Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on February 10th, 2025

Transferring Euros to a UK bank account is easy once you understand how it works.

We explain the best methods, the costs, common pitfalls and expert tips when you transfer euros to pounds. It’s all below!

What is the best way to transfer Euros to Pounds?

The best way to transfer euros to pounds is to use an international bank transfer as they are safe, quick and cost effective.

Both banks and money transfer companies carry out international bank transfers.

The main difference are the fees and charges.

Most UK banks will Europeans banks generally charge a lot more than money transfer companies (we look at the details below).

If you use a bank, expect costs in the region of 2%-5% of your transfer amount.

This will be a combination of direct fees and a margin added to the exchange rate.

If you choose a money transfer company, you can save 50%-90% depending on how much you send.

That’s significant!

When checking out the costs, the fees tend to be a flat rate per transfer whereas exchange rates get better the more you send.

Often banks will highlight the fees hoping you don’t notice the exchange rate.

It’s a sneaky trick.

Because exchange rates change so frequently, it is worth comparing quotes before you decide which company to use.

Note – Banks don’t provide quotes, which says a lot!

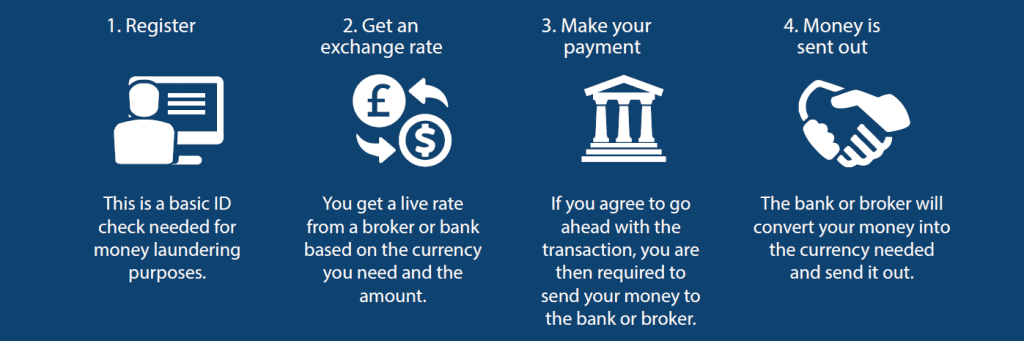

How to Transfer Euros to Pounds (in 4 simple steps)

Transferring euros to pounds can be explained in four simple steps.

Whether you choose to use a bank or money transfer specialist (currency broker), the steps are pretty much the same.

Step 1 – ID check

Before you can send money internationally, you need an identification check.

The reason is that governments are trying to prevent the bad guys from moving money around the world (drugs, terrorism, etc), so every new customer needs an ID check by law.

If you have a residential address in the UK, it can be quick and easy to verify who you are.

Most UK citizens are identified using their name, address, and date of birth.

If you don’t have an address in the UK, then you may need to provide the usual proof of ID and proof of address – a copy of your passport and a utility bill or bank statement in the last few months using does the job.

A lot of people just take a quick photo with their phone or iPad and email it over.

Step 2 – Secure an exchange rate

The next step is to get an exchange rate quote for Euro to Pounds.

This is sometimes abbreviated to EUR to GBP.

When you transfer Euros to Pounds, you are effectively selling euros and buying pounds.

The EUR to GBP rate moves every few seconds, so the amount of Pounds you will receive changes throughout the day.

Once you receive an exchange rate quote, you can decide whether to go ahead or not.

Nothing will happen without your permission. If you are happy to proceed, your bank or money transfer specialist will lock in your rate.

You will then be emailed a confirmation of your transaction, showing the amount of Euros you have sold and the amount of Pounds you have bought (will receive).

Step 3 – Send in your Euros

At this point, you need to transfer your money.

On the confirmation email, there will be the bank details of where you transfer your Euros.

This is done via a normal bank transfer. After that, your work is done.

Step 4 – Your Euros are changed to Pounds

Once your bank or money transfer specialist has received your Euros, they will convert them into Pounds and transfer them to the UK bank account you have requested.

That’s it.

On the move? … Here’s a 3-minute video summary

How long does it take to transfer Euros to Pounds?

Sending money from mainland Europe to the United Kingdom is quick.

Same day transfers are available when you transfer Euros to a UK bank account as long as the money is sent before the daily cut-off time. This means your money can arrive in your UK bank account on the same day you convert your Euros into Pounds.

The cut-off for high street banks and money transfer specialists is normally around 3pm to 4pm. We have a cut-off time at 3.30pm.

If your Euros arrive after the cut-off time, it will count as the next working day.

Bear in mind that most of the time taken is waiting for your funds to move through the banking system. Converting Euros to Pounds can be done in minutes.

As a tip, if you are under time pressure, you can always choose to transfer your money in before your Euros are turned to Pounds.

It will make the process quicker end-to-end.

Banks vs Money Transfer Specialists (which is better?)

When looking to transfer Euros to Pounds, the two most common services are either your bank or a money transfer specialist, below are some pros and cons, to help you compare before deciding on which provider to choose.

| Pros | Cons | Best for | |

| High street banks | Familiar, money already at the bank | Added fees & uncompetitive exchange rates | Small payments, convenience |

| Money transfer specialists | Lower cost, efficient service | Need to register | Larger amounts (over £5,000) |

How much does it cost to transfer Euros to Pounds?

When you transfer Euros to Pounds, there are two types of charges:

- Exchange rates.

- Transfer fees.

The exchange rate costs tend to be far greater than the transfer fees.

Most of the big UK and European banks have exchange rate margins in the region of 2% to 5% for transferring Euros to Pounds. You may also get charged a transfer fee between €20 and €50.

Before you carry out your transfer, it’s a good idea to get a quote from a money transfer specialist and compare the overall cost.

Euro to Pound Exchange Rates

Our research found that the exchange rates offered by the major banks are consistently non-competitive.

- United Kingdom: the exchange rate margin at HSBC, Lloyds, Barclays, and Natwest ranged between 2.9% and 5.5%.

- Spain: CaixaBank, Sabadell, Bankia, BBVA, and Santander have an exchange rate margin of 3.6% to 5.2%.

- France: leading banks such as Credit Agricole, BNP Paribas, and Societe Generale appear even worse than Spain, with margins at 4.4% to 5.2%.

- Portugal: exchange rate margins for BPI, Nova Banco, and Santander Totta coming in at 3.3% to 4.8%.

- Ireland: AIB, Bank of Ireland, and EBS have margins of 2.2% to 4.9%.

While the exchange rates set by banks are not very competitive, if you only intend to send a small amount (under €5,000), you may prefer the familiarity of your bank.

But the larger the amount of Euros you transfer, the more you should consider alternative options.

Accepting a bad Euro to Pound exchange rate could cost you thousands in additional charges.

What’s more, if you use your bank, they will probably charge you transfer fees on top of the exchange rate costs.

Euro Transfer Fees

A transfer fee tends to be a flat fee charged per international money transfer. They tend to be around €20-€50 when transferring Euros to Pounds.

This is in addition to the exchange rate costs we have covered above.

Beware – some banks charge you twice for the same transfer!

You get charged one fee by the sending bank in Europe, and another fee by your receiving bank in the UK.

The cheek of these big financial institutions! A law unto themselves.

If you want to avoid these fees, the simple solution is to use a money transfer specialist.

At Key Currency, we not only provide highly competitive exchange rates, but we also charge no fees.

The information you will need to transfer Euros to Pounds

To send money from Europe to the UK, you will need to provide details about the recipient’s bank account.

The most important bit of information is the IBAN.

IBAN stands for ‘international bank account number’.

It is a standard way of identifying bank accounts anywhere in the world.

For UK bank accounts, an IBAN consists of 22 characters (a combination of letters and numbers).

- 2-letter country code (GB)

- 2 number check code (29)

- 4-letter bank code

- 6 number sort code

- 8 number account number

Some banks display your IBAN on statements (usually in the top right) or when you log in to your account.

You can ask in a branch if you get stuck.

As part of our service, we help you set up your payment information.

You can now use our IBAN Checker tool to confirm/validate an IBAN, making sure everything is correct and in order before your transfer!

Are you selling a property abroad? Avoid this pitfall

For large Euro to Pound transfers, the extra cost of using a bank to transfer your money can be substantial.

If you are a British expat selling a property in Spain, France, Italy, or Portugal, you will need to transfer your sales proceeds from Euros into Pounds.

On a sales price of €200,000, you could be up to €6,000 worse off using a bank to move your money back to the UK!

That’s a lot of money in most people’s books (it is in mine).

Another thing to note is that your bank may limit the daily amount of money you can send online.

The daily transfer limit for UK banks tends to be between €15,000 – €100,000.

If you use your bank, you may need to go into a branch to complete your transfer in one payment.

Money transfer companies don’t limit the size of international money transfers, so they may be a better option if you are completing a property sale.

Is it safe to use a money transfer specialist?

Anyone sending euros to pounds will naturally want to know about the safety and security of their funds.

Fortunately, there are some key protections for customers.

The most important thing is to only deal with a company that is Authorised and Regulated by the Financial Conduct Authority (FCA) – the UK’s financial watchdog.

The reason is that an FCA Authorised company is required to segregate client funds.

Segregation of funds means that all customer money is held in a safeguarded bank account.

This means your transfer will be carried out using a separate bank account designated only for client transactions.

You can check if a company is Authorised by entering its name on the FCA register and clicking Search the Register. Companies also normally show their FCA registration number in the footer of their website.

Why you can’t trust Euro to Pound exchange rates you see online

If you need to transfer Euros for Pounds, the fluctuations in the EUR/GBP rate are the key thing to focus on.

These days you have probably seen that a lot of different websites display exchange rates.

The more popular sites include XE, Oanda, and DailyFX.

But there’s a problem…

The exchange rates you see online are not available to customers.

What you are seeing are ‘interbank exchange rates’.

Interbank exchange rates are used by major banks and institutions to exchange currencies between themselves.

To cut a long story short, even large corporations and money transfer companies don’t buy or sell currencies at interbank rates. Nor can the person in the street.

You will find a disclaimer somewhere on these foreign exchange websites saying that the rates displayed are “not available to consumers” or are “for informational purposes only”.

If you think that’s annoying, you’re not alone.

The bottom line is to avoid frustration and misinformation; you should base your plans on a genuine quote from a bank or money transfer company.

Transfer euros to pounds: timing your exchange for maximum value

Exchange rates can be volatile because they change every 2-3 seconds.

However, even small, fractional moves in the exchange rate can make a big financial difference to you.

It’s why it’s always worth trying to get the best rate you can.

A money transfer specialist can work with you to achieve the best possible exchange rate.

One of the advantages of using a money transfer specialist such as ourselves is that we will monitor the Euro to Pound rate for you – and alert you if the rate moves in your favour.

The financial impact can be substantial

For instance, even a 1% adverse swing in the Euro/GBP rate on a €100,000 transfer would cost you an extra €1,000.

Moves of that size happen all the time.

But most people aren’t experienced in foreign exchange.

Getting some guidance on exchange rates can help optimise the timing of your transfer and reduce your costs.

A bank or online-only platform won’t offer you any guidance or assistance when it comes to exchange rates.

You are left to fend for yourself.

If you need to transfer a large sum of Euros to Pounds, you may prefer having someone to assist you with the process and offer expert guidance on exchange rates.

Expert tip: How to protect yourself against a falling Euro

If you are worried about the Euro moving against you in the future, a money transfer specialist can lock in an exchange rate up to 12 months in advance of your money transfer.

This is called a ‘forward contract’.

Forward contracts are a way of protecting yourself against adverse exchange rate movements.

In short, they allow you to fix a rate now and exchange your money later.

Banks and money transfer apps don’t tend to provide this as an option to their customers.

The period for a forward contract can be up to 12 months ahead. And you can draw on the funds at the time of your choosing.

A forward contract can be useful if you have exchanged on the sale of a property abroad but are awaiting the completion date.

While you wait, which can drag on for weeks or months, you remain exposed to the daily fluctuations in exchange rates.

By taking out a forward contract, you can fix the Euro to Pound exchange rate and therefore know the exact amount you will receive in Pounds.

This not only takes the worry away but it allows you to move forward with your plans.

For example, a lot of people use the Pounds they receive to buy a property in the UK. By fixing the exchange rate, you will know what budget you have to work with.

Quick Summary

If you are looking to transfer Euros to Pounds, you can use a bank or money transfer specialist.

While banks might seem like the obvious option, money transfer specialists can be a lot cheaper and more efficient.

Who are we?

Key Currency is a leading money transfer specialist.

The cost of our service is included in the exchange rate we quote. There are no additional fees or charges you need to worry about.

By understanding your exact requirements, we can work with you to achieve a better exchange rate.

Importantly, we don’t push you onto a trading platform and make you do all the work.

Unlike a money transfer ‘app’, we provide you with a service. All our customers have an account manager who will take care of the entire process for you.

As a company, we are open and transparent. We don’t hide behind generic jargon or a faceless ‘app’.

The names, faces, and backgrounds of all our team of people are shown on our website.

You have the peace of mind knowing that Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

We have attained a 5-Star “excellent” customer rating on the review website Trustpilot, the highest rating available.

The bottom line is that we help customers transfer Euros to Pounds every day of the week. It’s our most common type of transaction.

We know how to do it efficiently and without incurring high charges.

To make a no-obligation enquiry, find out our latest rates or if you have any questions, please request a quote below.