Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 25th, 2024

It’s quite simple to transfer money from the Netherlands to the UK.

I’ll explain how it works, the best ways available, and how you can avoid paying high charges.

Are you looking to send money to the Netherlands from the UK? Click through for all the information you’ll need for that transfer!

Transferring money from the Netherlands to the UK (in 4 simple steps)

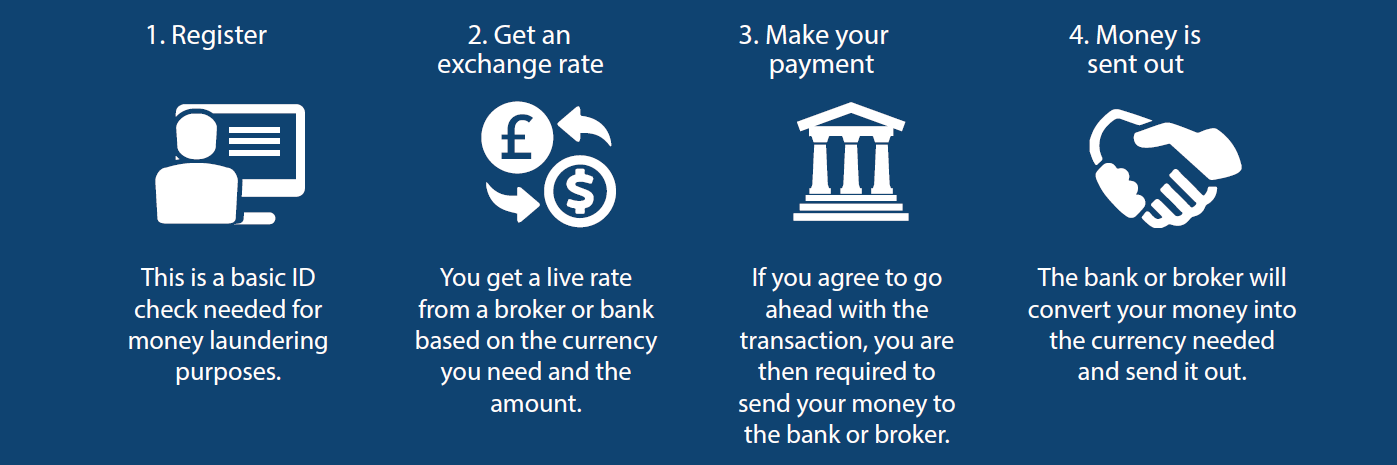

If you need to transfer money to a UK bank account, there are only four steps.

None are difficult.

Whether you use a bank or money transfer specialist, the steps are the same.

Step 1 – Identity check

Before you can send money from the Netherlands to a UK bank account, you will need an ID check.

It’s required by law due to anti-money laundering regulations.

Most people can be verified quickly and easily – sometimes just using basic details like your passport number and address.

Step 2 – Secure an exchange rate

Once registered, you are in a position to secure an exchange rate.

To send money to the UK, the Euro (EUR) to Pound (GBP) rate is what matters.

Note the exchange rate changes every few seconds throughout the day.

Whenever you’re ready, a bank or money transfer specialist will quote you their latest EUR/GBP rate.

No transaction will occur without your permission.

If you are happy to go ahead, the exchange rate is locked in, and you will be emailed a confirmation with all the details of your transaction.

Step 3 – Send in your Euros

Next, you need to pay for your money transfer by sending in your Euros.

All the details will be on the confirmation you received.

A bank will require your Euros upfront, whereas a money transfer company can secure a rate before you send your funds in.

Step 4 – Your Euros are converted and sent to the UK

Once your bank or money transfer company has received your Euros, they will be converted into Pounds Sterling at the exchange rate agreed upon.

Your Pounds will then be sent to the UK bank account you request.

How long does it take?

To send money from the Netherlands to the UK usually takes 1-3 working days.

Your money can be converted and sent out the same day. Most of the time taken is for your funds to clear into your UK bank account.

That can vary depending on your bank.

I note that ABN Amro says to allow 3-5 working days and Rabobank up to 5 working days.

That sounds slower than what I’ve seen in practice.

The best way to transfer money from the Netherlands to the UK

To transfer money to the UK, you have two options:

- Use with a bank; or

- Use a money transfer specialist.

The best way will depend on the size and frequency of your payments.

For a small, one-off payment, it may be more convenient to use the Dutch bank holding your money.

While banks tend to charge additional fees, they offer a familiar and safe way to send money to the UK.

If you are looking to transfer a large amount or need to make regular international payments, it makes financial sense to consider the alternatives to a bank.

From my own experience, I have found banks are a more costly option, and they can be difficult to deal with.

Banks offer all sorts of products, whereas money transfer companies only carry out international transfers.

| Pros | Cons | Best for | |

| Bank | Can use your existing account | High charges, minimal service | Small payments, convenience |

| Money transfer specialist | Lower cost, more efficient | Need to register | Large or regular amounts |

The charges explained (including the hidden ones)

Whenever you transfer money from the Netherlands to the UK, there are two types of charges to look out for:

- Fees

- Exchange rate

1. Fees

Most people focus on the fees because they are more visible charges (but not necessarily the largest).

The most common type of fee is a transfer fee.

A transfer fee is a flat amount charged for every international transfer you make.

It varies depending on whether you who you use.

Here are the transfer fees charged by the three largest Dutch banks:

- ING Bank charge €12 (standard) or €50 (urgent).

- Rabobank charge 0.1% with a minimum of €10 and a maximum of €50.

- ABN Amro charge €9 (online), €18 (urgent) and €25 (branch).

You will also find there are various fees for things like cancellations, incomplete or incorrect transfers, and even one if you make a complaint!

Some money transfer companies also charge transfer fees (we don’t by the way).

While the various fees are annoying, they often act as a distraction because the bulk of the cost is usually incurred in the exchange rate you get charged.

2. Exchange Rates

A lot of the big banks provide online Currency Converters or Rates Tables showing you their current exchange rates.

But if you look closely, they say that the rates shown are “indicative” or for “information purposes only”.

It means they are not real customer rates.

When you go to make an international transfer, you find out you are getting charged a different rate altogether.

While this is deceptive, it continues to be common practice.

The big Dutch banks are pretty guarded about the exchange rates they charge. They make it difficult to see their rates without tinkering with their payment system.

Most of the banks use a tiered system: The larger the transfer, the better the rate.

Our research found that the exchange rate margin varied between 2% and 5%.

You generally need to transfer around €50,000 or more to qualify for the best rates.

I have no gripe with any of the banks.

But my experience is you can do better elsewhere.

The reason you’re likely to get a better exchange rate from a money transfer specialist is that they have far lower overheads than a bank.

The running costs of a bank are in the billions. Ultimately, the customers have got to pay for that.

Before you send your money, always do a quick cost comparison against your bank.

Is there a maximum amount you can transfer?

The UK has no foreign exchange restrictions with the Netherlands, so there are no legal limits on money transfers between the Netherlands and the UK.

Although there are no legal restrictions, the big banks often impose their daily limits.

You may have to enquire first as they appear to set their daily limit based on your account information.

It is worth noting that money transfer specialists don’t tend to have any maximum amounts for international transfers.

For large amounts, it is generally more cost-effective and efficient to use a money transfer specialist.

How safe is a money transfer company?

I can’t make a sweeping remark about the safety and security of all money transfer companies.

However, I would always check you are dealing with a regulated company.

Why does it matter?

Using a regulated company is critical because your money will be held in a segregated client bank account.

That means your money can’t be mixed with company money.

It’s an important safeguard for customers.

The big British banks and many money transfer companies are regulated by the UK’s Financial Conduct Authority.

If you use a Dutch bank, it may be regulated by the De Nederlandsche Bank (DNB) or the Authority for Financial Markets (AFM).

You should be able to spot a company’s regulation number on its website.

Or you can look them up on either the UK’s FCA register or the Netherlands’ DNB register.

Key Currency can be found on both.

How to get a better exchange rate

You have probably seen that the Euro to Pound exchange rate moves every few seconds.

Over weeks, the moves can be substantial.

Even small swings in the rate can have a big financial impact.

As an example; say you were looking to transfer €75,000 to the UK.

If there was some big political or economic news, the rate could suddenly move by 4-5%, causing a difference of over €3,000.

Unless you are familiar with foreign exchange, you often don’t know the factors driving the rate or the underlying trends in the market.

It could lead to a costly mistake.

A money transfer specialist can discuss your requirements and work with you to achieve a more favourable rate.

That sets us apart from a lot of the other money transfer providers.

You may have heard of some of the bigger online-only operators, such as PayPal, TransferWise, and Revolut.

They essentially offer a “do-it-yourself” platform or app.

You enter all the information and press all the buttons yourself.

Using a system or app will suit some people, such as online merchants who need to make frequent payments or people sending money every month to families living overseas.

However, for larger transfers, many customers want the peace of mind of having someone they can speak to and get some guidance from.

It comes down to what you’re looking to do.

The larger your transfer, the more the costs and timing will make a difference to you.

Quick Summary

- To transfer money from the Netherlands to the UK, you can use either a bank or a money transfer company.

- It should take 1-3 working days.

- The cost is a combination of fees and exchange rates.

- It can be a lot cheaper to use a money transfer company.

- Make sure you only deal with regulated companies.

Who are we?

Key Currency is a leading money transfer specialist.

We help you achieve a better exchange rate and charge you no fees or commissions.

Unlike banks and online-only systems, we don’t make you do everything yourself.

All our customers are assigned an account manager who will talk you through the entire process, making sure everything goes smoothly from start to finish.

Our account managers can discuss rates with you to help optimise the timing of your transfer, thereby reducing your costs.

It’s one of the unique features of our service.

The cost of our service is included in the rate we quote. There are no additional or hidden fees to worry about.

As a company, we are open and transparent.

That’s why we are happy to show the names and faces of our people on our website.

We have a 5-star “Excellent” customer rating on the review website Trustpilot; which is the highest rating available.

We’re committed to providing a service of the highest integrity and safety.

Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

To make a no-obligation enquiry, please request a quote below.