Last Updated on June 9th, 2024

As someone who works in the industry, I’ve found that most people just want to know:

- How do their rates compare?

- Are there any fees or other charges?

- Can the company be trusted?

Below I’ve put together information to help make it easier for you to get a better dollar exchange rate and avoid hidden fees.

Which one are you: travel money or money transfer?

The market is split between travel money (cash) and money transfers (bank-to-bank).

Each market has different providers.

Here’s a quick overview of my findings:

| TYPE | BEST | WORST |

| Travel Money | Debenhams, Asda, John Lewis | Airports |

| Money Transfers | Currency Brokers | High Street Banks |

Best dollar rates for travel money

You probably know to avoid buying travel money at airports.

Sure, airports are convenient – but normally have the worst rates.

Forget the flashing signs “pay no commission” or “0% commission”. They are a deceptive marketing ploy.

The real money is made from the exchange rate.

The exchange rate margin at airports can be as high as 15%-30%.

In money terms, that means if you exchange £500 into Dollars, you could be losing £75 to £150 just in exchange rate costs.

A much cheaper way is to order your Dollars before you get to the airport.

Our research found that Debenhams, Asda, and John Lewis consistently offer some of the best dollar exchange rates for travel money (cash).

Some smaller providers beat these big names – but only by fractional amounts.

On £500, I’ve found the difference between the top 5 providers is only about £5 in cost.

Best dollar exchange rate for money transfers

Money transfers are electronic payments made from one bank account to another.

As money transfers tend to be larger amounts, it’s even more important to find the best dollar rates.

The first thing to decide is whether to use your bank or a currency broker.

It won’t come as a complete surprise to hear that banks are generally not the cheapest way to exchange money.

There is a convenience and familiarity to using your bank – so it’s a case of weighing up your options.

In terms of cost, banks can charge up to 4%-5% on money transfers.

The true cost is a combination of the fees and the exchange rate.

Most people focus on the fees, but the bulk of the cost is embedded in the exchange rate.

You still have to keep an eye out for unexpected fees.

The banks are good at dreaming up reasons to charge you more. In terms of money transfers, some of the additional charges can be a receiving bank fee, a priority payment fee, and a tracing fee.

If you are thinking of using your bank, I would suggest getting a quote elsewhere and comparing the cost.

Make your decision once you have all the facts in front of you.

Currency brokers can be a lot cheaper and more efficient compared to the banks – otherwise, there’s no point in them being in business.

If you would like to compare our dollar rates, please request a quote below.

Why I don’t trust comparison sites

When you search for the ‘best dollar exchange rates’, I’ve noticed a lot of comparison sites pop up.

They dominate the search results on Google these days.

I guess they are the modern-day gatekeepers for the best of anything and everything – including dollar exchange rates.

But I think they are fundamentally flawed and should be regulated.

They claim to “compare the market”.

What they cleverly do is “create the market”.

The lists you see are constructed around commercial deals.

No one is sitting at the top of the page just by chance.

The bottom line is the comparison sites are selling what is best for them – not you.

In reality, comparison sites add another layer of cost.

The UK’s top three comparison sites made over half a billion pounds in revenue last year.

They run a canny model because the fee is paid by the supplier/provider, not the customer. However, the costs ultimately get passed on.

Sometimes the comparison sites can be good for doing some initial research but bear in mind there are plenty of companies not listed. You are looking at a closed shop.

I am also wary of the dollar exchange rates shown on comparison sites.

They look pre-set to me. I’ve noticed on weekends and public holidays they still show a rate when the market is shut.

As an alternative, you can always go directly to the companies – whether that be us, another provider, or a bank – and get a live dollar rate.

At least that way you are cutting out the middleman.

Beware of ‘fake’ dollar rates

A lot of people get their dollar exchange rates from the internet.

Some of the more popular exchange rate websites are XE, Oanda, and DailyFX.

Even Google shows you a rate now.

So why even bother getting a rate elsewhere? It’s because the rates you are seeing are not customer rates.

They are something called “interbank exchange rates”.

Interbank rates are used by the banks to trade with each other.

The banks balance their books using interbank rates because there is no central exchange to trade within currency markets.

Google, for example, gets its rates from Morningstar – a US financial data company.

The leading FX websites don’t say where they get their rates from. It’s a mystery.

However, they do normally have a disclaimer (in the small print of course) disclosing that their rates are “not available to consumers” or “for informational purposes only.”

I’d imagine I’m not alone in thinking that should be made a bit clearer.

Customers are then making assumptions about what their Pounds or Dollars are worth using this misleading data.

If you intend to make a large international transfer, using a false rate could mess up your budget or the plans you have for your money.

The easy solution is to request a genuine dollar rate from a bank or currency broker, enabling you to make plans with confidence.

How safe is a money transfer?

Before working in the industry, I was on the other side of the fence – as a customer.

I had used my bank (Lloyds) for smaller international transfers but got fed up with the charges.

So I looked into using one of the money transfer companies or currency brokers (they’re the same thing).

As I was sending a decent chunk of money, getting the best rate was only part of it.

I wanted some reassurance that the process was safe and secure.

A good thing to know is that any company Authorised by the FCA (Financial Conduct Authority) must adhere to strict rules and procedures.

The most important of these rules is to do with the segregation of client money.

An FCA Authorised currency broker is required to keep all customer’s funds in a separate, safeguarded client account.

A safeguarded client account is not a regular bank account. The bank must be notified of its status and any money held in it is ringfenced from company-related activity.

It means when you carry out a money transfer with an Authorised Firm, your pounds or dollars will pass through a bank account used solely to carry out customer money transfers.

You can check if a company is Authorised by typing its name into the Financial Services Register.

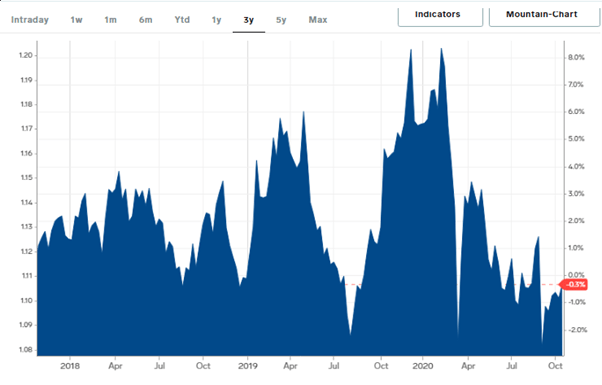

How timing can help you achieve the best dollar rate

Exchange rates are constantly on the move.

They change every 2-3 seconds.

I’ve found a lot of customers follow the rate closely but struggle with timing.

You can easily put all your energy into choosing who to send your money through, but not when.

Getting the best dollar exchange rate is partly down to timing.

For large money transfers, even tiny moves in the dollar rate can have a big impact on the money you receive.

If for example, you were moving $75,000 back to the UK, a move of just 0.5% up or down in the dollar-to-pound exchange rate works out at a $375 difference.

I see moves of that size almost every day.

Over several weeks, the dollar rate can move to 3%, 4%, or even 5%.

A 5% move on a $75,000 transfer would make a $3,750 difference.

You can see how timing matters. Our GBP to USD forecast guidance can help provide further information on its movements.

For more consistent, live updates, our Pound to US Dollar converter, will provide just that.

I’m not saying anyone has a crystal ball, but getting some guidance on rates from a currency broker could help you achieve a better dollar exchange rate.

Part of a currency broker’s job is to monitor rates.

If you speak to a currency broker and let them know your situation, they can give you a call if there is a favourable trend or a big swing in the dollar rate.

Because most customers have neither the time nor the inclination to watch exchange rates all day, they can easily miss opportunities that come up.

I should point out that banks and most currency brokers won’t offer assistance or guidance on rates.

They will offer you their prevailing rate and leave you to it.

Some currency brokers, such as ourselves, will take a more proactive and personalised approach.

Quick Summary

Getting the best dollar exchange rate comes down to three things:

- Choosing a trustworthy provider

- Finding a competitive dollar rate

- Avoiding any hidden fees

If you are an online merchant or someone sending a modest amount to a relative, a reputable online platform might be preferable. Online platforms are good for small, regular amounts.

If you are sending a larger amount, an FCA Authorised currency broker could be your best option as costs and timing are more important.

Who are we?

Key Currency is a leading UK currency broker.

We help our customers achieve better exchange rates on their money transfers.

As an independent currency broker, we have far lower overheads than the banks and London-based brokers.

This enables us to pass on genuine savings to our customers.

The cost of our service is included in the exchange rate we quote. There are no additional fees or charges.

As part of our service, you will also benefit from having a real person to assist you with your transfer.

These days a lot of money transfer specialists are just online platforms or fancy apps. In reality, you have to do most of the work yourself.

That’s not how we operate.

At Key Currency, we discuss and agree with you on the best time to exchange your money.

We will also assist you with the payment details of your transfer (to avoid any mistakes) and keep you informed from start to finish.

As a company, we are open and transparent.

The names and faces of our people are shown on our website. We don’t hide behind a logo or app.

We have attained a 5-Star “excellent” rating on the customer review website Trustpilot, the highest rating available.

Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

To find out our best dollar exchange rates, simply request a quote below.

Author,

Author,