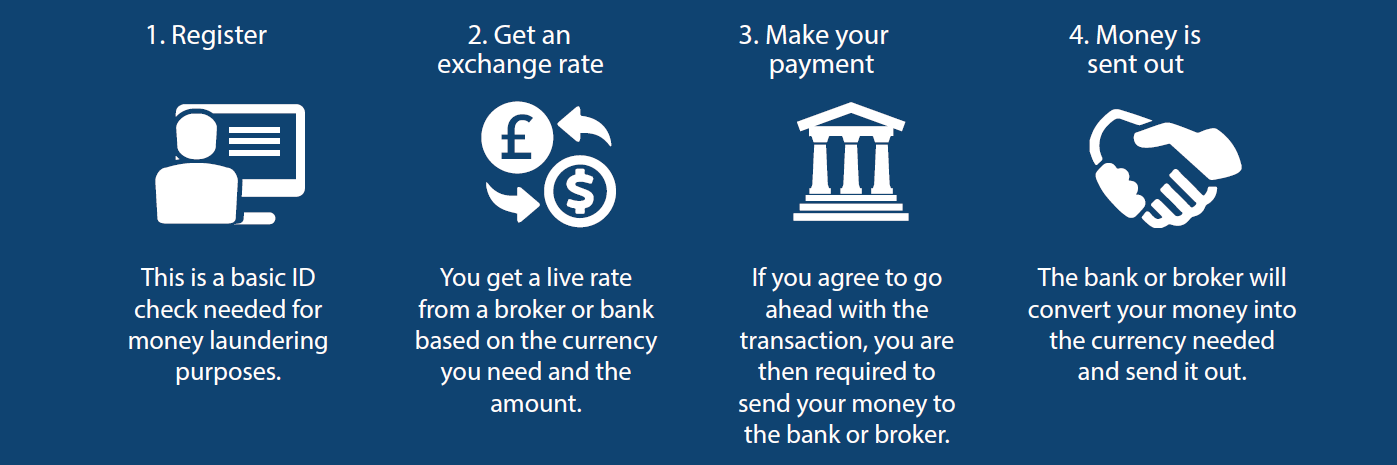

How to do an international bank transfer (in 4 simple steps)

Step 1 – Customer ID check

An ID check is a legal requirement for all new customers due to financial regulations.

You only need to do this once. Existing customers skip this step.

Most ID checks are done electronically now, which has made the process a lot quicker and easier.

Step 2 – Lock in an exchange rate

Your bank or money transfer company will want to know the currency you have (to sell) and the currency you need (to buy).

You will then receive the latest exchange rate.

If you are happy to go ahead, the exchange rate quoted will be locked in for you.

Shortly after, you will be emailed a confirmation with all the details of your transaction.

Step 3 – Pay for your transfer

You need to send your money in to pay for your international transfer.

If you use a money transfer company, you are normally given 1-2 working days to send your money in. Whereas if you use a bank, they will require the funds to be in your account already.

Step 4 – Your money is converted & sent out

Once your funds have arrived with your bank or money transfer company, they will convert the money into the currency you need and send it to the destination bank account you’ve requested.

How long does an international bank transfer take?

An international bank transfer will usually arrive at the recipient within one to five working days. This is usually quicker for transfers within Europe, where it can sometimes be as quick as one to two working days.

Converting your money into another currency is the quick part.

Most of the time taken is waiting for the recipient’s foreign bank to clear your funds.

It’s just a fact of life that some countries are faster and more efficient than others at processing cross-border transfers.

What details are needed for an international bank transfer?

International bank transfers are mostly done using the SWIFT payment network – a secure and reliable system used to connect banks all around the world.

Both banks and money transfer companies use SWIFT.

To make an international bank transfer you will need to provide the following details and information about the recipient:

- Their BIC or SWIFT code.

- Their bank account number or IBAN.

- Their full name.

You will also need to provide your personal and bank account information.

Finally, some money transfer providers may ask you for a reason for the international bank transfer you’re making but this is a common protocol and nothing to worry about.

Which is Cheaper: Banks or Money Transfer Specialists for international bank transfers?

Using your bank for an overseas money transfer might seem an obvious choice.

But there are lower-cost options to send money internationally.

Money transfer specialists tend to be a lot cheaper and more efficient than banks.

I guess they wouldn’t exist otherwise.

We looked into the exchange rates charged by the UK’s big banks.

As a ballpark, the UK banks are charging around 2-5% of your transfer amount. Money transfer specialists can cost up to 60%-70% less.

As an example, you could end up paying your bank £2,000 in fees on an international transfer of £50,000.

Most of the cost is hidden in the exchange rate (not the fees).

The banks use a tiered system, meaning the exchange rate margin depends on the size of your transfer.

For smaller amounts, the exchange rate margin is a lot higher.

The best rates are reserved for transfers over £200,000.

And the fact is banks can be a bit of a pain to deal with.

If you have tried to use a bank before to send money overseas, you may have noticed the staff are not very knowledgeable about money transfers.

That’s because they are trained in mortgages and savings products.

Money transfer specialists can offer much more efficient and hassle-free service as they are focused solely on international bank transfers.

Why banks may not be the best option

- It’s not their area of expertise

- Their exchange rates can be uncompetitive

- Banks charge transfer fees

- They won’t help you with timing

- You are not their priority

How safe is a money transfer company?

If you’ve never used a money transfer company before, it’s natural you would want to know what security measures there are in place.

Fortunately, there are some clear rules and procedures that regulated companies must follow.

The most important of these rules from a customer’s point of view is to do with the ‘segregation’ of client money.

A company Authorised by the FCA must transfer any client money through a separate and safeguarded bank account.

That’s why I suggest you choose a company that is Authorised by the Financial Conduct Authority (FCA).

To find out if a company is Authorised just type their name into the Financial Services Register and it will search for a match.

International bank transfers are often meaningful sums of money, so why risk using an unauthorised company?

How to avoid paying international bank transfer fees

Most people hate paying fees – me included!

For international bank transfers, you will find that most of the big banks and even some money transfer companies will charge you an assortment of fees.

However, you can avoid these fees by being selective about who you use.

Some money transfer companies, including Key Currency, charge no fees whatsoever!

That way customers can focus on the exchange rate and not have to worry about hidden or unexpected fees.

The most common type of fee is called a transfer fee.

A transfer fee is generally a flat fee charged on every international transfer regardless of the amount you send.

However, some banks have the cheek to charge the same transfer twice – a transfer fee for the sender and another for the recipient.

But there are also other types of fees to look out for too.

The big UK banks may charge a priority payment fee to speed up your transfer and another fee if you want to have your payment tracked and traced.

All these fees can add up and make it difficult to calculate the total cost of your international bank transfer.

Getting a great rate on your international bank transfer

The most important cost of an international transfer is usually the exchange rate.

Even tiny moves in exchange rates can have a significant impact on the money you receive.

On an international transfer of say £75,000, a move in the rate of just 1% up or down, makes a £750 difference to you.

A swing of 1% can often be a daily event.

Over several weeks, rates can move a lot more.

That’s why timing is important.

But how do you know when it’s a good time to exchange your money?

Most people have neither the time nor the inclination to watch exchange rates all day.

It’s not their field of expertise, and they would rather be doing other things.

That’s why you could benefit from getting some market guidance from someone who deals with the foreign exchange markets every day.

We monitor the market for you and let you know when the rate moves in your favour.

Why you should be careful of exchange rates you see online

Looking on the internet for the best exchange rates can be a minefield of misinformation.

There are so many free websites now that provide a feed to live exchange rates.

But there’s a problem.

Most of the exchange rates you see online are not available to consumers.

Buried somewhere on these sites is normally a disclaimer with words along the lines of the rates shown are “not achievable” or “for information purposes only”.

You are seeing something known as “interbank rates”.

Interbank rates are like wholesale benchmark rates between the big global banks.

Not even major corporations or money transfer specialists can trade at interbank rates.

If you want to get a real rate, I suggest you request a quote from an actual provider such as a bank or money transfer specialist.

Are money transfer companies all the same?

I appreciate that all money transfer companies can sound the same.

But there are some key differences.

Some focus on smaller micropayments to developing countries, like Western Union, MoneyGram, Ria, and WorldRemit.

Others are ‘online-only’ platforms or apps. The bigger names are PayPal, Wise, CurrrencyFair, and Revolut.

You pretty much do everything yourself, but it’s not possible to speak to anyone.

They do, however, offer webchat and email support.

There are also companies, such as Key Currency, that deal with larger sums or one-off payments.

Our service suits customers who want some human contact and personal guidance.

For large currency transfers, many customers want the peace of mind of having someone they can speak to.

If there is ever a problem, you can call and speak directly to them.

I guess it comes down to the individual and what they prefer.

Quick Summary:

- You can use a bank or money transfer specialist.

- It takes anywhere between 1-5 working days.

- You can avoid transfer fees by using a money transfer specialist.

- Use a company Authorised by the FCA.

Who are we?

I am one of the directors at Key Currency.

Here’s a link to our About Us page.

By all means, check us out.

We are a leading money transfer specialist serving customers in the UK, EU, Middle East, and Australasia.

Our exchange rates are highly competitive, and we charge you no fees whatsoever.

As part of our service, we can also discuss your requirements and agree on the right time to exchange your money, rather than using a bank or online-only system, and having to accept whatever rate they give you on the day.

In terms of regulation, we are an Authorised Payment Institution (Financial Services Register Register No. 753989), so all international bank transfers are conducted through safeguarded client accounts.

We are committed to providing our customers with value for money and outstanding service.

Key Currency has a 5-star customer rating on Trustpilot, based on over 2,500 reviews.

If you would like to compare us to your bank or existing provider, simply request a free quote below.

Read More…

Current GBP to USD Forecast for 2023