Author, Andrew Gibson

Author, Andrew Gibson

Last Updated on August 9th, 2024

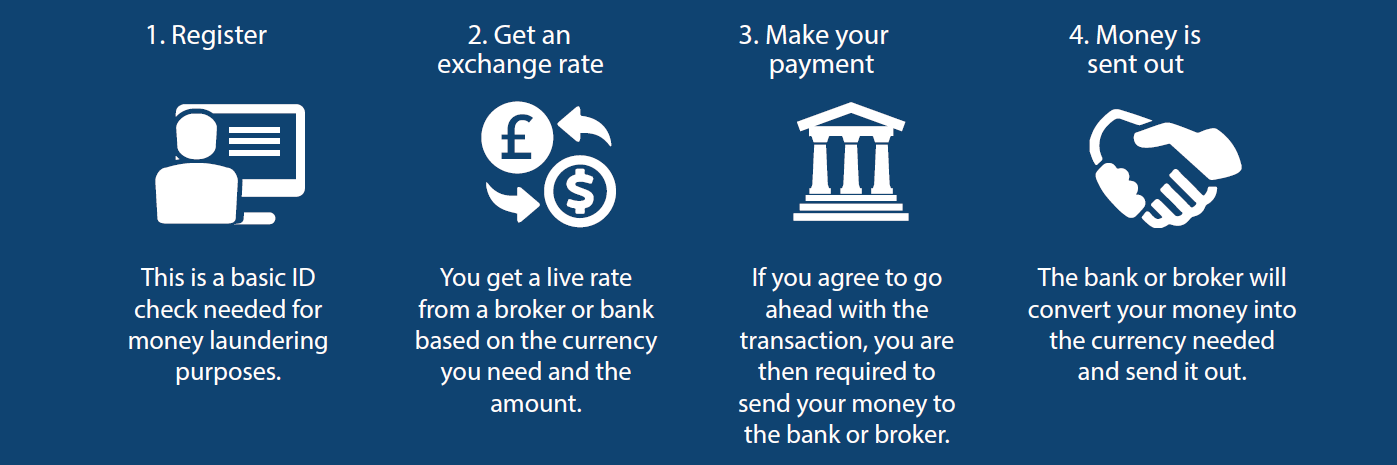

You can transfer Pounds to Dollars in 4 simple steps. I’ll show you how it works, how long it takes, the options you have, and the best ways to lower your costs.

If you’re looking to send money to the UK from the US, click through to our guidance on this transfer!

Transferring Pounds to Dollars (in 4 simple steps)

Transferring pounds to dollars and sending them to a US bank account can be explained in four steps.

Step 1: ID Check

A basic ID check is required for all new customers due to anti-money laundering regulations.

It’s generally a quick and easy process.

Step 2: Secure an exchange rate

To transfer Pounds to Dollars, you will be quoted a live GBP to USD rate.

The rate will change throughout the day.

Once you receive a quote, you can decide whether to go ahead or not.

Nothing will happen without your permission.

If you are happy to go ahead, the exchange rate is secured.

Shortly after, you will be emailed a transaction confirmation which will show the amount of Pounds exchanged into US Dollars.

Step 3: Pay for your money transfer

Before any money is exchanged, you need to send in your Pounds to pay for your money transfer.

The transaction confirmation will have the bank account details of where to you send your money. This is done via a normal bank transfer.

Step 4: Your Pounds are converted to Dollars and sent out

Once your pounds are received, they will be converted into dollars at the exchange rate agreed and sent to the US bank account you request. That’s it.

How long does it take to transfer pounds to dollars?

It typically takes 2-3 working days to transfer pounds into dollars and send them to a US bank account.

The time can vary because some US banks are slower than others at clearing funds that have come in from abroad.

Money transfers to the USA also have daily cut-off times.

If you send your Pounds into your bank or money transfer specialist late in the afternoon, it could count as the next working day.

If you are worried about a tight deadline, the best thing to do is send your Pounds in early as it will speed up the end-to-end process.

What information do you need?

You will need to provide the US bank details of where you want your dollars to be sent.

It doesn’t have to be an account in your name.

Here’s the information you need:

- Name of recipient

- Account name

- Routing number

- Bank account number

For those unfamiliar, routing numbers are used in the US to identify the bank and location where your account was opened.

A routing number is 9-digits long.

They are also sometimes called ABAs or RTNs (banks love a bit of jargon).

You can find your routing number when you log in to your account or by looking at a monthly statement.

A money transfer specialist can assist you should you wish.

Bank or money transfer specialist – is there a difference?

The banks used to have the foreign exchange market to themselves.

Fortunately, that is no longer the case.

These days, money transfer specialists offer a cost-effective and efficient alternative to using a bank.

As a general rule, banks can charge up to 4%-5% to transfer Pounds to Dollars.

Of course, the exact cost depends on the bank and the size of your money transfer.

There are two main reasons people use a money transfer specialist – the cost and the service.

The cost of transferring Pounds to Dollars

When you transfer money internationally, the overall cost is a combination of the exchange rate and international transfer fees.

1. International transfer fees

International transfer fees are the more visible cost.

The transfer fees charged by the big UK banks to transfer pounds to dollars vary.

Here is a summary:

- Santander: £25

- Lloyds: £9.50 plus £12 for the receiving bank

- Barclays: £0 (online-only) or £25 in branch

- HSBC: £4

- Natwest: £15 – £40 online or £23 – £40 in branch

The transfer fee is only part of the cost.

It’s almost like an ‘admin fee’.

For smaller transfers, they tend to be more of a factor in the overall cost.

If you are sending money to the USA on a regular basis or plan to send your money in several tranches, they can add up.

You need to be careful that the banks that charge the lowest transfer fees don’t then make up for it by charging you a bad exchange rate.

It’s the total cost that matters – so you are best to focus on the US dollars you will receive net of all fees.

By comparison, some money transfer companies charge similar amounts to the banks, while others charge no transfer fees at all.

At Key Currency, we don’t charge any transfer fees at all.

2. Exchange rates

There is no such thing as standard exchange rates.

Each bank or money transfer company will offer you a different exchange rate.

It is hard to compare exchange rates as they change minute-by-minute and are dependent on the size of your money transfer.

Generally speaking, the more money you transfer, the better the rate you will receive.

When you get an exchange rate quote from a money transfer company or bank, it will include a mark-up (or ‘spread’) on top of the wholesale rate.

In broad terms, we have found the rates offered by the big UK banks have a 4%-5% margin – depending on the size of your transfer.

A money transfer company has far lower overheads than a bank and can pass those savings onto customers.

It’s well worth your time comparing rates.

The cheapest way to transfer pounds to dollars will depend on your amount and the provider you choose.

Please be aware; the GBP/USD exchange rate is actively traded. It changes every 2-3 seconds. Our Pound to Dollar forecast guidance can provide more information.

If you request a quote from one provider and then a day or two later, request another quote from somewhere else, you may not be comparing apples with apples.

Our historical analysis on the GBP to USD rate can showcase just how volatile it can be!

5 reasons you shouldn’t use your bank

- It’s not their area of expertise

- Their exchange rates are uncompetitive

- Banks charge you fees

- They won’t help you with the timing of your transfer

- You are not their priority

Why you should be wary of exchange rates online

You have probably seen websites that show exchange rates online.

Some of the more popular sites are XE, DailyFX, FXStreet and Oanda.

But there’s a catch.

A lot of people don’t know that the exchange rates you see online are not actually available to the public.

They are what’s called ‘interbank exchange rates’.

Interbank rates are used by banks and major financial institutions to exchange currencies between themselves.

Even large corporations and money transfer specialists cannot buy or sell currencies at interbank rates.

I appreciate that it is not made very clear – it’s usually tucked away somewhere in a disclaimer.

You will see something like “consumers cannot access these rates” or the old classic “for informational purposes only”.

If you want to get a real Pound to Dollar exchange rate that you can use to budget with; I would suggest you request a quote from an actual provider.

Is it safe to transfer Pounds to Dollars?

Banks and money transfer specialists that are Authorised and Regulated by the Financial Conduct Authority (FCA) must adhere to the same rules regarding ‘segregation of client funds’.

What it means in plain English is that Authorised firms must hold your client money in a safeguarded bank account.

The reason that matters is it keeps client money completely separate from company money.

To find out if a company is Authorised and Regulated by the FCA, enter the company’s name on the FCA Services Register and click Search the Register.

How a money transfer service can help you save money

There’s a lot more to a money transfer service that just being polite and professional.

For a start, a good service can lower your costs.

And if there is no service at all, it can cause customers a lot of stress and worry.

I’ve found in practice that the service side is often the most important factor for customers once they have actually been through the process of sending money abroad.

As you know, the exchange rate is probably going to be the essential ingredient in your cost.

But exchange rates are always on the move.

This can make it difficult for a customer to know the best time to exchange their pounds into dollars.

Even small, daily fluctuations in the currency markets could make a huge difference to the money you receive.

If for example, you were looking to transfer £90,000, only a 2 cent move against you in the US dollar exchange rate could cost you over £1,000.

If the Pound’s been having a bad run, or the Dollar has important news coming up, I would want to know.

I appreciate this isn’t most people’s field of expertise.

In fact, most customers have neither the time nor inclination to sit and watch exchange rates all day long.

But a money transfer specialist, such as ourselves, have dealers watching the moves in rates throughout the day, as well as keeping an eye on key technical levels, and live news feeds.

They can alert you to opportunities and risks, and even let you know when the rate moves in your favour.

Receiving guidance on exchange rates could help you achieve a better rate and reduce your costs.

It’s important to note there are many money transfer providers that are essentially online-only platforms.

They will suit some customers, but not others.

PayPal, TransferWise, CurrencyFair and Revolut, are some of the more popular “do-it-yourself” online providers.

Not everyone wants to download an app or tap a load of information into a computer.

For larger money transfers, a lot of customers want the peace of mind of having a person they can speak to and who will offer them assistance.

The online experience can often fall short in terms of information and communication.

It’s a personal preference.

The best way to transfer pounds to dollars may come down to whether you want to transfer your money using an online platform or would rather speak to someone.

Quick Summary

- If you are looking to transfer pounds to dollars, you can use a bank or money transfer specialist.

- It takes 2-3 working days for your money to arrive.

- The cost is a combination of fees and exchange rates.

- An FCA Authorised company will safeguard client money.

- Some money transfer companies are just online apps, others provide a service.

Who are we?

Key Currency is an independent money transfer specialist.

We offer you great exchange rates and charge no fees.

What’s more, we don’t push you onto a trading platform or app and make you do everything yourself.

All our customers are allocated an account manager who will look after you from start to finish.

We also actively help our customers to achieve the best rate possible.

As a company, we are open and transparent.

We show the names, faces and backgrounds of all our people on our website.

Key Currency is an FCA regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

We have attained a 5-star “excellent” customer rating on the review website Trustpilot; the highest rating available.

To see how we compare to your bank or existing provider, simply request a free quote below.