Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 27th, 2024

If you need to exchange a large amount of currency, you want to choose a way that is safe, efficient, and cost-effective.

Below you will find out the costs, what options you have, how the process works, and the best way to exchange currency.

What are your options for exchanging large amounts of currency?

If you need to exchange a large sum of currency, you have two options:

- Use a bank

- Use a currency broker

The advantage of using your bank is that it’s more familiar, and the money is already set in your account.

The disadvantage is the banks know that too.

It probably won’t come as a complete surprise that banks are not normally the cheapest way to exchange large amounts of currency.

I suspect the banks can’t compete too aggressively because they are lumbered with very high costs.

The UK’s largest banks, such as Lloyds, Barclays, HSBC, and Natwest, have annual costs that run into the billions.

Who do you think pays for that? Their customers of course.

But the big banks know that there will be a certain amount of walk-in traffic no matter what they charge.

So, there isn’t a great incentive for them to cut their fees.

In contrast, a currency broker specialises in currency exchange.

They wouldn’t get any customers if they charged excessive rates and fees.

As a general rule, banks can charge up to 3%-4% more than a good currency broker.

With far lower operating overheads, a currency broker can undercut the banks and pass on the savings to customers.

What are the costs?

When you exchange currency, there are two costs you need to be aware of:

- Transfer fees; and

- Exchange rates.

The transfer fees are more visible.

Every time to make an international money transfer, a lot of banks charge you a flat fee.

Transfer fees are typically in the region of £10 to £25 per transfer.

On a large currency transfer, that may not sound like a lot. But if you send money regularly, the fees can begin to add up.

I’m not a fan of transfer fees. They annoy customers for a start.

And it complicates the cost of the transfer, which is probably deliberate.

For large currency transfers, the more important cost is the exchange rate. Transfer fees become less significant for larger amounts.

Think of an exchange rate as effectively the price of money.

Each bank or currency broker will quote you their exchange rates.

Our research has found that the big UK banks are still charging 2%-5% mark-ups on their exchange rates.

This information is hard to find.

The banks often won’t quote you a rate until you are almost at the end of your payment.

By that stage, a lot of customers may reluctantly proceed even though they could do better elsewhere.

Why you should be wary of exchange rates online

These days most people go online to look up exchange rates.

Many websites are offering free ‘live rates’ – such as XE, Oanda, or DailyFX.

But there’s a problem…

Most of the online exchange rates you see are not available to customers.

They are what’s called ‘interbank’ exchange rates.

As the name suggests, interbank exchange rates are used by banks to trade with other banks.

They are not rates that an individual, like you or me, can receive. We’re not a bank trading billions every day!

I don’t blame anyone for thinking interbank rates are accessible.

It’s not made clear on these websites at all – quite the opposite.

But if you take a closer look you will find a disclaimer somewhere saying words like “for information purposes only” or “consumer clients or small to medium-sized businesses cannot access these rates.”

I think it’s misleading to hide that.

The problem is it causes people to have an over-inflated expectation.

Knowing exactly what your money is worth allows you to budget effectively and takes away the uncertainty.

To get a genuine rate, the best thing to do is request a quote from your bank or a currency provider.

Is it safe exchanging large amounts of currency?

Safety and security are critical for anyone looking to exchange a large sum of currency.

I’ve been on the customer side myself.

Before I sent any money internationally, I wanted to understand what security measures were in place.

Let me first explain something that most people aren’t aware of.

Behind the scenes, both banks and currency brokers use the same SWIFT international payment system.

SWIFT is the standard, secure system used by everyone.

It’s been around for five decades now.

It connects almost all banks around the world.

When you transfer money abroad, it will travel via the SWIFT system – whether you use a bank or currency broker.

Another important thing to know is that any company that is Authorised and Regulated by the Financial Conduct Authority is required to segregate client funds.

What does that mean in plain English?

If a company is FCA Authorised, your money transfer will pass through a separate, safeguarded account used solely for client transfers.

To find out if a currency broker is Authorised, you can search for a company on the FCA register.

Is there a limit on large currency exchange?

In most countries, there are no legal limits on currency exchange.

The UK, US, Canada, Australia, NZ, and the countries in the EU have no restrictions on the maximum size of an international bank-to-bank money transfer.

There are, however, some countries such as India, China, Russia, and Argentina that do restrict the movement of money (it is always easier to get the money in than out).

In the UK, although there are no legal barriers, the big UK banks often set their internal daily limits for online transfers.

Here are the daily international limits of the UK’s big four banks:

- Natwest: £25,000

- HSBC: £50,000

- Barclays: £50,000

- Lloyds: £30,000

The daily transaction limits imposed by banks can be a problem for large currency exchanges. If you use a bank, you may have to send your money in several payments which will take longer and incur more fees.

If your transfer is over the limit, it may end up costing you more time, hassle, and costs.

You would need to make several transfers, and therefore pay extra fees.

An easy solution is to use a currency broker (also called a money transfer company).

Currency brokers don’t usually have any daily limits, so you might find them to be the best way to exchange large amounts of currency.

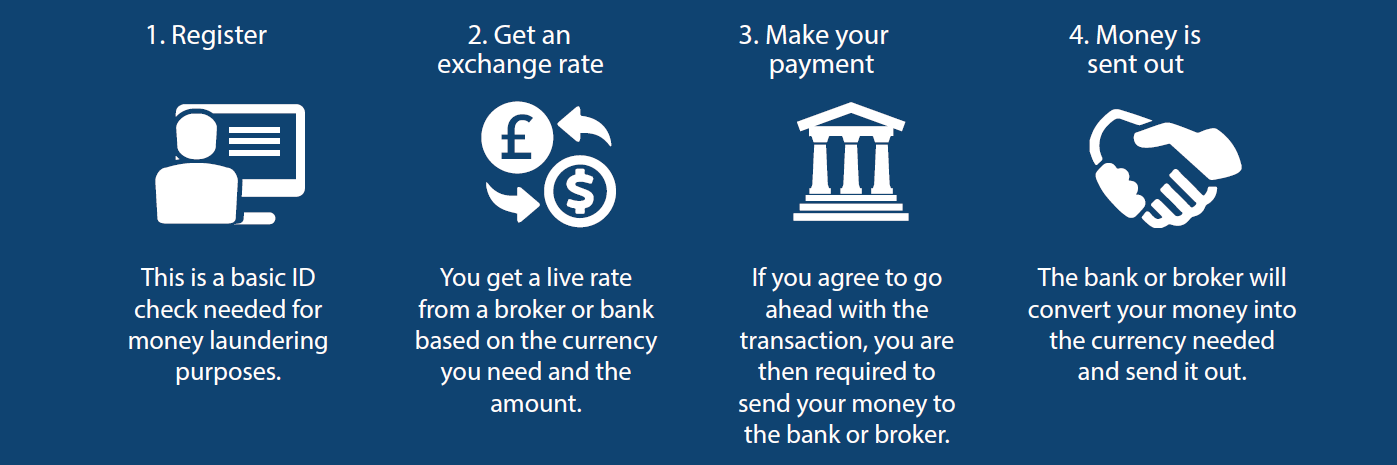

How to exchange large amounts of currency (in 4 simple steps)

Step 1 – Customer ID check

Before you can exchange currency, you need to be identified.

There is a legal obligation to verify new customers to comply with financial regulations.

It usually takes about 5 minutes, and there is no obligation to trade.

Step 2 – Secure an exchange rate

Once identified, your bank or currency broker will ask for the currency you need and the amount of currency you have and quote you their current exchange rate.

No transaction will occur without your permission.

If you are happy to proceed, the bank or broker will lock in your exchange rate.

You will then be emailed a confirmation with all the details of your transaction.

Step 3 – Pay for your transfer

Banks will require your money upfront, but currency brokers will allow you to lock in a rate before you send your money in.

The confirmation email will have the bank details of where to send your money.

Step 4 – Your money gets converted

When your money is received by your bank or currency broker, they will convert it into the currency needed and send your funds to the bank account requested.

Getting the best exchange rate for large currency transfers

Exchange rates move up and down every minute of the day.

On a typical currency chart, you can see big peaks and troughs, as well as plenty of minor movements too.

Given the natural volatility of foreign exchange markets, it’s not easy for customers to know the best time to exchange currency.

It’s why you might find it useful to speak to a currency dealer who is continually watching rates and is familiar with the news, events, and price patterns that trigger the fluctuations.

On a large currency transfer, even tiny fluctuations in the exchange rate matter. That’s because a large transaction size magnifies movements in the exchange rate.

As a simple example, a tiny 0.3% move in the exchange rate on a £200,000 transfer means a financial difference of £600.

A swing of that size can happen within minutes.

Over days, weeks, and months, the movements tend to be much bigger.

Timing can be critical.

Some currency brokers will monitor the market for you and alert you when good opportunities come along.

A currency broker can help you achieve a more favourable exchange rate.

Not all currency brokers offer this level of proactive service.

A lot of brokers these days are just online platforms or ‘apps’.

You pretty much have to do everything yourself.

For large currency exchanges, customers often want the peace of mind of having someone they speak to.

Having a real person you can speak to brings several advantages:

- The details of your transfer can be checked to make sure everything is in order.

- You can discuss current rates and levels to aim for.

- When you transfer your money, you are kept informed at all stages.

I think all three elements make the process a lot better for customers.

Quick Summary

- You can use a bank or currency broker to exchange large amounts of currency.

- The cost is a combination of exchange rates and transfer fees.

- Currency brokers can normally beat the banks in terms of cost.

- If a currency broker is Authorised by the FCA, it is required to use safeguarded client accounts.

- Some currency brokers (money transfer companies) are just online-only platforms, whereas others will offer you guidance on exchange rates and personal assistance.

Who are we?

Key Currency is a leading UK-based currency broker.

We give you access to top exchange rates and charge no fees.

And unlike banks and online-only operators, we don’t push you onto a trading platform and make you do everything yourself.

With us, you can expect service…by people.

As a company, we are open and transparent.

We don’t hide behind an app or a generic mission statement.

The names and faces of all our people are on our website.

All our customers are allocated an account manager who will take care of the entire process for you.

Of course, you want to get a preferential exchange rate and not be hit with any hidden charges, but you also want to know your money is secure.

We’re committed to providing a service of the highest integrity and safety.

As an Authorised Payment Institution, regulated by the Financial Conduct Authority (Register No. 753989), you have peace of mind knowing that all money transfers are conducted through fully safeguarded accounts.

We have a 5-Star “Excellent” rating on the customer review website Trustpilot.

To date, we have received over 2,500 reviews from happy customers.

Why not compare us to your bank or existing provider by requesting a quote below?