Last Updated on August 10th, 2024

You can transfer AUD to GBP using either a bank or a money transfer specialist.

In general, banks tend to be a more costly option.

There are plenty of money transfer companies to choose from, but there are differences in cost and service.

How to Transfer AUD to GBP (step-by-step)

Step 1: Register

All new customers need to register to comply with anti-money laundering rules.

International regulations require an identification check.

It doesn’t take long.

In the case of a money transfer company, you should be ready to go on the same working day.

At this point, you can also provide the bank details of the recipient in the UK (can be you or someone else).

Step 2: Get an AUD/GBP exchange rate

To transfer money to the UK, the Australian Dollar to Pounds Sterling exchange rate is what matters.

The rate will be fluctuating throughout the day.

Your bank or money transfer company will quote you their latest rate.

Nothing will happen without your consent.

If you are happy to proceed at the rate quoted, your bank or money transfer service will lock in your rate.

Make sure you know what fees will be charged before you commit to a rate.

Step 3: Send in your Australian Dollars

If you use a bank, they will need your Australian Dollars upfront.

If you use a money transfer company, you can lock in an AUD to GBP rate before you send in your funds.

A money transfer service will provide you with the bank details of your Australian Dollar account. You just need to send your money using a normal bank transfer.

Step 4: Your AUD is converted to GBP and sent out

Once your AUD is received by your bank or money transfer service, they will convert them into British Pounds at the exchange rate agreed upon.

Your money will then be sent to the UK bank account requested.

How long does it take to transfer AUD to GBP?

To be on the safe side, I would allow 3-4 working days for your British Pounds to arrive in your UK bank account.

It only takes a few minutes to convert your AUD into GBP.

Most of the time taken is waiting for your funds to clear into your UK bank account.

If you see a company advertising ‘same-day transfers’, it’s misleading.

They are referring to how long it takes them to convert and send your money out, but that’s not the same thing as you being able to access your money in the United Kingdom.

The costs & charges explained

When you transfer AUD to GBP, there are two charges to be aware of:

- Fees

- Exchange rates

As a quick tip: the fees are more visible but tend to be less important than the exchange rate.

Fees (an annoying distraction)

The big Australian banks charge you a fee on every international transfer.

These can vary depending on whether you use a branch or go online and the destination of your transfer.

Here’s a summary of the fixed fee for a money transfer to the UK:

| Bank | Fee charged |

| CBA | $6 under $1k, $12 over $1k, $30 branch |

| ANZ | $9 under $10k, $0 over $10k |

| NAB | $30 |

| Westpac | $20 online, $32 branch |

While the fees above aren’t that big, you may incur other fees.

Some of the big banks are experts at creating extra fees for their customers, such as a correspondent bank fee, tracing fee, amendment fee, or priority payment fee.

If you want to avoid fees altogether, some money transfer companies (we included) don’t charge any fees at all.

Exchange rates (the silent killer)

Exchange rates are by no means standardised.

Every bank and money transfer company set its own rates.

I was surprised by the AUD to GBP exchange rates offered by the big Australian banks. The profit margin was a lot higher than I expected.

I guess they make billions for a reason.

Below is a summary of their exchange rate margin:

| Bank | Exchange rate margin |

| CBA | 5.30% |

| ANZ | 3.40% |

| NAB | 4.10% |

| Westpac | 5.10% |

These figures were calculated using a $10,000 exchange of AUD to GBP using the online live exchange rates provided by the big four banks.

Based on our research, the average exchange rate margin charged by big banks is 4.5%.

Let’s put that into context with an example.

You decide to move back to the UK and have sold your Australian house for $450,000.

When you convert your Australian Dollars to British Pounds, your bank charges you 4.5% to convert your money.

That works out at $20,250 in exchange rate costs alone.

You could have bought a car or two first-class tickets to the UK with that!

The point is getting a good exchange rate can make a big financial difference to you.

Don’t feel obliged to use your bank.

Money transfer companies can do the same job but undercut the charges of banks.

And depending on who you choose, they can also assist you with the set-up, guide you on rates and track your money from start to finish.

Choosing a money transfer company

Not all money transfer companies offer the same thing.

Beyond the logos and slogans, a lot of the names you see these days are just ‘apps’.

Some of the bigger names are PayPal, Transferwise, Revolut, and CurrencyFair.

They offer a ‘do-it-yourself’ platform.

You have to enter all the info, hit all the buttons, and choose when to exchange your money.

That suits some people, but not others.

In my experience, the apps are popular with people sending regular amounts to family and friends, or online merchants that need to process a lot of small payments.

If however you are sending a more significant sum or are unfamiliar with foreign exchange, you may want a more professional service.

People that are sending life-changing sums don’t want to mess around with new technology.

Some money transfer companies offer expert assistance (from a human being).

They will manage the process for you, make sure things are set up correctly, and work with you to achieve a better exchange rate.

We fall into the latter.

It comes down to what you are looking to do and what your preferences are.

Don’t be fooled by the AUD to GBP rates you see online

The internet is full of information…and well, misinformation too.

When it comes to exchange rates, you will find many of the best-known websites that display live exchange rates.

I’m sure you’ve come across some of these.

But there’s a While they offer some good charts, news feeds, and articles, they have a fundamental problem.

Most of the AUD/GBP exchange rates shown online are not customer rates.

What you are seeing are ‘interbank rates’.

Interbank exchange rates are the rates used by banks to trade with each other.

In simple terms, it’s essentially a wholesale rate and not available to customers.

If you look closely, there will be a disclaimer stating that the rates shown are “not accessible” “not transactional” or “indicative only”. Thanks for nothing.

OK, so what should you do?

If you are planning to transfer AUD to GBP, then I suggest you get an actual quote from a real provider (bank or money transfer specialist).

That way, you will know where you stand and can budget effectively.

Getting the best AUD to GBP exchange rate

Exchange rates never sit still for long.

A popular currency pair like AUD to GBP changes every 2-3 seconds.

Over a few days, weeks, or months, the rate can move substantially.

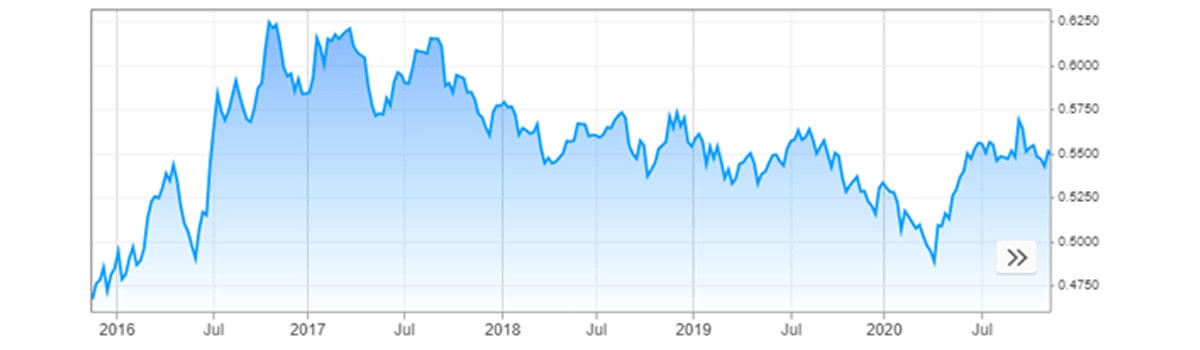

Below you can see just how much the AUD to GBP exchange rate has moved over the last 5 years.

Some of the moves have been massive.

In the chart above, there’s a 34% difference from the high point to the low point!

That’s a lot when you convert it into money.

If you had sent $100,000 at the high, it would have fetched £62,857.

Whereas $100,000 sent at the low would have given you only £46,793.

That’s a huge difference!

Over longer periods, the movements tend to be larger – particularly when big political events unfold.

But even over a few days or weeks, it’s quite common to have swings of 2%-3%.

On a $100,000 transfer of AUD to GBP, that equates to a $2,000-$3,000 difference.

The more you send, the more the rate matters.

If you are unfamiliar with the foreign exchange markets, you may inadvertently get a bad rate.

You might also be unaware of current trends or upcoming risk events.

While no one has a crystal ball, it can be useful to get some guidance from someone who is monitoring the markets all the time.

For example; they could understand your timeframe and let you know when the AUD to GBP rate moves in your favour.

Or they could discuss market limits or target levels to aim for.

In my view, that’s a lot better than just leaving things to chance or having to accept whatever rate is given to you by a bank or online platform.

Who are we?

Key Currency is a leading money transfer specialist.

The cost of our service is included in the exchange rate we quote. There are no additional fees or charges you need to worry about.

By understanding your exact requirements, we can work with you to achieve a better exchange rate.

Importantly, we don’t push you onto a trading platform and make you do all the work.

Unlike a money transfer ‘app’, we will take care of the entire process for you.

As a company, we are open and transparent. We don’t hide behind generic jargon or a faceless ‘app’.

The names, faces, and backgrounds of all our team of people are shown on our website.

You have the peace of mind knowing that Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

We have attained a 5-Star “excellent” customer rating on the review website Trustpilot; the highest rating available.

If you are based in the United Kingdom, Spain, France, Ireland – or anywhere in the EU – we can help convert Euros to Pounds in a quick, secure, and cost-effective way.

To make a no-obligation enquiry, please request a quote below.