Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 12th, 2024

Looking to transfer Dollars to Euros? Confused by all the jargon and companies to choose from? I will give you an insider’s perspective on how to save yourself time and money.

Where can I transfer Dollars to Euros?

When making a transfer from Dollars to Euros, the options can feel overwhelming.

How are you meant to know which way is best?

In short, there is a basic choice to make.

You can make a US Dollars to Euros transfer using a bank or a money transfer specialist.

Typically, a money transfer specialist is your best option for a large US Dollars to Euros transfer because they can get you a better exchange rate and charge lower fees.

If you secure a good exchange rate, you can make significant savings on your Dollars to Euros transfer.

Based on our research, US banks can be up to 4% more expensive than money transfer specialists.

On a $100,000 transfer, a 4% difference would cost you $4,000.

Although 4% savings may sound small, you see how it could cost you a lot of extra money.

You can also use money transfer apps.

There are loads of apps out there, and they can be handy for small, regular payments, but problems can arise when you want to move large sums through them.

Many people find this out the hard way when something goes wrong, and they can chase their money for weeks.

That’s not a risk I’d want to take.

Is it a good time to transfer US Dollars to Euros?

In 2022, the US Dollar gained strength against the Euro as investors favoured the safety of the US Dollar due to the war in Ukraine and global inflation risks.

Since September 2022, the Euro has gained back some of its losses.

Overall, the USD to Euro rate is still above its long-term average, meaning that now is a good time to transfer US Dollars to Euros.

A simple way to check whether it is a good time to make a Dollars to Euros transfer is by comparing the current exchange rate to historical averages.

A good rule of thumb, in my opinion, is if the exchange rate is above the average of the last 5 years, it’s a good exchange rate.

Over the last 5 years, the USD to EUR average has been 0.8805.

In terms of the range it has traded, it’s been as high as 1.0438 and as low as 0.8006.

Transfer Dollars to Euros (in 4 simple steps)

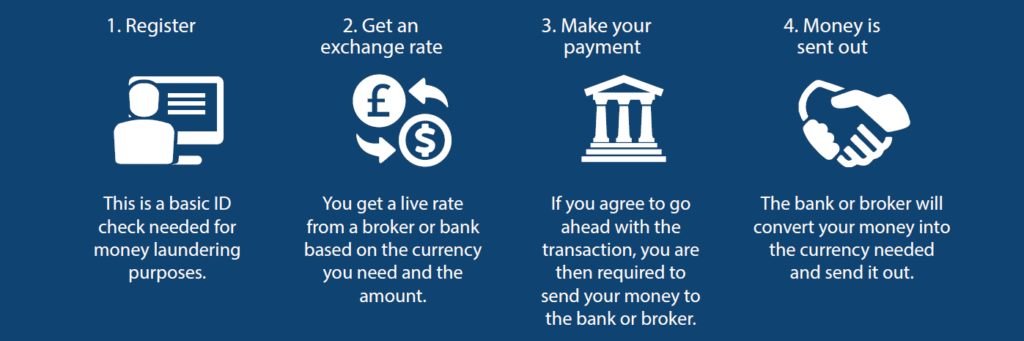

A US Dollars to Euros transfer will follow a simple 4-step process.

Let me explain each below.

Step 1: ID Check

The first step for any US Dollars to Euros transfer is to pass an ID check.

You’ll need to do this with any provider the first time you use them.

That may sound daunting, but it’s usually straightforward.

Normally a copy of your passport or driving licence and a utility bill is all that’s needed.

This is simply for anti-money laundering regulations.

Step 2: Secure an exchange rate

Securing a good USD to EUR exchange rate is the most important part of a Dollars to Euros transfer as this is where the biggest costs of your transfer will come from.

You should focus on getting the best USD to EUR exchange rate possible to save money.

Each provider will have a different exchange rate.

Not to mention that the timing of any currency transfer is hugely important as exchange rates can be highly volatile.

If you have the time, it’s best spent searching for the best exchange rate.

But let’s face it, many of us don’t have the time!

I’d suggest that the best solution is to speak to an expert who knows what they’re talking about.

At Key Currency, you get a dedicated Account Manager who watches the markets all day and can help you secure the best exchange rate possible.

When you get an exchange rate quote that you’re happy with, lock it in with your provider.

As a quick heads up, sometimes you’ll need to send in a percentage of the total Dollars as a deposit before you can secure an exchange rate.

Step 3: Send in the US Dollars

With the exchange rate secured, you’ll be ready to make the Dollars to Euros transfer.

You’ll need to send in the full amount of US Dollars to your money transfer provider.

They will make it clear exactly where to send the funds.

Obviously, for your peace of mind, you’ll want to double-check that you’ve got the details correct.

As part of our service here at Key Currency, we’ll let you know when your funds have arrived.

Once they arrive with your provider, that’s your part of the transfer done.

Step 4: Receive the Euros

Your US Dollars will be changed into Euros and sent to the recipient’s account.

A good, communicative broker will let you know when you can expect to receive the Euros.

It’s then just a case of waiting for your Euros to arrive at the receiving bank account.

How to avoid nasty transfer fees

It’s important to know that most banks and some money transfer providers add transfer fees to the cost of your international transfer.

All transfer fees are on top of the exchange rate costs.

I’ve found a lot of people think the transfer fee is the only charge.

But it’s just another way of extracting more money out of you.

At Key Currency, we never charge transfer fees. The cost of our service is built into the exchange rate.

This means you’ll know the exact Euros figure that will land in the recipient’s account.

No extra charges or fees after you’ve secured an exchange rate.

How long does it take to transfer US Dollars to Euros?

It usually takes between 1-2 working days to transfer US Dollars to Euros.

The actual conversion of Dollars into Euros doesn’t take very long (a few minutes).

That’s the quickest part of the process.

What tends to take the most time is waiting for your funds to clear through the banks.

Unfortunately, there’s not too much you can do about the clearing time from the recipient bank in Europe, but you can speed things up by sending your US Dollars ahead of time, so they are set with your money transfer provider and ready to exchange.

Why you should be wary of exchange rates online

You should be aware that most exchange rates shown online are ‘fake’ when making a US Dollars to Euros transfer.

Usually, the exchange rates that you see are not customer rates.

These exchange rates are known as the interbank rate and are only attainable by banks when they trade between themselves.

No bank or currency broker can offer this exchange rate to customers.

As interbank rates are displayed so widely, people often expect to get this exchange rate when making their currency transfer.

Sometimes people proceed with a transfer under the assumption that a company will be able to deliver this exchange rate, only to be stung with a higher exchange rate right at the end.

You don’t want to be in that position.

This is why it’s important to get a genuine exchange rate quote to find out how many Euros you will achieve.

How to get the best Dollars to Euros exchange rate?

Securing a good Euro exchange rate is the most important part of your Dollars to Euros transfer.

However, this is easier said than done.

Exchange rates are complex and affected by many factors and fluctuate every few seconds.

The currency market is a volatile beast.

If you’re not an expert in exchange rates, it’s easy to be stung by making a transfer at the wrong time.

It could you thousands of extra Dollars.

Yet most money transfer providers leave you to move your money by yourself.

That’s a big responsibility to put on you.

However, some currency brokers, like Key Currency, give you your currency exchange expert who can talk you through the entire process.

This could save you a significant amount of time and money and make the transfer easier, reducing stress.

We get there are plenty of apps these days. But they have their limitations.

If I were transferring a large amount of Dollars to Euros, I know I would want to deal with a real person.

Quick Summary

- It is usually a lot cheapest to transfer US Dollars to Euros using a money transfer specialist instead of a bank.

- In terms of recent history, now looks to be a good time to transfer US Dollars to Euros.

- Using a money transfer specialist, like Key Currency, can help you avoid unnecessary transfer fees.

- It usually takes 1-2 business days to transfer US Dollars to Euros.

Key Currency: Your friendly alternative

Key Currency is a UK-based currency broker.

We believe in providing a friendly and personal service to help you with your Dollar to Euro transfer.

You will have the same person to guide you from start to finish.

No need to explain yourself every time you speak to someone.

We can also keep track of the US Dollar to Euro exchange rate to take the burden off you.

If you want to see who we are, you can have a look at all of us on our About Us page.

We’ve also got a 5-star customer rating on Trustpilot with over 2,500 reviews.

In terms of regulation, we are an Authorised Payment Institution (Financial Services Register No. 753989).

All money transfers are conducted through fully safeguarded client accounts.

Click below for a free, no-obligation quote for changing Dollars to Euros.