Author, Mike Smith

Author, Mike Smith

Last Updated on August 8th, 2024

I’ll explain how to transfer money to France from the UK, what fees to look out for, how long it takes, and the information you will need.

For guidance on the reverse money transfer, see our article on transferring money to the UK from France.

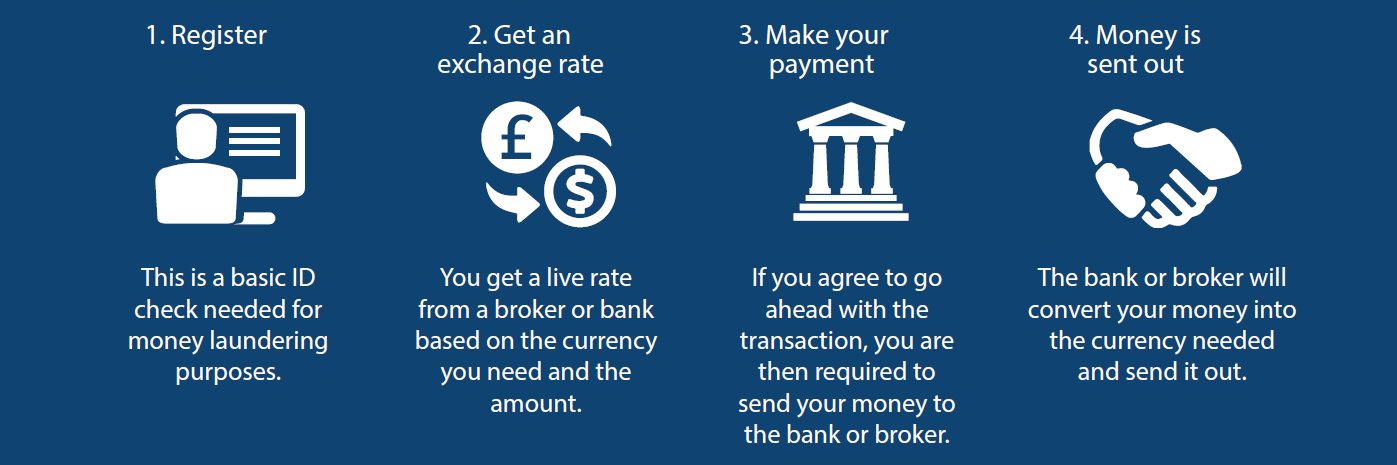

Transfer money to France (in 4 simple steps)

Step 1 – Register as a client

If you are a new client, you need to register before you can send money abroad due to financial regulations.

You only need to register once.

Registration is essentially an identification check.

For most people, it’s just a case of providing the standard information – name, address, and passport number.

Step 2 – Secure a Pound to Euro exchange rate

Once you’re registered, you can secure an exchange rate.

When you transfer money to France from the UK, the relevant exchange rate is Pound to Euro. This is also shown as GBP/EUR.

A money transfer company or bank will quote you their latest rate.

You can use our GBP to Euro converter to see the live rate today!

You need to confirm the rate before you are committed to any transaction.

If you go ahead, the exchange rate is locked in for you.

A confirmation of your transaction will be emailed.

Step 3 – Send in your Pounds

Before any money is exchanged, you need to send in your Pounds.

You can do this using a normal domestic bank transfer. Your confirmation email will have the bank’s details needed.

Step 4 – Your Pounds are converted to Euros

Once your Pounds have been received by your money transfer company or bank, they will be converted into Euros at the rate already agreed.

Now that your money is converted to Euros, it can be sent directly to the French bank account of your choice.

The recipient can be you or someone else. I will explain the bank information you need below.

What is the best way to send money to France?

The best way to transfer money to France is to use an international bank transfer as it is secure, fast, and cheaper than alternative methods.

You can use either a bank or money transfer company for an international bank transfer.

The process is essentially the same, but the costs can vary considerably.

How long does it take to transfer money to France?

Sending money to France from the UK usually takes 2-3 working days.

The currency conversion and onward payment are usually done on the same day, but it takes a few days for the receiving bank in France to clear the funds into the account.

All banks will carry out various internal checks on incoming funds, and you can’t speed that part up.

How much does it cost to transfer money to France?

The cost of a money transfer to France is a combination of fees and exchange rates.

A lot of people focus on the fees because they are the more visible part.

But for larger transfers, the exchange rate tends to be the most important charge.

Transfer Fees

The UK’s high street banks charge transfer fees in the region of £10-£25 when you transfer money to France.

You will also find that Barclays, HSBC, Natwest, and Lloyds, charge a ‘recipient fee’ too – so they effectively charge you twice for the same transfer.

HSBC and Barclays also charge a higher fee if you use a branch rather than their online system.

Some money transfer companies also charge fees, but they are usually less than the banks.

These fees may be on every transfer or only those transfers under a minimum amount (usually £3,000-5,000).

At Key Currency, we are one of the few money transfer companies to charge no fees when sending money to France.

Exchange rates

Exchange rates can vary a lot more than the fees.

In general, it’s fair to say that banks are not known for offering their customers great rates.

You can expect to pay 2%-5% in exchange rate charges if you use a major bank to transfer money to France from the UK.

The exact cost depends on the amount you send.

Even with money transfer companies, it depends on how much you send. There is no fixed rate.

As a tip, don’t use the rates you see online. They are not genuine customer rates.

Getting a genuine quote for your money transfer to France will allow you to make firm life plans and budget your spending more effectively.

With Key Currency, you can get a free quote whenever you like and we can also monitor the exchange rate for you, keeping an eye out for the best times.

What details do I need to transfer money to a French bank account?

Money transfers to France are processed using an IBAN (International Bank Account Number).

In France, an IBAN is 27 characters long, consisting of numbers and letters:

- 2-letter country code (FR)

- 2-digit check number

- 5-character bank code

- 5-digit branch code

- 11-digit account number

- 2-digit national code

It’s not enough to have only the bank account number. Additional information is also needed to ensure the transfer is carried out correctly.

You can usually get all the information by logging into the account or from a bank statement. Some money transfer companies will also help you put this together.

How safe is it to send money to France?

The protection and security of funds are understandably important for everyone.

One thing to note is that only some money transfer companies are regulated, while others are not.

Why’s it even matter?

A money transfer company that is Authorised and Regulated by the Financial Conduct Authority (FCA) must adhere to strict rules on how they carry out customer transactions.

The most important of these rules is the segregation of client money.

When your money is segregated, it will be held in a separate, safeguarded bank account designated only for client transactions. Unregulated firms may not follow the same secure process and could co-mingle their funds with yours. No thanks.

I would strongly suggest using only a fully regulated company when transferring money to France. A company’s FCA number is usually shown in the footer on its website.

You can verify its validity by searching for the company in the FCA Register.

Quick Summary

- Transferring money to France via an international bank transfer is one of the best ways to do so.

- It usually takes 2-3 working days to complete a money transfer to France.

- To complete the money transfer you will need to provide the IBAN of the French account.

- The costs of sending money to France are made up of transfer fees and exchange rate charges.

- Choose an FCA-regulated money transfer service to make sure your money is safe and secure.

Who are we?

Key Currency is an independent money transfer specialist.

We’re different from all the apps and online systems because we provide personal assistance alongside guidance on exchange rates.

Rest assured, Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989).

As such, when you send money to France through us, your transaction will be conducted directly through safeguarded client accounts.

We believe trust and transparency go hand-in-hand. It’s why we don’t hide behind a logo or slogan. All the names, faces, and backgrounds of our people are shown on our website.

Looking after customers is what grows our business. We have attained a 5-star rating on Trustpilot based on over 2,500 customer reviews.

If you would like to transfer money to France or find out more about our service, simply request a free quote.