Author, Mike Smith

Author, Mike Smith

Last Updated on August 15th, 2024

Below I’ll explain the simplest way to transfer money from Canada to the UK. This will help you avoid high fees and get the transfer done quickly and efficiently.

If you’re wanting information about sending money to Canada from the UK, then click through for guidance on that transfer!

Transferring money from Canada to the UK: a simple choice

If you need to transfer money from Canada to the UK, you have two main options:

- Use a bank

- Use a currency broker

Your first instinct may be to go to your bank as it’s familiar.

However, your bank will likely charge you a lot more and give you no help or guidance.

Your other option is to use a currency broker – also called a money transfer specialist.

A currency broker offers a more hands-on service and can provide better exchange rates and lower fees (sometimes no fees).

The fact is foreign exchange is just a sideline for banks.

They’re also aware that international money transfers are something the majority of their customers know much about.

Therefore, they make their exchange rate costs and fees hard to find and understand.

I’ve found most banks hide their charges within PDF downloads that are often 15-20 pages long.

Here is the key point…

Banks can charge up to 3%-4% more than currency brokers on international money transfers.

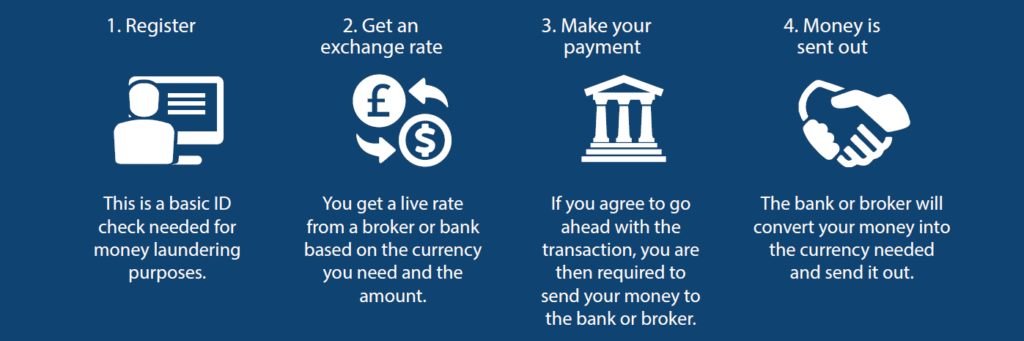

How to transfer money from Canada to the UK (in 4 simples steps)

-

Register & Identity check

New customers will need to register and create an account. As part of this, an ID check is carried out on your details.

This is usually a quick and painless process, but they differ slightly by provider.

At Key Currency, you’ll only need to do this the first time you trade.

-

Secure your exchange rate

Exchange rates change every second. Your provider will give you a live CAD to GBP exchange rate at the time you wish to make your transfer.

If you’re happy with the rate, you can ask to lock it in.

Once the CAD/GBP rate is secured, your currency broker or bank will confirm all the details of the transfer, usually by email.

-

Send in your Canadian Dollars

When you have the relevant bank details, you’ll be able to send in your Canadian Dollars.

Banks and some currency brokers may require your funds to be already deposited before they will agree on an exchange rate.

-

Receive your British Pounds

Your bank or currency broker will use your Canadian Dollars to purchase Pounds Sterling at the agreed exchange rate.

The Pounds Sterling will then be sent to the beneficiary you have requested.

Your currency broker or bank will notify you when the transfer has been completed.

It’s as simple and as painless as that!

How long will it take to transfer money from Canada to the UK?

Money transfers from Canada to the UK typically take between 1-3 working days for your money to arrive.

As Canada is part of the Commonwealth, they have a great relationship with the UK and you won’t have many barriers to overcome in comparison to some other currency pairs.

This means your provider should be able to complete the currency exchange reasonably quickly and the funds should land in no more than a few days.

Plus, banks and brokers use the same SWIFT payment system, so there won’t be a huge advantage either way in transfer times.

As traditional banks are often bloated and cumbersome, bureaucracy can slow them down.

The best way to transfer money from Canada to the UK

An international bank transfer (also called a wire transfer) is generally the best way to transfer money from Canada to the UK.

This can be done using either a bank, currency broker, or money transfer platform.

International bank transfers are safe, don’t have size limits, and are cost-effective compared to other payment methods such as credit and debit cards, cheques, or cash transfers.

Why currency brokers are different from banks

Big banks typically have higher charges for international transfers than currency brokers.

Even though banks may advertise that international transfers are ‘free’ or ‘without fees’, the main charge comes from the exchange rate.

But it’s not just about the rate. Currency brokers are specialists in international transfers. They have highly skilled staff who can provide expert support from start to finish.

One clear benefit is some currency brokers can keep an eye on exchange rates for you.

If the CAD to GBP exchange rate reaches a certain level that suits you, currency brokers can alert you and make the transfer at the right time.

Banks have a much more hands-off approach to currency exchange.

In practice, this often means almost no help or contact with their customers.

So, there are several significant differences in both cost and service between banks and currency brokers.

How to avoid fees when transferring money from Canada to the UK

Most banks will charge you fees for international money transfers.

Make sure you understand exactly what this means.

In some instances, banks will charge a ‘transfer fee’ per transaction.

It’s usually a fixed fee of anywhere between $20-$50.

You may also come across other sorts of fees charged by banks – intermediary fees, tracking fees, recipient fees, and priority payment fees.

Let’s be clear about something: these cheeky bank fees are in addition to the charge built into the exchange rate.

Most currency brokers will be cheaper than banks – both on fees and exchange rates.

At Key Currency, we keep things simple and transparent.

We do not charge any fees.

They quote you an exchange rate and let you know how much money that will give you at the other end.

In the case of transferring money from Canada to the UK, you will know exactly how many Pounds you will receive for your Canadian Dollars.

This gives you clarity and makes your international transfer as straightforward as possible.

Is it safe to use a currency broker?

Make sure your currency broker is regulated. In the UK, that’s done by the FCA (Financial Conduct Authority) and in Canada, the Financial Consumer Agency of Canada is the equivalent regulatory body.

All authorised money transfer companies are required to keep all client funds in safeguarded bank accounts that are separate and ring-fenced from company funds.

You can check here if a UK company is on the FCA register.

To verify a Canadian money transfer company you can search here.

Quick Summary

- For transferring from Canada to the UK, you can use a bank or a currency broker.

- If you use a bank you are likely to be charged 3%-4% more in exchange rate margins.

- Money transfers from Canada to the UK typically take 1-3 working days.

- Currency brokers have specialised skills and techniques that can make your transfer easier.

- Make sure you use an FCA-regulated broker that will protect your money.

Who are we?

Key Currency is a leading international currency broker.

In the last 12 months, we have helped over 6,000 clients move money to all corners of the world.

Our exchange rates are highly competitive and we charge no fees.

In addition, we provide you with a one-to-one personal service.

We don’t force you onto a complicated online platform and make you do all the work yourself.

That leads to stress, mistakes, and unhappy customers.

Instead, you will be looked after by one of our foreign exchange experts from start to finish.

You can even check out who you are dealing with – all our people are shown on our website.

We are real people you can trust.

Key Currency is Authorised by the Financial Conduct Authority (No. 753989) in the United Kingdom as an Authorised Payment Institution. All money transfers are conducted through safeguarded client bank accounts.

Our service has a 5-star rating on Trustpilot, based on over 2,500 customer reviews.

If you feel our service could be of use to you, simply request a free quote.