Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 21st, 2024

Everything you need to know about how to transfer money to New Zealand. How long it takes, the information you need, and how to reduce your costs.

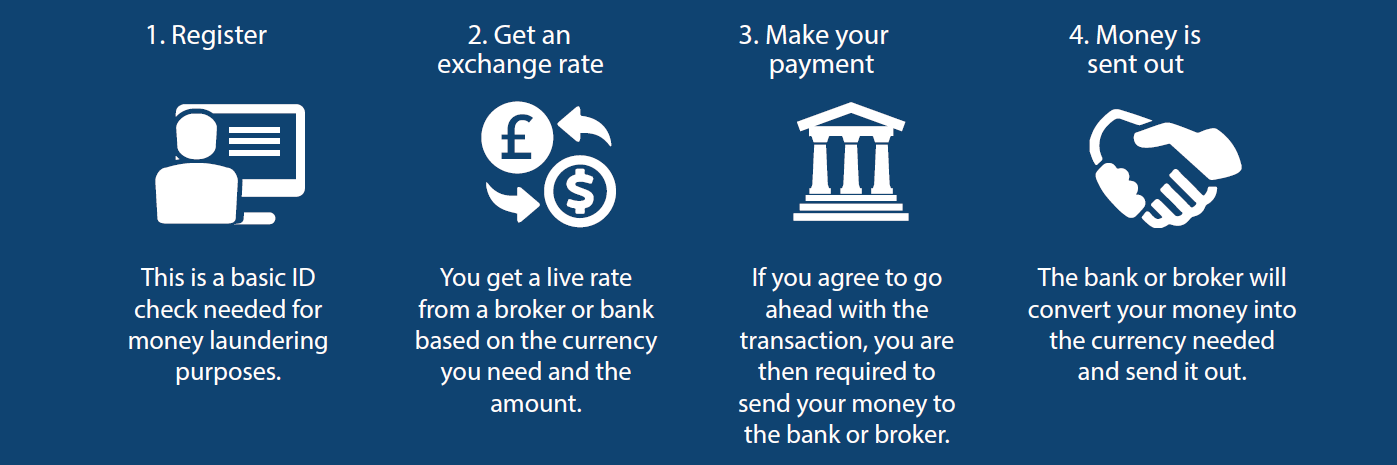

How to transfer money to New Zealand (in 4 simple steps)

Step 1: Register

Any new customer needs to register, which normally only takes a few minutes.

It is an ID check.

Registration is necessary to comply with Anti-Money Laundering regulations.

Step 2: Lock in an exchange rate

A currency broker or bank will quote you a live GBP/NZD exchange rate based on the amount you need to send.

No transaction will occur without your permission.

If you agree to go ahead, your rate will be locked-in, and you will be emailed a confirmation with all the details of your transaction.

Step 3: Send in your Pounds

Before any money is exchanged, you need to pay for your money transfer to New Zealand.

Your Pounds will need to be sent to the client account of your currency broker or bank.

The bank details of where to send your money will be in your confirmation email.

Step 4: Your Pounds are converted to New Zealand Dollars

Your currency broker or bank will exchange your Pounds for New Zealand Dollars at the rate agreed, and your payment is made to the bank account in New Zealand you’ve requested.

How long does it take to transfer money to New Zealand?

Transferring money to New Zealand from the UK typically takes 2-4 working days.

The time taken varies because the receiving bank in New Zealand will do its checks before accepting any inbound funds from abroad.

You also need to be aware that if your Pounds are sent to your bank or broker in the afternoon rather than the morning, it could count as the next working day.

The cut-off time is normally 2pm UK time.

If you are in a hurry, for example, to complete a property purchase in New Zealand, then you are best to send in your Pounds in advance of the date you exchange your money. It will speed up the end-to-end process.

What bank details do I need to transfer money to New Zealand?

To send money to a New Zealand bank account, you will need to have the following recipient bank details:

- Account name

- Bank name

- Bank Swift/BIC code

- Bank account number

The account could be in your name or someone else’s.

In New Zealand, they use a SWIFT/BIC code to identify the bank, rather than a sort code.

You can get all this information just by looking at a bank statement or logging into your account online.

A currency broker can assist you and help double-check the details.

Costs & daily limits when transferring money to New Zealand (how to avoid!)

If you use a bank to transfer money to New Zealand, there is normally a fee charged in addition to the money the banks make from the exchange rate.

Here are the fees charged by some of the big UK banks:

- Barclays: £25 fee per payment for branch or telephone banking, no transfer fee online.

- Lloyds: £9.50 but also add a £20 fee for the receiving bank in New Zealand (they both take a cut).

- Santander: a £25 fee, whether online or in a branch.

Bank fees can accumulate quickly if you make regular payments or are planning to send a larger money transfer in several installments.

If you want to avoid bank transfer fees altogether, then some currency brokers don’t charge transfer fees at all.

In terms of the total cost, a currency broker is normally the best way to transfer money to New Zealand.

Another consideration is that the big UK banks tend to have limits on how much money you can transfer to New Zealand per day.

The daily limit for UK banks tends to be in the region of £50,000-£100,000.

If you are planning to do a larger transfer, you may have to visit a branch.

Alternatively, a currency broker doesn’t tend to have any limit on the size of money transfers to New Zealand.

Your Best options for sending money to New Zealand

An international bank transfer is one of the best ways to send money to New Zealand. This method is secure and offers the best value for your money. Your bank, currency broker, or an online money transfer service can provide this money transfer method.

Other alternative transfer methods include debit or credit card payments, Google Pay, Apple Pay, or cash pick-up. These can be quicker than an international bank transfer but are usually more expensive.

Comparing Banks and Currency Brokers

| Pros | Cons | Best for | |

| Banks | Familiar | Can be a high-cost option | Small payments, convenience |

| Currency brokers | Low overheads, competitive rates | Need to register first | Larger amounts (over £5,000) |

A lot of people may automatically think of using their bank because it is more familiar.

However, the main drawback of using your bank is the cost.

Both the UK and New Zealand banks are known for their uncompetitive exchange rates and high fees on international money transfers.

It doesn’t matter whether you are a long-time customer or not.

Our research found that the exchange rates offered by the major banks can be up to 3%- 5% worse than the exchange rates offered by currency brokers.

It does depend on the bank you use and how much you’re looking to send.

For smaller money transfers to NZ, an extra 3%-5% cost may not bother you.

But for larger transfers, it is normally worth shopping around.

As an example, if you were looking to transfer £80,000, you could be up to £4,000 worse off using your bank.

That’s a lot of money. Why give it away to a bank?

As currency brokers have lower overheads than big banks, they can pass on the savings to their customers.

The exchange rates vary between currency brokers and the larger your transfer, the better the rate.

Most (but not all) currency brokers will also waive any transfer fees.

How safe is it to use a currency broker for transferring money to New Zealand?

There is one check to do before you use a currency broker to transfer money to New Zealand.

Make sure the company you choose is Authorised and Regulated by the Financial Conduct Authority (FCA) in the UK.

The reason this matters is that an Authorised firm must segregate client money from their own.

In plain English, it means your money will be transferred through a safeguarded client account, which is separate from any company bank accounts the broker may have.

To check whether a currency broker is Authorised by the FCA, enter the company name on the FCA’s register and click the button on the right that says Search the Register.

Are there differences between currency brokers?

I appreciate your dilemma.

There are quite a few companies to choose from, so it can be difficult to decide who to choose and why.

The main difference to look out for is whether the company is a broker or just an online platform.

These days there are a growing number of online-only operators.

Some of the biggest names in the online-only world are PayPal, Wise, Revolut, and CurrencyFair.

They are effectively ‘do-it-yourself’ platforms or apps.

You need to register yourself, upload your ID, enter all the payment information, and select the currencies and times you want to exchange your money.

They suit some people, but not others.

I know from my own experience when I was transferring money overseas, I didn’t want to do everything myself.

It’s not that I’m scared of technology (maybe wary is a better word).

But I would rather have someone check things over and perhaps give me a little steer on what’s happening with exchange rates.

The other thing I appreciated was being told when my money had arrived and when it was sent out.

Having someone you can speak to can take away any stress or worry.

How to get the best NZD exchange rate

The Pound to NZ Dollar exchange rate is on the move all the time.

Naturally, you want to achieve the best rate possible.

Even small moves in the exchange rate can make a big financial difference to the amount of New Zealand Dollars you receive.

Most people have a timeframe in which they can exchange their money.

It could be a few days, weeks, or even months.

During that window, the GBP/NZD exchange rate will fluctuate daily.

That will lead to opportunities and risks.

Rather than hope for the best, a currency broker can work to get you the best rates, avoid losses and reduce your overall cost.

By speaking to a currency broker and explaining your situation, they can then monitor the markets for you and alert you to opportunities or risks as they arise.

Even a 0.5% dip in the exchange rate on a £100,000 transfer could cost you an extra £500.

Moves of that size happen almost daily.

Getting some guidance on rates could help achieve a better outcome for you and your New Zealand money transfer.

With a currency broker, you could target a certain level or look to capitalise on a spike in the rate.

For larger amounts, many customers also want the peace of mind of having someone that can offer them assistance and market guidance.

How to spot ‘fake’ exchange rates for a money transfer to New Zealand

If you are sending money from the UK to New Zealand, then the GBP/NZD exchange rate is what matters.

An actively traded exchange rate, such as GBP/NZD, changes every 2-3 seconds throughout the day.

These days you can easily find live exchange rates online.

Some of the more popular sites are XE, DailyFX, and Oanda.

But there’s something most customers don’t know.

The exchange rates you see online are known as ‘interbank exchange rates’. They are not available to customers.

Interbank exchange rates are the rates that major banks use to balance their books with each other.

Not even major corporations or currency brokers buy and sell currency at interbank rates.

The point is the exchange rates you see online are not commercially available.

If you want a real exchange rate, so you can budget your money effectively, it’s best to receive a quote from an actual provider.

Quick Summary:

- To transfer money from the UK to New Zealand, you can use a bank or currency broker.

- Banks and currency brokers use the same SWIFT payment system.

- It usually takes 2-4 working days for your money to arrive in New Zealand.

- Choose a currency broker that is Authorised by the FCA.

- Some currency brokers can also offer guidance on exchange rates.

Key Currency is a leading currency specialist.

Whether you are based in the UK or New Zealand, we can help make the process of moving your money hassle-free and cost-effective.

We offer great exchange rates, charge no fees, and provide you with personal guidance on rates and start-to-finish support.

As a company, we are open and transparent.

The names, faces, and backgrounds of all our people are shown on our About Us page.

We have a 5-star “excellent” customer rating based on over 2,500 customer reviews.

Key Currency is Authorised by the FCA (No. 753989) and Registered with HMRC (No. 12888761). We conduct our business with the highest level of integrity, and all transfers are conducted through client-safeguarded accounts.

If you feel our service could be of use to you and your money transfer to New Zealand, please request a free quote below.

Want to See the Live Rate?

Want to Read More?