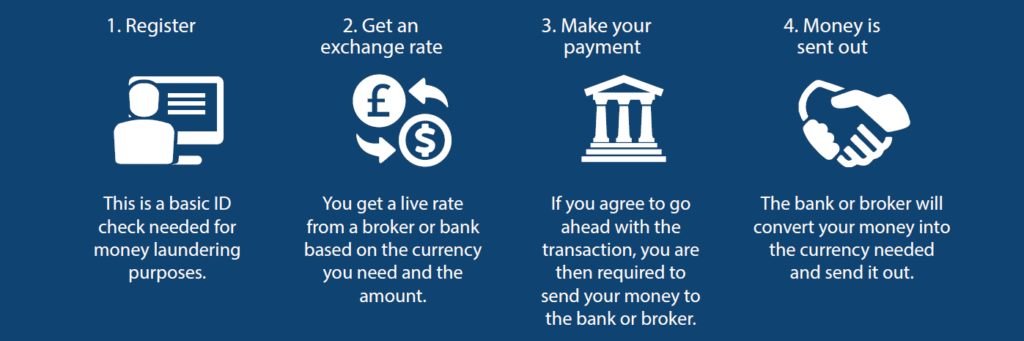

How do I transfer money to the UAE? (in 4 simple steps)

There are 4 simple steps to make a money transfer from the UK to the UAE.

These steps should make the process nice and easy.

They largely remain the same, whichever money transfer provider you use.

Step 1: ID check

When you first register with a money transfer provider, you need to pass an ID check.

This is to comply with anti-money laundering regulations.

For British citizens, sending in a copy of your passport or driving license, along with a utility bill is usually enough.

Although it can seem a little tedious, it ensures your security.

You’ll only have to go through the check the first time you make an international money transfer with a provider.

Step 2: Secure an exchange rate

The exchange rate you get largely determines how much your money transfer to the UAE will cost.

For a money transfer from the UK to the UAE, you’ll need the Pounds to the Emirati Dirham exchange rate.

This is GBP to AED for short.

You can improve your exchange rate by finding the cheapest provider.

A common misconception is that there is an ‘official’ exchange rate.

This isn’t true.

However, there is what’s known as the interbank exchange rate – which the banks use to trade between themselves.

You’ll often see this listed on sites like Google or XE.

Look out for phrases in the small print like interbank rate, mid-market rate, or market rate.

They’re all talking about an exchange rate that isn’t achievable for the man on the street.

For you and me, the interbank rate is purely informational.

To get a real exchange rate, you need to get a quote from a genuine provider, not an information website.

Once you get a quote that you’re happy with, lock it in with your provider.

Be aware that providers may require you to send in a percentage of your transfer amount to secure an exchange rate.

Step 3: Send in your funds

Once you’ve secured an exchange rate for your money transfer to the UAE, you will need to send in the full amount of Pounds.

Your provider will make it clear where you need to send the full transfer amount.

As with any money transfer, make sure you enter the bank details correctly!

It’s basic but always worth double-checking.

Once you’ve sent the full amount, it’s over to your money transfer provider to make the currency exchange.

Put your feet up, you’ve done your job.

Or if the money transfer is to help you make the move out to the UAE, get packing!

Step 4: Your Pounds are exchanged into Dirhams

Your money transfer provider will make the currency exchange and buy the agreed amount of Dirhams with the Pounds you’ve sent in.

The currency exchange will happen fairly quickly.

As soon as the provider has bought the Dirhams, they will be sent to the recipient’s account as you’ve requested.

Once the funds arrive, the money transfer is complete.

The Best Ways to Transfer Money to UAE from the UK

There are various money transfer methods available for customers to send money to the UAE, these include:

- Bank transfer.

- Debit or credit card payment.

- Cash pick-up services.

- SWIFT payment.

- Apple or Google Pay.

Each has its pros and cons.

An international bank transfer is one of the best options due to it being secure, safe, and the most cost-effective with most providers being able to offer this method of transfer.

Strictly online methods such as Google and Apple Pay or using your debit or credit card may make your money transfer to the UAE quicker but at the cost of higher fees.

How long does it take to send money from the UK to UAE?

It typically takes 2-4 working days to transfer money from the UK to the UAE.

Unfortunately, it’s perhaps a little slower than sending money to some other countries.

Most of the time it takes comes from the clearing time as money is sent between banks.

It’s easy to think that transferring money to the UAE is as instant as sending money to a friend for dinner.

Unfortunately, it’s not that quick.

Just bear this in mind and plan when transferring money to the UAE to make sure that you don’t miss any deadlines.

Information you’ll need to transfer money to a UAE account

Naturally, you’ll want to be as prepared as possible when making a money transfer from the UK to the UAE.

The best way to make sure you’re organised is to have all the details you need ready beforehand.

You’ll need these details:

- Your name and the name of the recipient

- The recipient’s account number

- The recipient’s contact details

- The recipient’s IBAN

If you don’t know what an IBAN is, fear not, you won’t be alone.

IBAN stands for International Bank Account Number, and they are used to identify bank accounts from anywhere in the world.

They’re not something most people use in usual day-to-day personal banking.

But when it comes to international bank transfers, IBANs are crucial.

You or your recipient can usually find the IBAN on a bank statement, or you can sometimes find it through your online banking.

If you can’t find it though, don’t worry.

Call a currency broker, like Key Currency, and they will be able to help you find it.

Best options for a large money transfer to UAE

There are two main options for making a large money transfer from the UK to the UAE.

- Use a bank

- Use a currency broker

You’re likely to save money by using a currency broker who will usually get you a better exchange rate.

As we’ve established, the biggest cost of any money transfer comes from the exchange rate.

The better your exchange rate, the cheaper your money transfer.

It’s as simple as that.

Keep in mind though, that even small differences in exchange rates make a huge difference when transferring large amounts.

Let me show you what I mean:

High street banks typically charge exchange rate margins of 3%-4%.

If you’re transferring £100,000 to Dirhams, this margin would cost you £3,000-£4,000.

Every extra 1% in margin means another £1,000 in cost.

This shows how even small exchange rate changes can make your transfer cost thousands more.

Case and point as to why you need to use a cheap exchange rate provider.

Put simply, currency brokers generally offer better exchange rates than big banks.

Not only that, but currency brokers are specialists that can offer a more tailored and efficient service.

Banks on the other hand, often have unnecessary red tape.

If you’ve ever tried using a bank for a large international transfer before, you’ll have quickly found that guidance or support is virtually zero.

At Key Currency, you get your currency representative who will be able to discuss your transfer with you throughout.

They will explain the entire process to you and answer any questions you may have at any point.

This takes the pressure off you.

A currency broker can give you better exchange rates, an easier and more efficient process, and personal support throughout the process.

What more could you wish for?

How to avoid costs when sending money to UAE

Some companies add extra fees to every money transfer to the UAE.

This is unnecessary.

The exchange rate should include all the costs.

It’s often the big banks that are guilty of charging additional fees.

Don’t settle for a money transfer provider that adds extra charges per transaction.

If you accept this, you’re paying for your transfer twice, every time.

It’s bonkers.

You wouldn’t pay twice for anything else.

Why put up with it for an international money transfer to the UAE?

Find a currency broker that doesn’t charge additional transfer fees.

At Key Currency, the exchange rate you’re quoted includes all the costs.

This means you know exactly how much your transfer will cost.

You can also be 100% sure of the total amount of Dirhams that will land in the recipient’s account after the transfer.

Nothing skimmed off the top.

No little extras slipped in at the last minute.

The amount that you’re quoted is the exact amount that will be received.

We’ll take the time to explain exactly how the transfer will work, and we’ll tell you exactly how much you’ll receive.

No additional charges.

Making sure your money is safe when transferring to UAE

Before you make an international money transfer to the UAE, it’s worth checking whether the company is FCA Authorised.

The FCA (Financial Conduct Authority) regulates financial services in the UK.

If a company is not on the FCA register, you are not protected by the regulations enforced by the FCA.

You can search the FCA register to find out whether a currency broker is FCA Authorised.

How to get a great exchange rate on a money transfer to UAE

It’s best to transfer your money to the UAE when the Pound to Dirham rate is favourable.

This is when the Pound is strongest against the Dirham.

The hard part is knowing when the optimum time is.

If this were easy, we’d all be billionaires by trading the currency markets.

Plus, who has the time to sit and study the currency markets 24/7?

Nobody can be expected to spend all day studying trends to find the optimal time to make a currency transfer to the UAE.

That’s why our currency representatives spend all day watching the currency markets for you.

You can pick their brains, discuss what they’re seeing in the markets and find the best time to send your money to the UAE.

They’ll also listen to your needs and situation to find out what best suits you.

The result should be a better exchange rate for your money transfer.

Quick Summary

- To transfer money from the UK to the UAE you can use a bank or a currency broker.

- It should take 2-4 working days.

- It’s generally cheaper to use a currency broker rather than a bank to send money to the UAE.

- Using a currency broker can also help you avoid additional transfer fees.

- Some currency brokers help you by watching the market and providing expert support.

- Beware of ‘fake’ exchange rates listed online that aren’t achievable.

Key Currency: About Us

Key Currency is an independent British-based currency broker.

We’re based away from the city to keep our overheads low, with the ultimate goal of giving our clients better exchange rates.

Your personal currency representative will manage your international money transfer to the UAE from start to finish.

This is so you can always speak to someone familiar with your situation.

We’re not a faceless corporation and we operate under an open and honest ethos.

You can find out all about us and can see all our names and faces.

Get to know us just as well as we’ll get to know the ins and outs of your currency transfer!

You’ll get a personal service as well as a great exchange rate.

Rest assured, we’re fully FCA registered and authorised (No. 753989).

We also have a 5-star customer rating on Trustpilot, from over 2,500 customer reviews.

If you need to transfer money to the UAE or want to find out more about our service, request a free quote below.

Want to Read More?