Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 3rd, 2024

You can transfer money from Hong Kong to the UK using either a bank or a money transfer company.

Both will get the job done, but the costs can vary quite a lot.

I’ll explain how it works, how long it takes and the best ways to keep your costs down.

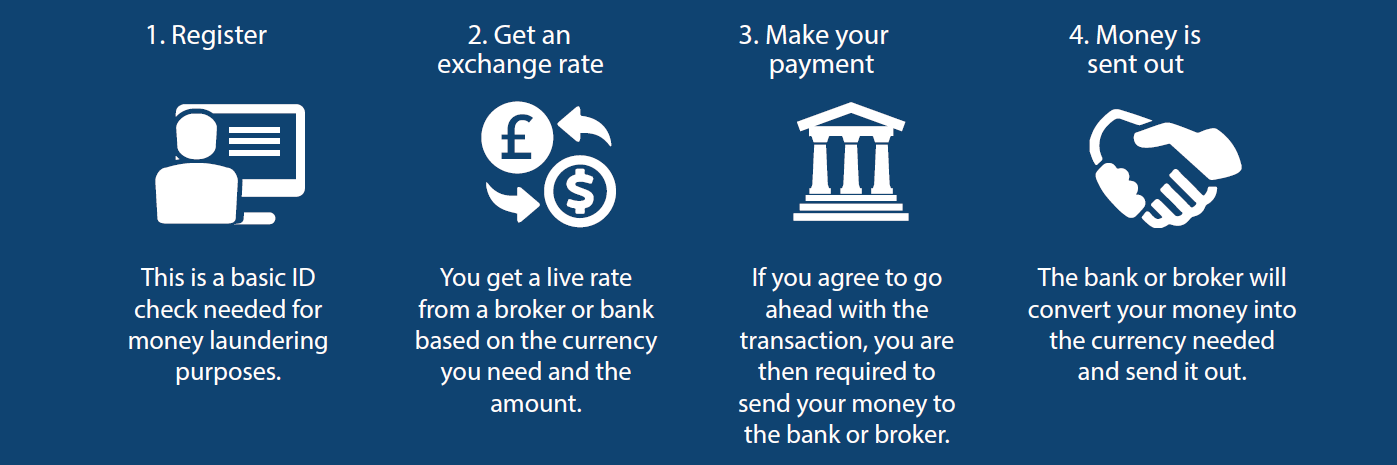

How to transfer money from Hong Kong to the UK (in 4 steps)

It might seem daunting to send money from the UK to the USA, but in practice, the process is extremely quick and easy.

Here’s how it works…

Step 1: Identity check

All new customers need a quick ID check.

It is required by financial regulations.

Most people can be verified using their passport number and driver’s licence (or a recent bill). You can take a photo with your phone or scan them in.

Step 2: Secure a HKD/GBP rate

To send money to the UK, you need to convert your Hong Kong Dollars (HKD) to Pound Sterling (GBP) rate.

The exchange rate changes every few seconds.

A bank or money transfer company will provide you with their current HKD/GBP rate.

When you are happy to go ahead, you need to give your consent, and the exchange rate is locked in.

Step 3: Send your funds

This step is slightly different depending on whether you use a bank or money transfer company.

A bank needs the money already in your account, whereas a money transfer company allows you to agree to a rate and then send in your funds.

You will be emailed the bank details of where to send your funds. This can be done using a regular bank transfer.

Step 4: Your money is sent to the UK

Once your Hong Kong Dollars are received, your bank or money transfer company will convert them into Pound Sterling at the rate agreed.

The funds will then be sent to the UK bank account you have requested.

That’s it!

How long does it take?

Sending money from Hong Kong to a UK bank account transfer normally takes 2-3 working days for your money to arrive.

The time taken may vary due to time zones, weekends, and public holidays.

Another factor is simply how quick your UK bank is to clear funds into your account. That part of the process is, unfortunately outside anyone’s control and can be a bit random.

Banks tend to be a bit slower at clearing funds for international transfers, compared to domestic transfers.

The best way to transfer money from Hong Kong to the UK

While it might seem like you have endless options, your decision comes down to this:

Whether you use a bank or a money transfer company.

If you want to send money from your Hong Kong bank account to a UK bank account, then an international money transfer is your best option.

These can also be called telegraphic transfers or wire transfers.

Different jargon, same thing.

Both banks and money transfer specialists can do this for you.

It’s a case of weighing up the cost and service differences.

There are pros and cons to each, which you can see below.

| Pros | Cons | Best for | |

| Bank | Familiarity | High charges, minimal help | Small, infrequent payments |

| Money Transfer Company | Lower fees | Need to register first | Large or regular amounts |

What are the costs?

The cost of sending money from Hong Kong to the UK is often a combination of two charges:

- Fees

- Exchange rates

I know for customers that can make it confusing.

But I suspect in a lot of cases; it’s deliberate.

The main thing to remember is that the fees aren’t the only cost.

I see people post online the fees they pay and they don’t seem to be aware that the exchange rate is also a cost (albeit less visible than the fees).

Fees (an annoying distraction)

When you send money overseas, the banks charge a transfer fee.

Transfer fees are a fixed, flat fee charged per transfer.

Some money transfer companies also charge transfer fees, while some don’t.

The big banks in Hong Kong use different terms to describe a transfer fee, such as an “outward remittance fee” or a “telegraphic transfer fee”.

Here’s what two of the biggest banks for British expats charge per international transfer:

HSBC: $50 online, $120-$240 in a branch (depending on the account), $0 if to another HSBC account & you are an HSBC Jade or Premier customer.

Standard Chartered: $100-$200 (depending on your account type).

Both banks also mention you may get levied “correspondent bank charges” (fees paid to other banks).

HSBC doesn’t say how much these will be, but Standard Chartered states they will be a minimum of $250 per telegraphic transfer.

In addition, if you amend, cancel, or make a mistake on your transfer, the banks will also charge a fee in the region of $100-$250 for each item.

Exchange rates (the most important charge)

Each bank or money transfer company sets its own exchange rates.

This will include markup or margin.

As a general observation, I’ve found that big banks don’t tend to offer the best rates.

I suspect they don’t have to.

Because they hold your money, many people will automatically use their bank without checking out the alternatives.

I’m not suggesting you are in a position to negotiate with your bank.

They’re not going to bend for you or anyone else.

But you can just as easily use a money transfer company, so it’s worth comparing the difference in cost.

Looking at the exchange rates set by HSBC and Standard Chartered, the margin (exchange rate cost) for HKD/GBP looks to be around 2.0% – 2.2%.

To put that into perspective, on a $400,000 telegraphic transfer to the UK, you could end up paying $8,000 to $8,800 in exchange rate costs.

The banks may vary their rates based on the time of day and the amount you send.

But my point is the exchange rate costs are likely to be far greater than the fees when you send a large amount.

If you wish to make a comparison with a money transfer specialist, make sure you do it at roughly the same time (as the exchange rate will move throughout the day).

How to choose a money transfer company?

With so many expats living in Hong Kong, there are plenty of money transfer companies vying for your business.

Not all offer the same thing.

It depends on whether you want to do it yourself online or get some human assistance.

You will find most money transfer companies are just online-only platforms or “apps”.

They essentially offer a “do-it-yourself” service.

Some of the best-known ones are PayPal, Transferwise, and CurrencyFair.

These platforms or apps are popular with online merchants and those sending smaller amounts.

I know from experience (including my own) that a lot of people aren’t comfortable sending large amounts over the Internet.

And you may find doing things online frustrating or stressful.

If that’s the case, you may wish to speak to a money transfer specialist.

A money transfer specialist can:

- Assist you with the payment set-up

- Monitor and guide you on exchange rates

- Keep you informed from start to finish

Before choosing a money transfer company, I would make sure they are regulated.

Most money transfer companies that can send money from Hong Kong to the UK, are regulated by the Financial Conduct Authority (FCA).

You can check if a company is regulated by the FCA by searching their name in the FCA register.

An FCA-regulated company is required to keep all client funds in safeguarded bank accounts.

It means your money will be transmitted through a segregated bank account used solely for customer transactions and won’t be mixed with company funds.

How to get the best exchange rate

Achieving a favourable exchange rate is often the most important factor when you send money from Hong Kong to the UK.

But if you’ve watched live exchange rates before, you will know they change every few seconds.

For someone unfamiliar with currency markets, it’s not easy to decide when you should convert your Hong Kong Dollars into Pounds.

If you are planning to send a sizeable amount, even small moves in the HKD/GBP rate can result in significant differences in the Pounds you will receive.

For example, if you were looking to transfer $500,000 back to the UK, even a tiny 1% move against you in the rate would cost you $5,000.

Moves of that magnitude are frequent events.

Over weeks and months, the swings can be 4%-5% – or even more if there’s major economic or political news.

Given what’s at stake, it may be worth your while speaking to a currency broker.

A currency broker can monitor currency markets on your behalf and keep you informed of upcoming events that may impact the exchange rate.

A bank or one of the many online-only “apps”, won’t assist you with exchange rates.

For small amounts, you may feel it doesn’t matter so much.

However, I’ve found that most people looking to transfer a larger amount, want some guidance on rates, and feel a lot more comfortable being able to speak to someone.

It’s not just about reassurance.

It’s also about achieving a more favourable rate and knowing where your money is at any point.

Quick Summary

- To send money from HK to the UK, you can use either a bank or a money transfer company.

- It should take 2-3 days for your money to arrive in your UK bank account.

- The cost of an international money transfer is often a combination of fees and exchange rates.

- To ensure your money is safeguarded, use an FCA-regulated company.

Who are we?

Key Currency is a leading money transfer specialist.

We have far lower overheads than the banks, enabling us to pass on the savings to you.

Our rates are highly competitive, and we don’t charge any fees.

What’s more, we give you a service.

I’m sure you’ve noticed that there’s a big push these days to make customers do everything themselves online.

It suits the companies, but not the customers.

The average person doesn’t make regular international money transfers.

So a lot of people don’t want to download an app, enter a bunch of information, and then decide on the right time to exchange their money.

At Key Currency, we assist you with the payment details, discuss and agree on the right time to exchange your money and keep you informed at all stages of your transfer.

It’s a better way of doing things.

As a company, we are open and transparent.

The names and faces of all our employees are shown on our website.

We have a 5-star customer rating on the review website Trustpilot, based on over 2,500 reviews.

You also have the peace of mind of knowing that we are an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

To make a no-obligation enquiry, please request a quote below.

Further Guidance & Tools

For the reverse transfer: transfer money to Hong Kong from the UK

A quick look at the current rate: Convert HKD to GBP