Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on September 20th, 2024

Below is a step-by-step guide on how to send money to the UK from the USA. I’ll explain the steps involved, the costs, how long it takes and mistakes to avoid.

How to Send Money from the USA to the UK (in 4 simple steps)

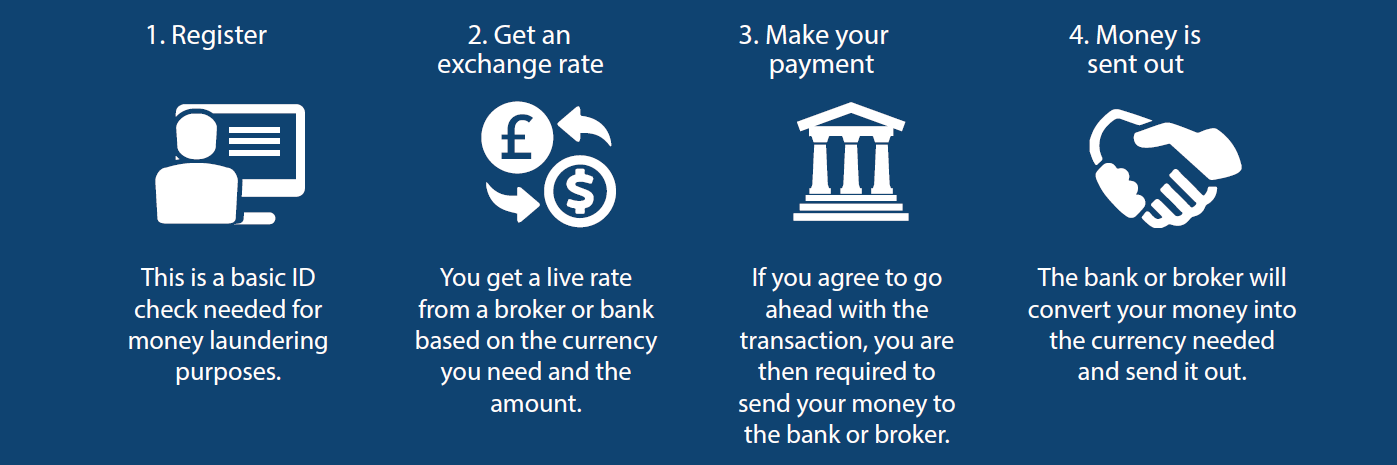

Transferring money from the US to a UK bank account is a straightforward process that can be done in four steps.

1. ID check

Before anyone can send money from the US to the UK, they need an identification check.

It’s a legal obligation to verify the sender of money due to global anti-money laundering rules.

This check only applies to new customers.

Usually, this check is completed on the same working day.

2. Secure a USD to GBP exchange rate

The USD to GBP exchange rate is the biggest cost when moving your funds.

A bank or a money transfer company will quote you their current rate.

You must give your permission to proceed.

If you are happy to go ahead with the exchange rate quoted, the bank or service provider will lock in your rate at that point.

You will then receive an email confirming the details and status of your transfer – this will include the rate agreed, the amount of Dollars sold, and the amount of Pounds bought.

3. Send in your US Dollars

Banks require your US Dollars upfront before they will agree on an exchange rate.

However, a payment service provider will allow you to secure an exchange rate before you move the funds.

Note – this can be a real advantage.

If the GBP to USD rate is at a favourable level, you don’t want to miss out on getting a good rate.

With a currency exchange company, you normally are given 1-2 working days to send in your US Dollars (via a regular bank transfer).

On your confirmation email, it will have the details of where to send your US Dollars (in the case of an international payment provider it will be a designated client bank account).

4. Your US Dollars are converted to Pounds and sent

Your bank or currency exchange company will perform this step.

Once your US Dollars are received, they are converted into Pounds at the rate previously agreed with you.

Your bank or service provider will then send your money directly via the SWIFT global payment system to the UK bank account you have nominated, completing your money transfer from the USA to the UK.

How Long Does it Take to Send Money from America to the UK?

When you wire money from the US to the UK, it typically takes 2-4 working days for the funds to reach a UK bank account.

Converting your US Dollars into Pounds takes only a few minutes.

The rest of the time is governed by the speed of the US domestic and international banking system (SWIFT).

A quick word of advice….

The US banking system is very fragmented. There are still many small local banks and credit unions.

From our experience, these smaller players are usually unfamiliar with international money transfers (or ‘wire transfers’) and do not have their own systems in place to carry them out.

Put simply, the smaller banks tend to use larger ‘intermediary’ banks such as JP Morgan or Citibank to help facilitate an international payment. It’s a bit of a mess from a customer’s point of view.

At Key Currency we’ve helped hundreds of clients move their money from the USA to the UK, so we know the kinds of issues that will arise and how they can be overcome. What’s more we can help you bypass the bank fees that would otherwise arise.

Just request a quote if you want some assistance.

How Much Does it Cost to Transfer Money to the UK from the US?

When you transfer money from the US to the UK, there are two charges to look out for:

- Transfer Fees

- Exchange Rates

Transfer Fees

The US banks charge their customers a flat fee every time they do an international transfer.

These fees can go by different names, but in the US, they tend to be called ‘international wire fees’ or ‘international transaction fees’.

Here are the international wire fees charged by the four largest US banks:

| Bank of America | $45 |

| Citibank | $25 |

| JP Morgan Chase | $45 branch, $40 online |

| Wells Fargo | $30-$45 |

At first glance, these fees don’t seem too high.

But they are an unnecessary expense.

They can add up if you are sending money regularly or need to send a large amount over several payments.

Some money transfer companies, such as ourselves, are happy to waive these fees altogether. We also don’t have any limits on transfers and you’ll always see a full breakdown of any costs.

Exchange Rates

There are no standard exchange rates.

All banks and international payment providers set their exchange rates.

And the exchange rates on offer tend to improve the more money you send.

Our research found that the exchange rate margin charged by the big four US banks ranged between 4% and 5.5%.

It’s hard to be any more specific because the US banks will adjust the rate depending on your exact amount.

But it stands to reason that the banks will find it difficult to compete with money transfer specialists.

Banks have operating costs that run into the billions. Therefore, it won’t come as a surprise that you can find better exchange rates from the money transfer specialists.

I would encourage you to carry out a cost comparison before using a bank.

Another thing to note is that a lot of people find the big banks difficult to deal with.

Sound familiar?

Many a customer has experienced unexpected fees, payment delays, complicated processes, and over-the-top security checks from their bank.

And try talking to a human these days. Mission impossible.

As money transfer companies are focused only on international transfers, they tend to be a lot better at getting the job done efficiently and keeping their customers happy.

Best Ways to Send Money to the UK from the US

-

Bank Transfers

Bank transfers are secure, reliable, and cost-effective, especially for larger amounts. Both banks and money transfer companies widely use them due to low fees and strong security.

For instance, a $10,000 transfer may cost just $5-$10, compared to $30-$50 with credit cards. With 1-3 business days for processing, bank transfers offer a balanced choice for high-value, one-time transactions.

-

Direct Debit

Direct debit automates payments directly from a bank account, ideal for recurring expenses like tuition or mortgage payments.

Processing takes 3-5 business days and often requires fixed amounts, with fees sometimes higher than bank transfers. This method suits predictable, recurring payments but lacks flexibility for one-off or varied transactions.

-

Debit Card

Debit cards offer a fast, convenient way to transfer money, typically with lower fees than credit cards.

They’re well-suited for smaller transactions but may not provide the best value for high-value transfers due to potential limits and less favourable exchange rates compared to bank transfers.

-

Credit Card

Credit cards are widely accepted and offer quick processing but often come with higher fees and, at times, cash advance charges.

For example, a $1,000 transfer could incur fees of $30 or more. Credit cards are ideal for smaller, urgent transfers but not for larger sums, where bank transfers typically provide better rates and lower fees.

-

PayPal

PayPal provides a quick and familiar way to fund smaller transfers, offering convenience for everyday payments.

However, its fees are generally higher than bank transfers; for instance, a $500 PayPal transfer may cost about $15 in fees, compared to $5 for a bank transfer.

This makes PayPal ideal for low value, casual payments, while bank transfers remain more cost effective for larger sums.

-

Apple Pay

Apple Pay is a fast, digital option for small transfers but can incur higher fees, especially if linked to a credit card due to cash advance charges.

It’s best for quick, low-value transfers, while bank transfers or dedicated services provide better value for larger amounts.

-

Google Pay

Google Pay enables quick digital transfers, particularly for smaller amounts.

Fees depend on the linked payment method and may increase if using a credit card.Google Pay is suitable for smaller, one-off transfers, but bank transfers offer more favourable rates for larger transactions.

While several methods are available, Key Currency specialises in bank transfers due to their cost-effectiveness and suitability for larger transfers, helping clients maximise the amount received

How to Keep Your Money Safe When You Send Money to the UK from the USA

When you send money to the UK from the USA, you want to be absolutely sure your transfer is secure. While there are plenty of service providers, not all are trustworthy.

Things like longevity, customer reviews, and awards can help bring confidence.

And regulation should be an absolute must for any company you do business with.

The rules are more complicated in the US because financial regulation is set state by state.

In the UK, a company is Authorised by the Financial Conduct Authority (FCA) – the UK’s financial regulator.

Security systems are vital and UK Authorised firms are required to keep client money in a separate, safeguarded bank account.

To find out if a UK-based money transfer company is Authorised by the FCA, you can search their name on the FCA register.

Why You Shouldn’t Trust Online Exchange Rates for US to UK Transfers

If you track the USD to GBP exchange rate, you have probably come across websites offering free exchange rate feeds.

Some of the more popular sites are XE, Oanda, and DailyFX.

But there’s a catch to these.

A lot of the exchange rates you see online are not available to customers.

If you look closely at these sites, you will find a disclaimer somewhere saying “consumer clients can’t access these rates” or the more generic “for information purposes only”.

That’s because the rates you are seeing are ‘interbank exchange rates’.

Interbank rates are used by banks to trade with other banks.

Not even large corporations or money transfer companies, buy and sell currencies at interbank rates.

To budget effectively when you send money from America to the UK, it’s best to get a genuine exchange rate from a bank or money transfer specialist rather than rely on false information you find online.

Be Cautious of Daily Transfer Limits on International Money Transfers Imposed by US Banks

The big US banks tend to have a daily limit on the size of a bank transfer from the USA to the UK.

These limits are not required by law.

Daily limits imposed by banks can be a frustration for customers looking to transfer a large sum of money from the US to the UK.

JP Morgan Chase, for example, has a $100,000 daily limit.

Wells Fargo and Bank of America also have daily limits, but it’s based on your account history (whatever that means!).

If you want to send more money than the limit, you have to make several transfers.

That means more fees, more time, and more hassle.

Money transfer companies don’t have daily limits, so offer a more convenient and flexible solution to send money from the USA to the UK.

How to Get a Better Rate When Sending USD to GBP

When you transfer money from the US to the UK, the exchange rate is usually the critical factor.

Getting a better exchange rate comes down to two things:

- A competitive rate

- Optimal timing

A lot of people focus on the first part and overlook the second.

If you’ve watched live exchange rates, you will have noticed that they move every few seconds.

Price patterns in exchange rates are always changing.

You can see peaks and troughs, uptrends, downtrends, and trading ranges. Our GBP to USD forecast shows this further.

As currency brokers, part of our job is to watch rates very closely. It’s a key part of what we do.

If you are sending money from the US to the UK, even tiny moves in the rate can make a big financial difference.

As an example; if you were planning to send $75,000 to the UK, an intraday move of just 1% in the USD/GBP exchange rate would make $750.

Moves of that size can be a daily event.

Over a week or month, the swings can be substantially more – sometimes as much as 5% if markets are volatile. That’s when bad timing can cost you thousands.

When managing your US to UK money transfer, understanding your requirements allows us to work with you to achieve a better exchange rate.

It could simply be a case of alerting you when there’s been a favourable move.

Or we can let you know when the USD/GBP rate hits a specific level.

Banks and most other international money transfer companies don’t offer a proactive service like ours.

If you would rather speak to someone than download an app, you might find our service a better way to transfer money from the US to the UK.

Moving money from the US to the UK requires precision and timing, and we’re here to help you make the most of it.

Quick Summary

- To send money from the US to the UK, you can use a bank or a money transfer company.

- Your money will usually arrive within 2-4 days.

- Money transfer companies are normally a cheaper and more efficient option.

- Some money transfer companies also offer guidance on exchange rates and timing.

Who are we?

Key Currency is an independent money transfer specialist.

Our exchange rates are highly competitive. There are no additional fees or hidden charges.

As part of our service, we will assist you with the details of your transfer and work with you to achieve a better exchange rate.

That sets us apart from a lot of other money transfer specialists that are just online platforms or apps.

As a business, we are open and transparent.

The names, faces, and backgrounds of all our people are shown on our website.

We don’t hide behind a logo or generic mission statement; instead, we offer transparency, personalised service, and real solutions tailored to your needs, so you can count on us every step of the way.

We have attained a 5-star “excellent” rating on the customer review site Trustpilot; the highest rating possible.

In terms of regulation, we are an Authorised Payment Institution (Financial Services Register register No. 753989).

All money transfers are conducted through fully safeguarded client accounts.

To compare us to your bank or existing provider, simply request a free quote below.

FAQs when Transferring Money from America to the UK

When it comes to moving money from the US to the UK, there are some common questions people often wonder.

Let’s break down each of these one-by-one so you know exactly how to send money from the US to the UK and keep your money safe.

What Bank Details Will I Need to Transfer Money from a US to UK Bank account?

With so many bank account details to get right, transferring money from the USA to the UK as your destination can seem tricky, but don’t worry, it’s easier than you think. Here’s what you need:

First, enter your recipient’s details – their full name, just as it appears on their bank account and their full address. Think of it like sending a postcard, every detail matters.

You’ll also need the bank’s name and address. Picture it as sending a package, you need to know exactly where it’s going. The recipient’s bank account number (8 digits) and sort code (6 digits) are essential too, they guide the bank transfer to the UK.

The SWIFT/BIC code is like the bank’s international ID, usually 8 to 11 characters. And don’t forget the IBAN, starting with ‘GB’ for UK accounts, followed by up to 22 characters.

Lastly, you may need to include the reason for sending money from the US to the UK, a brief description keeps everything transparent and can help avoid unnecessary delays.

Providing these details ensures your US to UK money transfer will glide through effortlessly, just like a hot knife through butter.

What are the Tax Implications of your US to UK Money Transfer?

When figuring out how to send money to the UK from the USA, tax can often become a major hurdle that stands in your way.

Generally, the act of transferring money from the US to the UK isn’t taxed. However, the purpose of the payment matters and can change the picture.

Sending a gift? In the UK, you’re in the clear, no gift taxes here. But back in the US, if you’re sending over $18,000 per recipient in a year, you might need to file a gift tax return.

Now, if you’re wiring money from the US to the UK for business or investment purposes, things get a bit more complex.

The UK could tax any income or gains from these payments so it’s vital that you report any earnings to HMRC in the UK and the IRS in the US to avoid penalties.

Plus, you should always keep thorough records when you transfer USD to GBP, including amounts and reasons, to provide clear documentation if needed.

And, just as you wouldn’t attempt to fix your car without a mechanic’s help, getting advice from a tax professional can make all the difference.

They’ll steer you through the complexities of tax regulations, keeping you compliant and clear of any surprises.

What is the Cheapest Way to Transfer Money from the US to the UK?

Finding the cheapest way to send money from the US to the UK can be tricky, but let’s explore your options.

Big banks might seem convenient because they already have your money, but have you noticed how their high fees and poor exchange rates add up? They’re just not cost-effective.

Online platforms, on the other hand, offer lower fees and great exchange rates, making them more affordable. But there’s a catch: they often limit the transfer amount, which can be a drawback.

Let’s say you want to send a large sum. With online platforms, you might have to split the amount into multiple transactions, each incurring its own set of costs.

This can quickly make a dent in your pocket, making what seemed like an affordable option much less so.

If you’re planning to send money from the USA to the UK, especially for larger transfers, Key Currency is the best choice.

We provide competitive rates and low fees without imposing frustrating limits, making your money go further.

Sure, online platforms are handy for smaller amounts, but for bigger transactions, Key Currency is your best bet.

We blend great rates with exceptional service, making your transfer both cost-effective and hassle-free.

What Are the Limits for Online Money Transfers to the UK?

When you’re looking to send money from the USA to the UK, daily transfer limits can make things trickier than they need to be.

Big US banks, like JP Morgan Chase with its $100,000 limit, or Wells Fargo and Bank of America with limits tied to account history, can quickly become frustrating.

These limits aren’t set by law, but if you need to send a large sum, you’ll end up making multiple transfers – more fees, more time, and more hassle.

Even online platforms often cap the amount you can send in one go, which means breaking the payment into smaller parts. And with each transaction, the fees add up, making the process less cost-effective.

But with Key Currency, there are no daily limits. You can send everything in one smooth transaction, enjoying competitive rates and low fees without the extra steps.

It’s the easiest, most cost-effective way to transfer money from the US to the UK, saving you time, money, and stress.

How Much Money Can be Transferred from the US to the UK?

The good news is, there’s no strict cap – you can send as much as you like! But if you’re sending over $10,000, the IRS will need to know about it.

No need to stress, though. It’s more about keeping everything transparent, and as long as you keep your paperwork in order, you’ll be fine.

Now, remember how we talked about limits earlier? Some banks and online platforms impose their own daily limits, which can be a bit of a headache.

If you’re moving a large sum, you might end up having to split it into multiple transactions.

And of course, that means more fees and more hassle, which isn’t exactly ideal when you just want to get the job done and have the recipient receive money quickly.

That’s where Key Currency really makes a difference. No daily limits, no hidden fees for bigger transfers – you can send everything in one go, no fuss.

So, whether it’s a smaller amount or something larger, transferring money from the US to the UK becomes a smooth, hassle-free experience.

How to Send Money Online to the UK from the USA?

Transferring money from the US to the UK online is quick and easy, and it only takes four simple steps.

Whether you need to send money online for personal reasons or for business, the process is straightforward.

First, a basic ID check is needed for new customers due to anti-money laundering regulations. Don’t worry, it’s usually done within the same day. This step ensures security when you send money internationally.

Next, you’ll be offered a USD to GBP exchange rate by your bank or money service provider.

Once you’re happy with the rate, it’s locked in, and you’ll receive an email with all the details – how much you’re sending in Dollars and receiving in Pounds.

After securing the rate, it’s time to send your Dollars via an available payment method. While banks require you to send the funds upfront, international payment providers give you 1-2 days to send the money after locking in the rate.

Finally, your money is converted into Pounds and sent to the UK bank account you’ve chosen via the SWIFT system.

And just like that, your money transfer from the US to the UK is complete – quickly and without any hassle.