Author, Mike Smith

Author, Mike Smith

Last Updated on August 27th, 2024

Are you looking to transfer money to South Africa?

Whether you’re sending money to a loved one, your own South African account, or transferring money for business, our guide below has everything you need to know!

Once you have the information, a money transfer to South Africa is super simple!

How to Transfer Money to South Africa

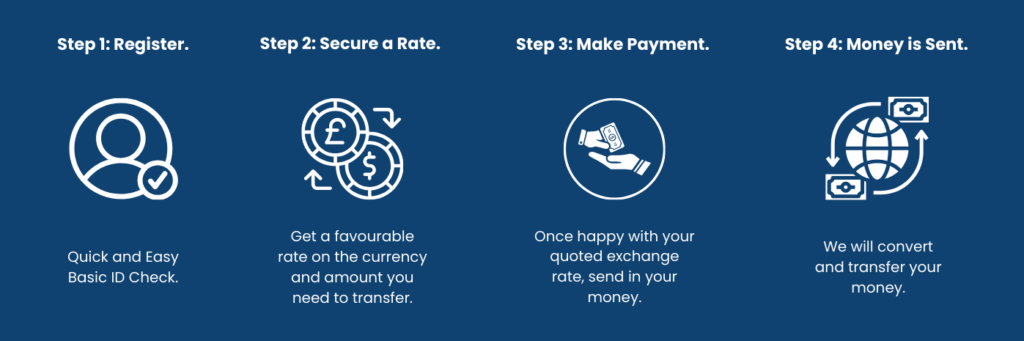

If you decide to use a currency broker, the process is easy and can be done in 4 simple steps.

1) Register as a client

New clients will need to register before sending money to South Africa.

Once you have registered, you won’t have to do so again.

To register with a currency broker, you will need to provide standard information for an identification check which includes:

- Name

- Address

- Passport Number

2) Secure a Pound to South African Rand exchange rate

When you transfer money to South Africa from the UK, the relevant exchange rate is Pound to South African Rand or GBP to ZAR.

You will be provided with a quote for their latest rate.

To commit to a money transfer to South Africa you must confirm the exchange rate beforehand.

Once you agree on the rate, it is then locked in and will not change.

3) Send in your Pounds

Send your Pounds to the currency broker of your choice.

This can be done using a normal domestic bank transfer.

You will have received a confirmation email in step 2 with their details.

4) Your Pounds are converted to ZAR and transferred

Once your Pounds have been received, they will be converted into South African Rand at the rate already agreed upon in step 2.

Now converted, the ZAR will be sent directly to the South African bank account of your choice.

This can be your account or someone else’s.

What is the best way to transfer money to South Africa?

One of the best ways to transfer money to South Africa is to use an international bank transfer. This is due to it being secure, fast, and usually cheaper than alternative methods.

To make an international bank transfer to South Africa you can use:

Your Bank

This is a familiar and convenient option for customers who are looking to make a one-off international money transfer abroad.

However, using your bank for a money transfer to South Africa will incur higher charges than the options below.

Cost comparisons can be found further down in our guide!

A Currency Broker (money transfer specialist)

If you’re looking to make a large money transfer to South Africa of around £2,000 or more, currency brokers may be your most suitable option.

As money transfer specialists, currency brokers typically charge much less in fees compared to online apps and high street banks.

Some do not charge a fee, like us at Key Currency.

Currency brokers are experts in international money transfers.

The service provided to customers is much more supportive with consistent personal contact and guidance.

Online Transfer Apps

For those looking to do a small transfer of money to South Africa, the various online transfer apps available are worth considering.

The impact of the GBP to ZAR exchange rate charges on your transfer is much less when sending small amounts.

Each online app will add its transfer fee for an international bank transfer to South Africa, but these usually are cheaper than banks.

How much will it cost to transfer money to South Africa?

The cost of transferring money to South Africa is a combination of transfer fees and exchange rates.

Transfer fees are what people focus on the most as they’re more visible when researching transferring money internationally.

However, for sending large amounts to South Africa, the exchange rate will be the higher charge of the two it is constantly moving.

Let’s look at the different services and what they charge in terms of Transfer Fees.

The UK’s high street banks will charge a transfer fee in the region of £5-£25 for transferring money to South Africa.

Some banks will also charge a recipient (receiving) fee too.

When this happens, customers who transfer between two personal accounts are charged twice for the same transfer.

Bank Transfer Fees (destinations outside EU)

| Bank | Transfer Fee (if using online methods, manual fees are higher) |

| Lloyds | £20 |

| RBS | £15 |

| NatWest | £10 |

| HSBC | £5-£17 |

| Barclays | £11 |

| Santander | £25 |

Currency broker & Online app Fees

For online transfer apps, some will have no fees for sending money to South Africa while others are currently charging in a range of £3-£6.

Similarly, Currency brokers will apply transfer fees in a similar range to the apps but only if a money transfer is under a certain limit, between £3,000-£5,000 usually.

Exchange Rates

With exchange rates constantly changing, there is no ‘fixed rate’ like there is with the transfer fees set above.

The exchange rate charge is usually a percentage of the amount you send.

Banks are known to have much higher percentages than other money transfer services available. The exchange rate charges are around 2-5% more if you use a bank for sending money to South Africa.

It is important to remember that the rates you see online are not customer rates. These are called interbank rates.

The way to compare and get the best GBP to ZAR rate is to have genuine quotes sent to you by each provider.

How long does a money transfer to South Africa take?

An international bank transfer to South Africa from the UK will usually take between 3-5 business days.

The time it takes for your money transfer to arrive in South Africa depends on the method that you use.

If you choose to pay for a transfer via an online app with a credit or debit card, this transfer can happen on the same day.

However, you are often subject to higher fees and worse rates, and it isn’t as secure as an IBAN, especially with a larger currency transfer.

How much money can I send to South Africa?

With various limits on money being sent out of South Africa, fortunately, there are no limits to the amount of money you can transfer into South Africa.

Some banks and money transfer services may set their daily limits.

This is usually around £50,000-£100,000 but will depend on the transfer service you choose.

What details are needed to send money to South Africa?

South African banks do not use the IBAN system, this is predominantly for EU and bordering countries.

For a money transfer to South Africa from the UK you will need:

- Your details

- Reason for the transfer

- Recipient name (South African account)

- Recipient account number

- SWIFT Code or Routing Number

Our guide on everything you need to know about the SWIFT payment system will show you how to find the code and how it all works.

Quick Summary

- You can use either your bank, currency broker, or an online money transfer app.

- An international bank transfer is the best way to transfer money to South Africa.

- It will take usually 3-5 business days.

- There are no limits on the amount you can transfer into South Africa.

Let us help you with your money transfers

Our service is much more personal compared to banks and online apps.

We provide you with consistent updates on exchange rates to find you the best rate possible.

Trust is important to us, all of our employees can be found on our website, so you know who you’re dealing with.

And that’s not all…

As an FCA-regulated Authorised Payment Institution, when you transfer money to South Africa with us, the transaction will be conducted through safeguarded accounts, ensuring security.

With a 5-star rating on Trustpilot from over 2,500 customer reviews; don’t just take our word for it!

If you’re looking to transfer money from the UK to South Africa, get a completely free quote with us today.

Further Guidance & Tools