Author, Mike Smith

Author, Mike Smith

Last Updated on August 24th, 2024

In this article, I’ll explain how to transfer money to Italy as easily and cheaply as possible. I’ll also answer some common questions about money transfers to Italy and make it clear exactly what you’ll need to do.

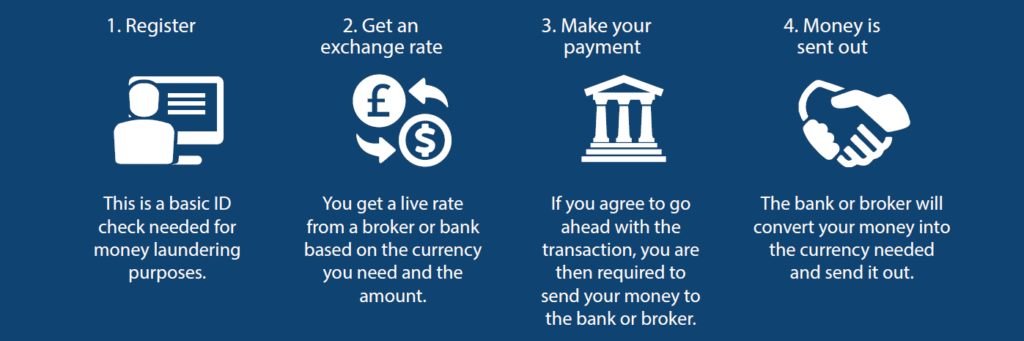

How to Transfer money to Italy (in 4 simple steps)

Step 1: Identity check

To transfer money to Italy, firstly you’ll need to pass an ID check to open an account.

This is for anti-money laundering purposes and is necessary wherever you go.

It’s the same for everyone the first time they make an international money transfer.

For UK residents, a copy of your passport and a utility bill is usually enough to prove your identity and set up your account.

Step 2: Secure an exchange rate

When your account’s created, you’re ready to get an exchange rate.

Securing the best exchange rate is the most important part of your currency transfer to Italy.

Remember, there’s no standard exchange rate.

This is why exchange rates vary between international transfer providers.

Get a quote on the Pound to Euro exchange rate from your bank or money transfer provider.

Once you’ve found an exchange rate you’re happy with, you can lock it in.

Be aware, you may need to transfer a percentage of the full transfer amount before you can guarantee an exchange rate.

Step 3: Send in your Pounds

Once you have your exchange rate confirmed and your money transfer to Italy booked, the next step is to send in the full amount of Pounds.

When you book the transfer, your bank or broker will make it very clear where you’ll need to send the Pounds.

After you’ve sent the funds, your part of the money transfer is done.

You can relax and wait for the Euros to land in the recipient account.

Step 4: Your Pounds are converted to Euros

When your Pounds reach the account of your money transfer provider, they will do the currency conversion and exchange them for Euros.

The Euros will then be sent to the Italian bank account as you requested.

Nice and easy!

The Best Ways to Transfer Money to Italy

Various options are available to transfer money to Italy from the UK.

These include:

- International bank transfer.

- Google or Apple Pay.

- SWIFT Payment.

- Debit or credit card payment.

- Cash pick-up services.

Many providers are also available to help you transfer money in the methods above, the three most common are your bank, a currency broker, or an online money transfer service.

Cheapest way to transfer money from the UK to Italy

An international bank transfer is usually the most cost-effective way to transfer money to Italy from the UK. It is also one of the most securest too.

Other online alternatives such as debit or credit card payments may see the transfer complete quicker, but this will be subject to higher transfer fees.

In most cases, using your bank for a money transfer to Italy will incur much higher transfer fees and less favourable exchange rates compared to independent money transfer services.

It’s always recommended to do as much research and compare all of the available options and their charges.

Transfer Fee Costs to Italy (compared)

| Transfer Provider | Transfer fee to send money to Italy |

| Key Currency | £0 |

| Xoom | £1.99 |

| PayPal | £2.99 |

| Wise | £4.49 |

| Nationwide | £20 |

How long does it take to send money to Italy?

Money transfers to Italy are generally a quick process.

It normally takes between 1-3 working days to transfer money to Italy from the UK.

The good news for you is that you’re making a transfer to the Eurozone.

Transfers from the UK to Europe are usually straightforward – even after Brexit.

If you’re lucky, you may even find that your money is sent to Italy and completed the next working day.

However, there are no guarantees, and cut-off times to book next-day transfers vary.

Keep in mind that all international money transfers are subject to clearing time at the banks.

The currency exchange itself is usually the quick part of the process!

If you have a deadline, it’s often best to be safe and do the money transfer to Italy in advance so you don’t risk missing it due to any delays in the banking process.

Bank Details and Information you’ll need to transfer money to Italy

To send money to Italy, you’ll need these details of the recipient’s bank account:

- Account name (whether it’s your name or someone else’s)

- IBAN (International bank account number)

The IBAN is used to identify a bank account from anywhere in the world.

You can usually find the IBAN on a bank statement of your Italian bank account.

IBANs in Italy are 27 digits long and are a combination of numbers and letters.

Italian IBAN components are:

- Country code – ‘IT’ in Italy.

- Check digits – Calculated using an algorithm to validate the IBAN

- National code – A 1-digit code

- Bank Code – 5 unique digits that identify the bank

- Bank Branch – 5 digits for the branch

- Bank Account Number – A maximum of 12 digits are used to identify the bank account.

IBANs aren’t the easiest thing in the world to find though.

I know if someone asked me to pick out my IBAN, I’d have to go scrambling through my paperwork.

If you’re struggling to find the IBAN on a bank statement on your online banking, speak to a currency broker like Key Currency, who will be able to talk you through how to find it and make sure it’s correct.

Bank or Currency Broker for a money transfer to Italy?

Your two main options for making an international money transfer to Italy are using a bank or a currency broker.

You’re likely to get a better exchange rate using a currency broker.

Although banks are familiar names, they’re not designed to make large currency transfers cheap or efficient.

They’re focused on mortgages, loans, and credit.

It’s obvious when you see how expensive their exchange rates are.

Banks typically charge exchange rate margins of 3%-4%.

If you were to make a £100,000 transfer at a bank, margins of this size would cost you between £3,000 to £4,000.

This is enormous!

There’s no need for international transfers to cost this much – familiar name or not.

That’s without taking any extra transfer fees into account.

On the other hand, currency brokers are also known as money transfer specialists, and this should give you a clue as to what sets them apart.

They’re more efficient than banks and you can get better exchange rates.

The bottom line, sending money to Italy is easier and cheaper for you when you use a currency broker.

How to avoid paying fees when transferring money to Italy

Many UK high street banks will charge additional fees when sending money to Italy.

It seems to be such a regular occurrence, that people have come to expect hidden fees to be sprung upon them (usually at the very last minute!) for their international transfers.

As if an extortionate exchange rate margin wasn’t enough, they have the cheek to add more costs every single time you make a transfer.

Some banks charge up to £25 per international currency transfer.

Why should this be the norm?

In my opinion, it shouldn’t.

Some currency brokers, like ourselves, don’t charge additional fees.

At Key Currency, all our costs are built into the exchange rate quote.

That way, it’s clear exactly how much your transfer to Italy will cost, and you’ll always know exactly how much will be received at the other end.

We believe that’s much better for you.

How safe is a currency broker?

When transferring money to Italy, you want to know that you’re using a company you can trust and that your money is safe.

You want to ensure the company you use is Authorised by the Financial Conduct Authority (FCA).

FCA-Authorised currency brokers must keep all customer funds in a separate and safeguarded bank account.

Checking that a currency broker is on the FCA register is the best way you can ensure your money is safe while sending money from the UK to Italy.

How to get a great exchange rate for your money transfer to Italy

Exchange rates change every few seconds.

As a result, we often see large movements in exchange rates over days, weeks, or months.

Even a 1% swing in the Pound to Euro exchange rate on a £100,000 would make a £1,000 difference to the final amount.

Movements of 1% happen all the time. It could easily change 1% over a week.

In a perfect world, everyone would put in the time and effort to become experts in the latest exchange rate trends.

But keeping in the know isn’t easy.

We’re all busy people with better things to do than study exchange rate graphs all day.

This is where it pays to get some guidance with your transfer.

Pro-active currency brokers watch the markets for you and can even let you know when the market moves in your favour and when it is the right time to transfer money to Italy.

This separates currency brokers from cumbersome high-street banks and makes them more helpful than online-only apps.

Online services like Wise or Revolut make you do every aspect of international transfers yourself.

For large transfers, why risk losing money by making the transfer at a time when the exchange rate has moved against you?

Plus, if something were to go wrong using an app, there’s nobody for you to contact and you’re left staring at your phone screen.

I’d want an expert on my side.

Using a currency broker, you’ve always got someone at the end of a phone who has dealt with your transfer from start to finish to answer your questions at a moment’s notice.

This takes the stress out of transferring money to Italy.

Quick Summary

- To transfer money to Italy you can use a bank or a money transfer specialist.

- It should take between 1-3 working days.

- Currency brokers are generally a cheaper option to send money to Italy than a bank.

- You can also avoid extra transfer fees by using a currency broker.

- Some currency brokers can help you get the best exchange rate by watching the market for you.

- Beware of ‘fake’ exchange rates online that only display the interbank rate.

About Key Currency

Key Currency is an independent currency exchange broker.

We believe in making international money transfers to Italy as easy as possible.

You get your account manager who will learn the ins and outs of your transfer and talk through all the details with you.

We take a personal approach to international money transfers.

As well as providing great exchange rates, we also offer helpful personal service.

While most money transfer companies hide behind a logo or app, we’re transparent.

You can find out all about us and see our names, faces, and backgrounds.

Key Currency is Authorised by the FCA (No.753989). As such, all transfers are conducted through safeguarded client accounts for your peace of mind.

We also have a 5-star customer rating on Trustpilot, from over 2,500 customer reviews.

If you would like to transfer money to Italy or find out more about our service, request a free quote below.