Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 16th, 2024

You can transfer money from Ireland to the UK quickly and simply.

I’ll explain how it works, the best ways available, and how you can avoid excess charges.

If you’re looking for information regarding sending money to Ireland from the UK, click through for guidance on that transfer.

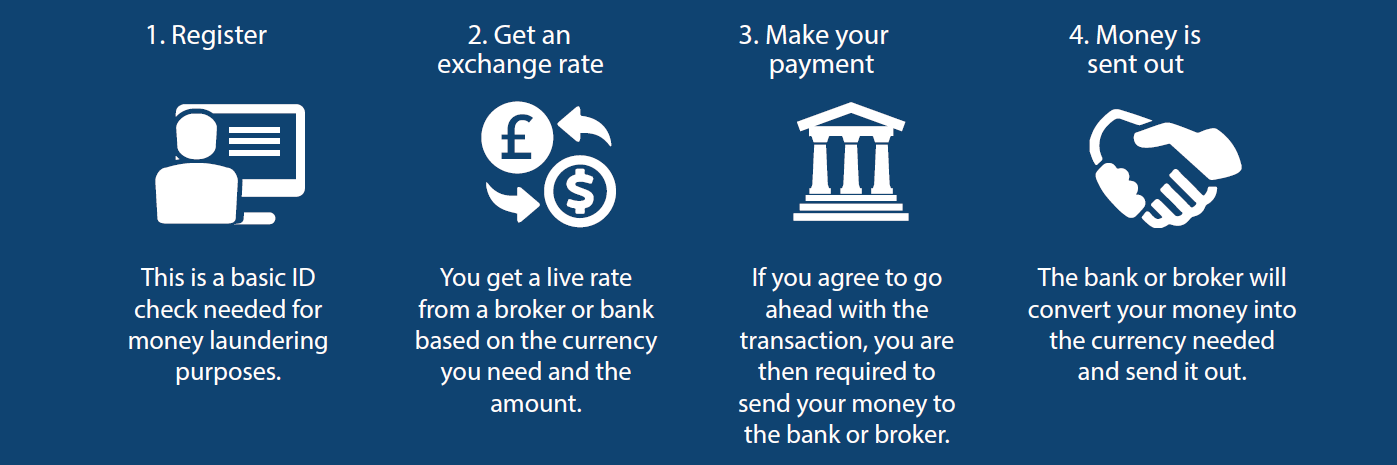

Transferring money from Ireland to the UK (in 4 simple steps)

Step 1 – Identity check

Before you can transfer money from Ireland to a UK bank account, you will need a quick ID check.

It is a regulatory requirement to check a new customer’s identity.

Fortunately, most people can be verified using basic information. You may need to provide your passport number and address.

Step 2 – Lock in an exchange rate

The Euro to Pound exchange rate changes every few seconds.

When you are ready to move your money, you will be asked what currency you wish to buy (GBP) and the amount of Euros (EUR) you wish to sell.

You will then receive a live quote for the EUR/GBP exchange rate from your bank or money transfer specialist.

No transaction will occur without your authority.

If you are happy to go ahead, the rate is locked in, and you will be emailed a confirmation with all the details.

Step 3 – Send in your Euros

Before any money is converted and sent to the UK, you need to send in your Euros.

Your email confirmation will show the bank details of where to send your money.

Step 4 – Your Euros are converted and sent to the UK

Once your bank or money transfer company has received your Euros, they will exchange them into Pounds Sterling and send them to the UK bank account you have requested.

That’s it in a nutshell.

How long does it take?

Overall, money transfers from Ireland to the UK are quick.

To send money from Ireland to the UK normally takes 1-3 working days for your money to arrive.

The time taken varies because of weekends, public holidays, daily cut-off times, and the efficiency of the receiving bank.

If you send in your Euros in the afternoon, not the morning, it may count as the next working day. The cut-off time for international payments to the UK is normally around 4 pm (Irish Standard Time).

The receiving bank in the UK can also sometimes hold things up.

All banks have their internal checks when money comes in from another country. Some British banks are quicker than others at clearing money into your UK account.

The best way to transfer money from Ireland to the UK

As a customer, you basically have two options.

You can use it with a bank or money transfer specialist. Each has pros and cons.

| Pros | Cons | Best for | |

| Bank | Can use your existing account | High charges, minimal help, daily limits | Small payments, convenience |

| Money Transfer Specialist | Normally lower cost | Need to register first | Large or regular amounts (over €5,000) |

How much does it cost to send money from Ireland to the UK

Whenever you transfer money from Ireland to the UK, there are two charges to look out for:

- Transfer fees

- Exchange rates

The overall cost is what matters, but a lot of people focus on the fees and forget the biggest cost is the exchange rate.

1. Transfer fees

For international transfers, the transfer fee is a more visible cost, whereas the exchange rate cost is more hidden.

The big Irish banks have realised that people hate paying fees, so have scrapped transfer fees on international transfers. But they are still making a killing on the exchange rate.

Bank of Ireland and Allied Irish charge no transfer fees for a non-urgent payment (1-3 business days).

If you want an express (same-day) payment, there is a €25 fee.

Some money transfer specialists charge no transfer fees, while some may add a fee for smaller amounts (under €3,000).

Although the fees are modest, the real money is in the exchange rate.

2. Exchange Rates

There are no standard exchange rates.

A bank or a money transfer company will offer you different exchange rates.

The exchange rates charged by the Bank of Ireland are tiered and vary depending on whether your transfer amount is below €10,000, €20,000, or €70,000 (or above).

The larger the amount, the tighter the exchange rate margin.

Our research found that Bank of Ireland’s exchange rate margin varies from 3% to 4.9%.

To put that into context, on a €50,000 money transfer to the UK, you would pay €1,500 in exchange rate costs.

That’s a lot of money in anyone’s books.

Allied Irish seem to use a basic exchange rate for transfers up to €70,000.

Looking at their rates, we found Allied Irish Bank charged an exchange rate margin of 3.1%.

Using our example of a €50,000 transfer, you would pay €1,550 in exchange rate costs.

In my experience, both the big Irish banks are charging much higher margins compared to money transfer specialists.

I have no gripe with either of the banks mentioned. It’s just that I think you can do better elsewhere.

The reason you’re likely to get a better exchange rate from a money transfer specialist is that they have far lower overheads than the big banks.

Banks have annual overheads that run into the billions. Someone’s got to pay for that.

If you do a cost comparison to find the cheapest way to transfer money from Ireland to the UK, make sure you do it at roughly the same time.

Exchange rates move every few seconds, so you want to be comparing apples with apples.

To keep it simple, just ask for the amount of Pounds you will receive net of all fees.

Is there a maximum amount you can transfer from Ireland to the UK?

While there are no foreign exchange restrictions between Ireland and the UK, most of the big banks impose daily limits on their customers.

For the Bank of Ireland, the daily limit is €20,000 for international transfers.

Allied Irish Bank has a €10,000 daily limit.

That’s going to be an inconvenience for someone that wants to transfer a larger amount.

Money transfer specialists tend not to have any daily limits. There is no maximum amount.

So if you are looking to transfer a large sum from Ireland to the UK, it may take several days longer if you use a bank.

In that situation, it is generally easier and more efficient to use a money transfer specialist.

How safe is a money transfer specialist?

Not all money transfer specialists have the same level of regulation or customer safeguards.

Some money transfer companies aren’t regulated at all.

The key thing to look out for is whether a company is Authorised and Regulated either in the UK by the Financial Conduct Authority (FCA) or in Ireland by the Central Bank of Ireland (CBOI).

The reason this matters is that Authorised companies are required to keep client funds in a safeguarded account – held separately from any company funds.

To find out if a money transfer company is Authorised, just enter the company’s name in the FCA register or the CBOI register.

Why you can’t trust the rates you see online

These days there are lots of websites that quote exchange rates.

To more popular sites are XE, DailyFX, FX Street, and Oanda – to name just a few.

But there is a problem…

A lot of people don’t realise that the rates you see online are not available to customers.

They are something called ‘interbank exchange rates.

Interbank exchange rates are used by banks to trade with each other.

The websites that publish interbank rates hide this important fact in disclaimers saying things like “these rates are not available to consumers” or are for “informational purposes only”.

A lot of the leading comparison sites have similar disclaimers about their rates too.

My point is that if you want to budget effectively and know what your Euros will be worth in Pounds, then I would suggest you request a genuine quote from a bank or money transfer specialist.

How to get the best Euro to Pound rate

Even small, fractional moves in the rate can have a big impact on the amount of Pounds you receive for your Euros.

A 1% improvement in the exchange rate on a €100,000 transfer is a difference of €1,000.

You see 1% moves all the time – sometimes within a day.

A money transfer specialist can help you time the point at which you exchange your money.

One of the advantages of using a money transfer specialist is you can have someone keep an eye on the rate for you.

I should point out that not all money transfer specialists offer a personalised service.

These days there are a lot of online-only operators, such as PayPal, TransferWise, and Revolut, which offer “do-it-yourself” platforms or apps.

You have to enter all the information, press all the buttons, and make all the decisions.

They tend to be popular for smaller amounts or online merchants making frequent payments.

For larger international money transfers, many customers want the peace of mind of having someone that can offer expertise and a helping hand.

If the EUR to GBP rate moves in your favour or begins to go the wrong way, a money transfer specialist can alert you to opportunities or risks as they arise.

Getting some guidance on exchange rates could help optimise the timing of your transfer and ultimately, reduce your costs.

If you are worried about exchange rates moving against you in the future, a money transfer specialist can even lock in an exchange rate for you up to 12 months in advance of your money transfer.

This is called a forward contract.

Forward contracts are a way of protecting yourself against adverse exchange rate movements.

You then have the option to draw on the funds at the time of your choosing.

A forward contract can be useful if the rate is at a good level and you don’t have your chance, or you may want to know the rate you’re getting so you can budget effectively in terms of how you will spend or invest the Pounds you will receive.

Quick Summary

- To send money to the UK from Ireland you can use your bank or a currency broker.

- It usually takes 1-3 working days for the money transfer from Ireland to arrive in the UK.

- There are no legal limits on the amount you can send. Banks may put their limits on it, however.

- Using an FCA-regulated money transfer service will ensure that your money is secure and safe.

- Currency brokers can help you find the best Euro to Pound rate for your money transfer to the UK.

Key Currency is a leading money transfer specialist.

We actively help customers get better exchange rates, minimise their risk and reduce costs.

As a company, we are open and transparent.

That’s why we show the names and faces of our people on our website.

We have a 5-star “Excellent” customer rating on the review website Trustpilot; which is the highest rating available.

Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

If you feel our service could be of use to you, simply request a free quote.